When managing a global career, securing premier international health coverage for your partner is as critical as overseeing your investment portfolio. For couples who are not legally married, the key to this is providing proof of domestic partnership.

Consider this the official dossier that substantiates your relationship for an insurer. It is the tangible evidence—such as a shared property lease, joint financial statements, or a notarized affidavit—that verifies you are in a committed, cohabiting relationship. This documentation is essential for adding your partner to your executive-level health insurance plan and securing comprehensive family benefits.

Securing Your Partner's Health on the Global Stage

As your professional life expands across international financial centers, protecting your family’s well-being is a paramount concern. While a marriage certificate simplifies the process of adding a spouse to an insurance plan, many modern couples in long-term, committed relationships require a different approach. Understanding precisely what insurers accept as proof of domestic partnership provides a distinct strategic advantage.

For discerning individuals who value precision and clarity, navigating these requirements is not a bureaucratic impediment. It is a formal due diligence process insurers employ to manage risk and extend coverage appropriately. They simply require verifiable evidence that you and your partner share a life and are financially interdependent.

Why Insurers Require Formal Proof

From an insurer's perspective, adding a partner to a policy represents a significant financial commitment. They require documentation to verify the relationship is legitimate and stable, ensuring policies are administered with fiduciary responsibility. This is no different from the due diligence an underwriter performs before insuring a high-value asset; your family's health is of equal importance.

Providing this proof successfully allows you to:

- Access Comprehensive Family Coverage: Unlock premium benefits for your partner under a single, unified policy.

- Ensure Seamless Medical Care Abroad: Guarantee your partner access to premier medical facilities, wherever your assignments may lead.

- Demonstrate Financial Interdependence: Formally establish the shared nature of your life, from financial portfolios to personal responsibilities.

This practice is increasingly standard. In the U.S.—a useful benchmark for global professionals—access to employer-provided health benefits for unmarried domestic partners is on the rise. According to the U.S. Bureau of Labor Statistics, the availability of these benefits for opposite-sex partners among private industry workers grew from 36% in 2013 to 45% in 2018, indicating a clear trend toward acknowledging diverse family structures.

Knowing how to assemble a compelling file of evidence is the first step toward true peace of mind. For any individual managing a global career, robust international private medical insurance is not a perquisite—it is a fundamental component of a secure and successful life abroad.

What Insurers Deem Credible Proof

When applying for premier international private medical insurance (IPMI), the insurer requires a clear and verifiable portrait of your relationship. This is a standard due diligence procedure, much like a financial institution would conduct before issuing a joint credit facility. Your objective is to present a set of documents that leaves no ambiguity regarding your status as a committed, cohabiting partnership.

Organize your evidence in tiers of importance. At the highest level are official, government-issued documents, which carry the most authority. Below these are legally binding agreements and financial records that demonstrate a shared life and mutual responsibility. The goal is to construct a case so robust that your partner’s eligibility is indisputable.

The Gold Standard: Primary Documents

Certain documents are considered the "gold standard" for proof of a domestic partnership because they are officially recognized and difficult to contest. Insurers invariably prefer these, as they represent a formal, public declaration of your union.

The most compelling forms of proof are:

- A State or Municipal Domestic Partnership Certificate: This is the most definitive evidence you can provide. A certificate from a government registry (in jurisdictions that offer them) is unequivocal proof that your relationship is legally recognized.

- A Signed and Notarized Affidavit of Domestic Partnership: This is a sworn legal statement in which both parties declare the facts of their relationship under penalty of perjury. It confirms cohabitation, financial interdependence, and the intent to remain in a committed relationship, much like a marital union.

When official government registration is not an option, a meticulously drafted affidavit often becomes the core of your application.

Building Your Case with Supporting Evidence

While a primary document is an excellent foundation, a truly compelling application is reinforced by a collection of secondary evidence. These documents substantiate the claims made in your affidavit and illustrate the day-to-day reality of your shared life. Insurers seek consistency over a significant period.

"A well-prepared portfolio of evidence should narrate a clear story of interdependence. It’s not about a single document, but the collective weight of multiple proofs that confirms the authenticity of the partnership for underwriting purposes."

This supporting evidence typically includes:

- Proof of a Shared Domicile: You must provide documents showing both names at the same address for a substantial period, generally at least 6-12 months. Acceptable documents include joint mortgage statements, rental agreements, or property deeds.

- Evidence of Shared Finances: This is a critical component. Records proving shared financial responsibilities are highly persuasive. Examples include joint bank account statements, shared credit card statements, or documentation showing one partner is the beneficiary on the other's life insurance policy.

