Arranging for your parents to visit the United States is a significant undertaking. While planning their itinerary is an exciting part of the process, overlooking the necessity of premier medical insurance can expose your family to substantial financial risk.

Securing appropriate medical insurance for parents visiting the USA is not merely a suggestion—it is an indispensable component of responsible planning. It stands as the only effective safeguard against the formidable costs associated with the American healthcare system.

Protecting Your Parents and Your Assets from the US Healthcare System

Attempting to rely on your parents’ home-country insurance or adding them to your domestic US plan is a flawed strategy that consistently fails to provide adequate coverage.

Your US-based health insurance is structured for US residents and will not permit the addition of non-resident, visiting parents. Similarly, their policy from their country of origin is unlikely to offer meaningful coverage within the United States, leaving them financially vulnerable in the event of a medical incident.

A Financial Analysis of US Medical Expenses

To be direct, the financial stakes are exceptionally high. The US healthcare system is globally recognized for its exorbitant costs.

A routine consultation with a physician can range from $150 to $400. An emergency room visit for a minor issue will typically start at $1,500 and can escalate rapidly. A multi-night hospital stay can generate invoices reaching tens, or even hundreds, of thousands of dollars. Without a US-centric insurance policy, an unforeseen illness or accident can precipitate a severe financial crisis.

To provide a clear perspective, let's compare common medical service costs with the coverage provided by a well-structured visitor insurance plan.

US Healthcare Costs vs. Typical Visitor Insurance Coverage

The following table illustrates why foregoing insurance is an untenable risk. It starkly contrasts out-of-pocket expenses with the financial protection offered by a comprehensive visitor policy.

| Medical Service in the USA | Typical Uninsured Cost | Coverage with Comprehensive Visitor Insurance |

|---|---|---|

| Emergency Room Visit (Minor Injury) | $1,500 – $3,000+ | Covered (after deductible/copay) |

| Ambulance Transportation | $500 – $1,200+ | Covered (for medically necessary transport) |

| Hospital Stay (Per Day) | $3,000 – $10,000+ | Covered up to policy limits (e.g., $100,000+) |

| Major Surgery (e.g., Appendectomy) | $30,000 – $60,000+ | Covered up to policy limits |

| Diagnostic Imaging (MRI/CT Scan) | $1,000 – $5,000+ | Covered (when medically necessary) |

| Prescription Drugs (Urgent Care) | $100 – $500+ | Covered up to sub-limits |

The potential for catastrophic expenditure is undeniable. Visitor insurance is specifically engineered to absorb these significant costs, providing an essential financial shield.

The core challenge extends beyond the high price of services; it encompasses the system's complexity. Navigating provider networks, billing codes, and payment processes without a US-based insurance administrator is an overwhelming task, particularly during a medical emergency.

True peace of mind is achieved by securing a robust policy well in advance of any potential medical need.

The Premier Solutions for Visitor Health Coverage

Fortunately, specialized insurance products are designed for this precise scenario, ensuring your parents receive excellent care without jeopardizing your family's financial stability. The two primary options are:

-

Specialized Visitor Medical Insurance: These plans are tailored for short-term travel to the US, designed to cover new illnesses, injuries, and medical emergencies that arise during their stay. They represent the most common and practical choice for typical family visits.

-

Short-Term International Private Medical Insurance (IPMI): This is a more comprehensive and robust solution. Functioning much like a domestic US health plan, it is a superior choice for longer stays (exceeding six months) or for parents with pre-existing conditions that require diligent management.

To fully appreciate the critical role of these plans, it is useful to understand how medical services are funded within the US healthcare landscape. Both visitor insurance and short-term IPMI are structured to integrate seamlessly with this complex system, allowing you to focus on your parents' well-being. The key is selecting the optimal plan for their specific circumstances.

Visitor Insurance vs. Short-Term IPMI: Selecting the Right Structure for Your Parents

Choosing the appropriate insurance structure is the most critical decision in arranging medical coverage for your parents' US visit. The primary options are a comprehensive visitor medical plan or a short-term International Private Medical Insurance (IPMI) plan.

While both provide protection, they are designed for fundamentally different applications. Making the correct choice from the outset is essential for ensuring the right level of care and avoiding unforeseen coverage gaps.

Comprehensive visitor medical insurance is engineered specifically for travel. Its function is to cover acute, unexpected medical events that occur during the trip. It is best understood as high-quality, short-term emergency protection for accidents or new illnesses.