- Joint Utility Bills: Simple yet effective. Invoices for electricity, gas, or internet services bearing both names clearly demonstrate a shared household.

- Driver’s Licenses or Official IDs: When your government-issued identification cards show the same residential address, it adds another layer of official verification.

Each document contributes to the integrity of your case. A lease proves cohabitation, while a joint bank account shows financial union. Together, they create a comprehensive and credible file. To better understand the policy specifics, our guide to expat medical insurance policy terms can clarify requirements often stipulated in the fine print.

To ensure your documentation meets the rigorous legal standards of insurers, it is helpful to understand the basic elements of a valid contract. This context explains the importance of notarized signatures and clear declarations. Your affidavit, for instance, is a sworn, enforceable statement whose power derives from these legal principles. Presenting a well-structured and legally sound case from the outset demonstrates preparedness and expedites the process.

Proving Your Partnership: A Look at Requirements in Key Expat Hubs

When relocating internationally, proving your domestic partnership is not a one-size-fits-all exercise. What an insurer in London considers irrefutable proof may be deemed insufficient in Singapore. For globally mobile, high-net-worth individuals, understanding these local nuances is essential for a seamless transition.

Addressing this correctly from the outset prevents frustrating, and often costly, delays in securing essential coverage for your partner, such as an international private medical insurance (IPMI) plan. Having your documentation in order before your arrival demonstrates a level of foresight crucial in the world of international assignments.

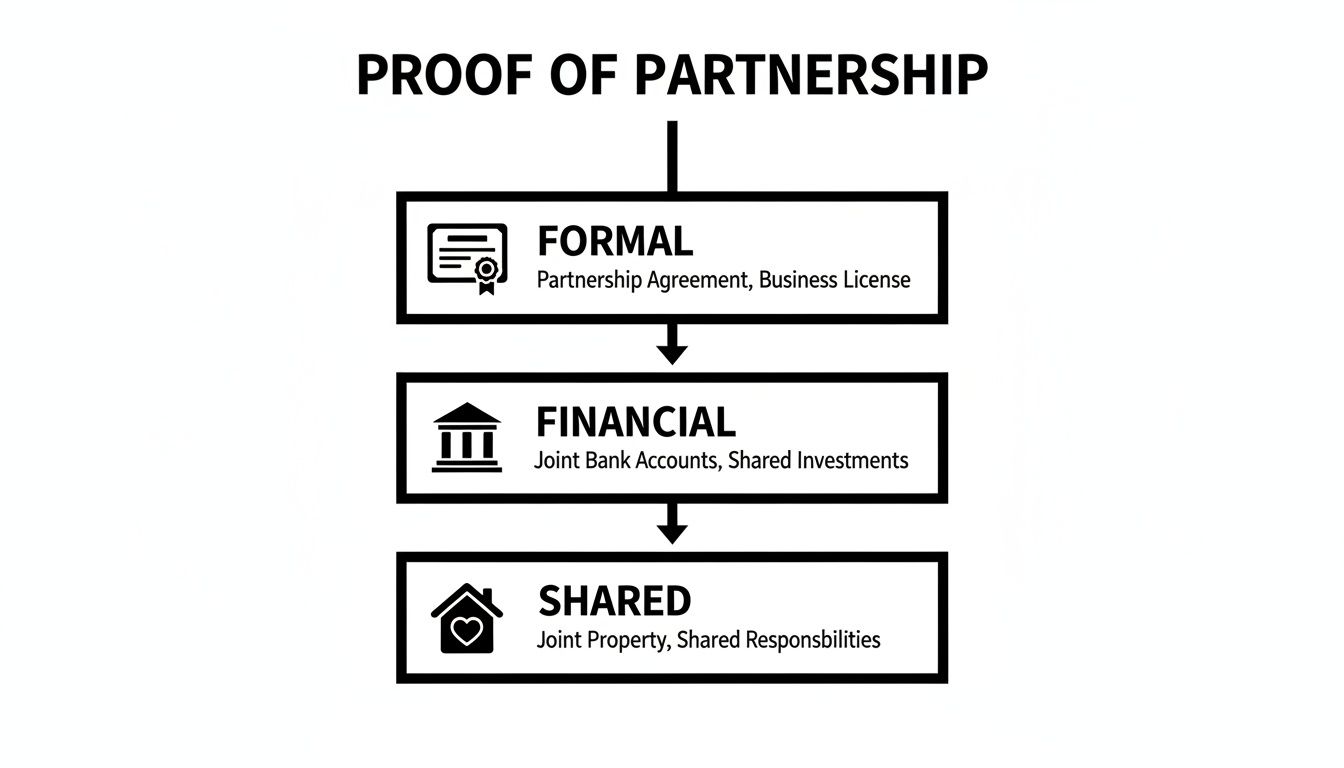

The required proof generally falls into three categories, from most to least authoritative. Formal legal documents are the gold standard, followed by evidence of intertwined finances, and finally, proof of a shared home and life.

As illustrated, a formal registration is your most powerful asset. In its absence, a compelling case can be built by layering financial and lifestyle evidence to paint an undeniable picture of your committed relationship.

A Comparative Look at Documentation

The following table outlines the common requirements across several major expat destinations. It serves as a quick reference to help you begin assembling the necessary documentation.

| Jurisdiction | Primary Accepted Documents | Secondary Supporting Evidence | Notes for HNWIs |

|---|---|---|---|

| United Kingdom | Civil Partnership Certificate | Joint tenancy/mortgage, joint bank accounts, shared utility/council tax bills | The Civil Partnership Act provides a clear, legally binding path that simplifies verification for all insurance and employment purposes. |

| Singapore | Stamped tenancy agreement, notarized affidavit of partnership | Joint bank accounts, beneficiary designations (on insurance/pension), shared credit cards | Insurers here prioritize verifiable, official documents. A meticulously organized file is non-negotiable. |

| Hong Kong | Notarized affidavit, official tenancy agreement in both names | Evidence of financial co-mingling, beneficiary designations | Similar to Singapore, the emphasis is on concrete proof. Declarations alone are insufficient without a strong paper trail. |

| United States | State-issued Domestic Partnership Certificate (where available), sworn Affidavit of Domestic Partnership | Joint leases, shared bank accounts, joint car titles/insurance, beneficiary designations on wills/401(k)s | Requirements are highly state-specific. Proof that works in California may not suffice in Texas. Federal recognition is not guaranteed. |

This table highlights a critical point: your documentation strategy must be tailored to your destination. What is considered standard practice in one jurisdiction can be entirely different just a short flight away.

H3: The United Kingdom: A Clear Framework

The UK offers one of the most straightforward frameworks for unmarried couples. The Civil Partnership Act 2004, extended to opposite-sex couples in 2019, allows you to obtain a legal status nearly identical to marriage.

A Civil Partnership Certificate is the ultimate proof of domestic partnership. It is universally accepted without question. If you do not have one, you must assemble a strong portfolio of other evidence.

- Cohabitation Evidence: At a minimum, expect to show a joint tenancy agreement or mortgage statement proving cohabitation for at least 12-24 months.

- Financial Interdependence: Joint bank account statements are powerful. Shared utility bills and council tax statements listing both names are also highly persuasive.

In the UK, the bottom line is formality and longevity. A legal registration is optimal, but a well-documented, long-term relationship with shared residence and finances is also highly credible.

Singapore and Hong Kong: A Focus on Verifiable Facts

In Asia's premier financial hubs, the approach is more conservative and data-driven. Neither Singapore nor Hong Kong offers a formal domestic partnership registry like the UK's, but the multinational employers and insurers there have established robust verification protocols.

Here, the burden of proof rests squarely on you to demonstrate a tangible, financially intertwined relationship. You can be certain that every document will be scrutinized for consistency and authenticity.

For discerning professionals in Asia's dynamic hubs, presenting a meticulously organized dossier of financial and residential proof is paramount. Insurers here value irrefutable data over declarative statements, demanding a clear paper trail of a shared life.

Key documents you will need to gather include:

- Proof of Shared Address: A stamped tenancy agreement is non-negotiable. This should be supported by utility bills or official correspondence addressed to both of you at the same address.

- Financial Links: While not always common among expats, a joint bank account is incredibly persuasive. Naming your partner as a beneficiary on your life insurance or retirement accounts is also excellent proof.

- Formal Declarations: A notarized affidavit is often the final piece that synthesizes all other evidence into a single, coherent narrative.

The United States: A State-by-State Approach

The U.S. presents the most complexity, as domestic partnership recognition is handled at the state or municipal level, not federally. Some states, like California and Oregon, have official registries that issue certificates, which carry significant weight.

In states without a formal registry, you may encounter the term "common-law marriage," but the criteria are exceedingly strict and vary widely. For most IPMI and employer purposes, you will need to build a case file much like in Asia.

- Affidavit of Domestic Partnership: This is a cornerstone document and a common employer requirement. It is a sworn statement outlining your shared life, financial commitments, and intent to remain partners.