Conversely, a short-term IPMI plan operates in a manner analogous to a domestic health plan. It offers broader, more substantial coverage that is often renewable, making it a far more suitable option for extended stays or for parents with known health conditions that may require attention.

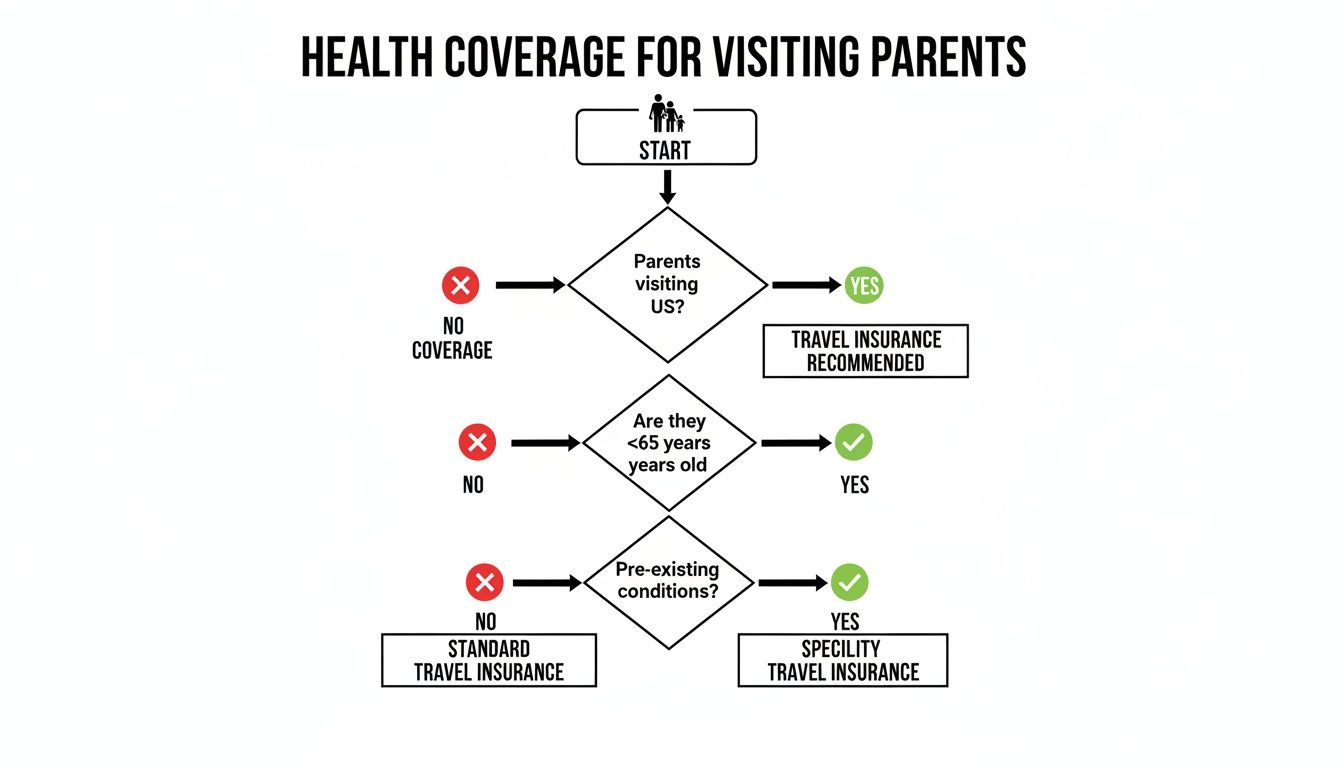

This decision tree helps visualize the initial thought process.

As illustrated, once the travel plans are confirmed, your parents' specific health needs and the duration of their stay become the decisive factors.

How Each Plan Manages Pre-Existing Conditions

The most significant differentiator—and a detail you cannot afford to misunderstand—is the policy's treatment of pre-existing conditions.

Most standard visitor insurance plans offer extremely limited or no coverage for them. Some may provide a benefit for the “acute onset of a pre-existing condition,” a narrowly defined term. It specifically refers to an unforeseen crisis stemming from a known condition, not routine management, scheduled consultations, or prescription renewals.