- Comprehensive Supporting Evidence: Your affidavit must be backed by a robust collection of documents: joint leases, shared bank accounts, joint car titles, shared auto insurance policies, and proof of naming each other as beneficiaries on wills or retirement accounts.

Because regulations differ so dramatically from one state to the next, it is vital to research the specific requirements where your employer or insurer is based. Investigating the local legal environment is a crucial part of your relocation preparations. Our detailed country guides are an excellent starting point for this location-specific intelligence. A few hours of research now can prevent prolonged administrative headaches later.

When Bills and Statements Aren't Enough: The Role of Affidavits and Registries

At times, a collection of shared utility bills or bank statements is insufficient. Perhaps you have recently relocated, or your financial arrangements are complex. When your paper trail is limited, or when an insurer requires more definitive proof, a formal declaration becomes your most critical tool. This is where an Affidavit of Domestic Partnership or an official registry certificate transitions from a "nice-to-have" to an absolute necessity.

These documents serve as a powerful, official statement of your commitment, articulating the nature of your relationship in legal terms that institutions understand and trust. An affidavit, in particular, can be the linchpin of your application, especially if you lack traditional proof like a joint mortgage or a long-term lease. By formalizing your partnership under penalty of perjury, you demonstrate a level of seriousness that commands respect from employers and insurers.

Why You Might Need an Affidavit

An affidavit is the foundation of your proof of domestic partnership, particularly when other evidence is scarce. It is not merely a signed letter; it is a sworn legal statement, notarized and carrying significant weight. It is essential in several common scenarios.

You will almost certainly require a formal affidavit if:

- You've Recently Relocated: If you have just arrived in a new city, you likely lack the 6-12 months of joint utility bills or a shared lease that most institutions require.

- You Maintain Separate Finances: It is common, particularly for high-net-worth individuals, to maintain separate bank accounts for practical reasons. An affidavit can formally declare your financial interdependence, even without joint statements.

- The Insurer Mandates It: Some top-tier IPMI providers require an affidavit as a standard part of their protocol, regardless of other documentation provided.

An Affidavit of Domestic Partnership is your opportunity to state your case with clarity and authority. It consolidates the core elements of your relationship—a shared home, financial interdependence, and mutual care—into a single, authoritative document. It provides underwriters the unambiguous proof they need to extend coverage with confidence.

When drafting formal declarations like an affidavit, using established legal document templates can streamline the process. A quality template ensures you address all necessary legal points, helping you create a solid, professional document from the outset.

The Gold Standard: Formal Registration

While an affidavit is a statement you create, a certificate from a domestic partnership registry is an official validation from a government entity. In jurisdictions that offer this, such as the UK or U.S. states like California, registering your partnership is the most definitive and unimpeachable proof of domestic partnership available.

For an insurer, a government-issued certificate is the ultimate proof. It eliminates all doubt, confirming that your relationship meets a specific set of legal criteria. This official stamp of approval is often treated with the same weight as a marriage certificate, which can expedite your application and reduce requests for additional documentation.

This is not a niche concept; formalizing relationships outside of traditional marriage is a growing global trend. For example, recent data from the U.K. showed 6,879 new civil partnerships formed in 2021, with 83.7% of those being between opposite-sex couples. This broad acceptance strengthens the credibility of such registries for expats in major hubs from London to Singapore.

How to Word Your Formal Declaration

Whether you are drafting an affidavit or completing a registry application, the language must be precise. You must clearly and confidently address the key pillars that define a domestic partnership. Your declaration should explicitly state that you and your partner:

- Share a Common Residence: List your shared address and confirm it is the primary home for both of you.

- Are Financially Intertwined: State that you are jointly responsible for basic living expenses, such as housing, food, and bills, to demonstrate mutual financial support.

- Are in a Committed, Exclusive Relationship: Affirm that you are in a relationship that functions like a marriage and that neither of you is married to or in a registered partnership with anyone else.

- Meet Age and Relation Requirements: Confirm that you are both of legal age (typically 18 or older) and are not related by blood in a way that would legally prohibit marriage.

By clearly articulating these points in a notarized document, you are not just submitting paperwork. You are presenting a powerful, legally recognized testament to the stability and authenticity of your partnership, perfectly suited to meet the high standards of global insurance providers.

An Actionable Checklist for Assembling Your Proof

When proving your domestic partnership, organization is your greatest asset. Diligent preparation can transform what may seem like a daunting task into a straightforward process. Approach this as building a case file for your relationship—the more complete and robust it is, the smoother the path ahead.

Begin with the most influential documents. These are the foundational elements that carry the most weight with any institution, so securing them first is a prudent strategy.