IPMI plans, by contrast, are typically medically underwritten. This is a crucial distinction. You provide a complete medical history for your parents, and the insurer may offer to cover those specific conditions, potentially for an adjusted premium. This creates a much more reliable and predictable framework for managing chronic illnesses such as heart disease, diabetes, or hypertension.

For a parent with any managed health issue, an underwritten IPMI plan provides a level of certainty that a standard visitor plan cannot match. It elevates the coverage from "emergency-only" to genuine health management.

Policy Maximums and Renewal Options

The level of financial protection also varies significantly. Visitor insurance plans commonly offer policy maximums ranging from $50,000 to $1,000,000. While the upper limit may seem substantial, a major medical event in the US can exhaust lower-tier limits with alarming speed. These plans are purchased for a fixed term and are not designed for renewal.

Short-term IPMI policies often feature higher maximums, frequently $1,000,000 or more, reflecting their comprehensive nature. Critically, they are often renewable, providing a continuous coverage solution for parents staying six months or longer, or for those who might extend their visit without a lapse in protection. You can learn more about how International Private Medical Insurance delivers this level of sustained security.

The differences are stark. The table below provides a side-by-side analysis of key features to clarify the distinction.

Visitor Medical Insurance vs. Short-Term IPMI: A Feature Comparison

| Feature | Comprehensive Visitor Medical Insurance | Short-Term International Private Medical Insurance (IPMI) |

|---|---|---|

| Primary Purpose | Emergency medical coverage for acute, unexpected events during travel. | Broader health coverage, similar to a domestic plan, for extended stays. |

| Pre-Existing Conditions | Generally excluded, except for a narrow "acute onset" benefit. | Can be covered through medical underwriting, often for an adjusted premium. |

| Underwriting Process | Minimal underwriting; policy issuance is often immediate. | Full medical underwriting required; application review takes time. |

| Coverage Scope | Inpatient hospitalization, ER visits, ambulance, repatriation. | Comprehensive inpatient and outpatient care, including specialists and prescriptions. |

| Policy Maximums | Typically $50,000 to $1,000,000. | Often $1,000,000+. |

| Renewability | Not typically renewable; a new policy is required. | Often renewable, providing continuous coverage for extended visits. |

| Best For | Shorter visits (under 6 months) for healthy parents with no chronic conditions. | Longer visits (6+ months) or for parents with managed pre-existing conditions. |

Ultimately, this comparison highlights a simple truth: the choice is between a travel safety net and a temporary health plan.

A Real-World Scenario to Clarify the Distinction

Imagine your father, who has well-managed hypertension, is visiting for four months.

- With Visitor Insurance: If he suffers a sudden heart attack (an acute event), the plan would likely cover his emergency medical care. However, if he requires a routine blood pressure check with a physician or needs a refill of his medication, these are not considered emergencies. The plan would not cover these expenses.

- With Short-Term IPMI: Following medical underwriting where his hypertension is disclosed, his condition could be fully covered. The plan would not only respond to a cardiac event but could also cover specialist appointments or prescription adjustments related to his condition during his stay. This provides far greater security and peace of mind.

The conclusion is clear: for a short visit by healthy parents, a high-limit comprehensive visitor plan is an excellent and efficient solution. However, for longer stays or any time pre-existing conditions are a factor, the superior breadth and reliability of a short-term IPMI plan are indispensable.

When arranging medical insurance for parents visiting the USA, their age and any pre-existing health conditions are the two factors that will dictate the entire process. For families who value a high standard of care, addressing this aspect correctly is non-negotiable.

The terminology used by insurers can be complex, but understanding it is essential. Many off-the-shelf visitor insurance plans advertise a limited benefit for the "acute onset of a pre-existing condition." While this sounds reassuring, it represents a very narrow, emergency-only provision.

In practice, it means the policy may cover a sudden, unforeseen crisis related to a chronic condition—for example, a heart attack for an individual with a known cardiac history. It will not cover routine management, scheduled check-ups, or prescription refills for that same condition.

This distinction is paramount. An acute onset benefit is a safety net for a catastrophe, not a plan for managing your parents’ ongoing health. Relying solely on this, particularly for parents with any chronic illness, is an exceptionally high-risk strategy.

The Decisive Role of Full Medical Disclosure

To secure genuine, reliable coverage for known health issues, the only viable path is a policy that utilizes full medical underwriting. This requires complete transparency regarding your parents' health history. While the process may feel intrusive, it is the only way to achieve certainty of coverage.