Primary Documentation: The Cornerstones of Your Case

These documents offer the most direct, official proof of your relationship. If you possess these, your case is already substantially made.

- Official Registration Certificate: If your municipality or state offers a domestic partnership registry, this certificate is invaluable. It is the single most powerful piece of evidence you can provide.

- Notarized Affidavit of Domestic Partnership: This is a sworn legal statement in which you both affirm your commitment, shared life, and financial ties. Having it notarized by a qualified official makes it a legally binding document.

Secondary Evidence: Painting the Full Picture

Next, gather supporting documents. These pieces of evidence corroborate the claims in your affidavit and show a consistent, long-term pattern of a shared life. The objective here is to demonstrate stability over time.

Proof of Shared Residence (Minimum 6-12 Months):

- Joint mortgage statements or the deed to your property.

- A joint lease or tenancy agreement signed by both of you.

- Driver's licenses or other official IDs showing you both live at the same address.

- Official mail from a financial institution or government agency addressed to both partners at your home.

This level of documentation is required because cohabitation has become increasingly prevalent. In the U.S. alone, the number of unmarried partners living together grew substantially from 6 million in 1996 to 17 million by 2017. This demographic now constitutes 7% of the adult population, which is why insurers have developed clear, structured methods to verify these partnerships. You can read more about this demographic shift and what it means for modern families.

Proof of Financial Interdependence:

- Statements from a joint bank or investment account.

- Shared credit card statements where you are both liable for the balance.

- Paperwork showing you have named each other as the primary beneficiary on a life insurance policy, 401(k), or will.

- Utility bills (such as power, gas, or internet) that are in both of your names.

Final Action Items: The Finishing Touches

With your documents gathered, it is time for a final review. Do not allow minor errors to cause unnecessary delays at this critical stage.

Meticulous organization is a hallmark of success. Presenting a complete, logically ordered, and professionally verified file demonstrates foresight and expedites the underwriting decision, reflecting the high standards you apply to all your professional endeavors.

Here are your final steps before submission:

- Review and Organize: Arrange all documents chronologically. It is also advisable to create digital copies for your records and for convenient online submission.

- Verify Notarization Requirements: Double-check if the company requires specific documents, particularly the affidavit, to be notarized. Do not assume—always inquire.

- Anticipate Timelines: Ask your provider for their typical processing time for partnership verification. If you have not received a response within that timeframe, a polite and professional follow-up is entirely appropriate.

Got Questions? We've Got Answers

When navigating the specifics of partnership verification, certain questions inevitably arise. We have compiled direct answers to the most common inquiries, providing the clarity you need to proceed with your international private medical insurance application.

How Long Do We Actually Need to Live Together?

This is a critical question. Most insurers require evidence of cohabitation for a minimum of 6 to 12 months. Some policies, particularly more comprehensive plans, may stipulate a longer duration.

The key factor is not just the time but the proof. You will need solid documentation showing a shared address over that period, such as joint lease agreements, utility bills in both names, or bank statements sent to the same residence. For premium IPMI plans, this will be scrutinized closely, so a continuous, well-documented paper trail is your strongest asset.

Can We Just Write Our Own Affidavit, or Do We Need a Lawyer?

While you can draft your own affidavit, engaging legal counsel adds significant weight and credibility to the document. This is especially true when dealing with high-value insurance policies where the stakes are elevated.

A lawyer ensures the language is legally sound and that you have addressed all necessary points, drastically reducing the likelihood of rejection. Regardless of who drafts it, the one non-negotiable step is getting it notarized. An affidavit is merely a piece of paper until a qualified official has stamped and signed it.

Consider legal counsel not as a formality, but as a strategic investment that strengthens your proof of domestic partnership. It transforms your personal statement into a document that meets the rigorous standards of global insurers, helping you bypass frustrating delays.

Are There Tax Implications for Domestic Partnership Benefits?

Yes, and this is an area of considerable complexity, as tax regulations differ significantly between countries. It is imperative to seek advice from a qualified financial expert on this matter.

For example, in the United States, the fair market value of your partner's health coverage is often considered "imputed income," meaning it is taxable unless your partner officially qualifies as your tax dependent.

However, in the UK or Singapore, the rules are entirely different. The only way to ascertain your specific tax liability is to consult with a qualified tax advisor in your country of residence. This is a crucial step for proper financial management and legal compliance.

This is precisely the kind of complex territory Riviera Expat helps high-net-worth individuals navigate every day. We offer the expert guidance you need to secure premier international health coverage for you and your partner, ensuring all your documentation meets the highest standards.

Ready to find a clearer path to global health security? Visit us at https://riviera-expat.com to learn more.