Imagine your father has a managed cardiac condition. During the underwriting process, this history is disclosed. The insurer assesses the risk and may offer a policy that explicitly covers that condition, perhaps with an adjusted premium or a specific deductible.

This upfront disclosure is your most powerful tool against a future claim denial. Attempting to conceal a condition to secure a lower premium is a classic false economy that almost guarantees the insurer will reject a related claim, leaving you responsible for the entirety of what could be a staggering medical bill.

This is where expert guidance is crucial. A deep understanding of policy exclusions and how they apply to a specific health profile is key. You can gain a more thorough understanding of why you must watch out for policy exclusions and understand medical conditions cover before finalizing a decision.

How Age Influences Premiums and Coverage Limits

It is a fundamental principle of insurance that age is the primary driver of cost. As individuals age, the statistical probability of requiring medical care increases, and premiums reflect this elevated risk. The cost differential for a parent in their early 60s versus one in their late 70s can be substantial.

Insurers typically structure plans around specific age brackets, which determine both the price and the maximum available coverage.

- Ages 60-69: This demographic usually has access to numerous options, with high coverage limits often reaching $1,000,000. Premiums are manageable but are markedly higher than for younger individuals.

- Ages 70-79: At this stage, the options begin to narrow. While some select providers continue to offer high limits, many plans will cap coverage at lower amounts, such as $50,000 or $100,000. Premiums increase significantly in this bracket.

- Ages 80+: Securing robust coverage becomes considerably more challenging. Policy maximums are often lower, and fewer insurers offer comprehensive plans for this age group.

Recognizing these challenges, some forward-thinking insurers are developing more suitable products. For example, certain new plans for 2025 offer up to $25,000 for travelers under 70 and $20,000 for those 70 and older, specifically for the acute onset of pre-existing conditions during longer stays. These are designed for elderly parents visiting for significant family events, offering a more practical safety net.

While our focus here is on short-term visitor insurance, it is helpful to consider how other types of health coverage, such as those explained when understanding long-term care insurance policies, address similar issues of age and health history. A broader perspective clarifies the risk principles utilized by all insurers.

Ultimately, the objective is to secure a plan that realistically accounts for your parents' age and health, providing true security rather than the mere illusion of it.

What a Truly Protective Policy Looks Like

When arranging medical insurance for your parents’ visit to the USA, the specific details within the policy document distinguish adequate coverage from genuine protection. For discerning families who expect a high standard of care, many standard policies are insufficient. The focus must be on specific, high-value benefits that align with your family's precise needs.

The first critical metric is the policy maximum—the total amount the insurer will pay for all covered medical expenses. While plans are available with limits as low as $50,000, this amount is dangerously insufficient given the reality of US healthcare costs.

For genuine financial security, a policy maximum of at least $100,000 should be considered the absolute minimum. Higher limits are always preferable.

Premier Networks and Direct Billing Are Non-Negotiable

Beyond the aggregate coverage amount, the policy's operational effectiveness in a crisis is paramount. A superior plan will always provide access to an extensive Preferred Provider Organization (PPO) network.

This is not a discretionary feature; it is essential. A PPO network ensures your parents can receive treatment at top-tier hospitals and clinics that have pre-negotiated rates with the insurer. Crucially, it facilitates direct, cashless billing. In an emergency, the hospital bills the insurance company directly, sparing you the administrative burden and financial strain of paying enormous sums out-of-pocket and subsequently seeking reimbursement.

For expatriates, particularly those in hubs like Singapore or Kuala Lumpur, securing this level of coverage often necessitates working with IPMI brokers like Riviera Expat. We can objectively compare comprehensive options, as neither their home-country insurance nor Medicare for non-US residents is a viable solution. With US healthcare costs continuing to escalate, some analysts project that by 2026, even minimum policy limits will need to exceed $50,000 just to offer basic protection. You can discover more insights about international insurance needs on InternationalInsurance.com.

The value of a strong PPO network cannot be overstated. It transforms the policy from a simple reimbursement mechanism into a powerful logistical tool that provides immediate access to quality care without the immense financial and administrative burden.

Core Coverage: Hospital Stays and Prescriptions

A robust policy must provide strong provisions for the core elements of any serious medical event. This includes comprehensive coverage for:

- Hospitalization: The policy must cover the cost of a semi-private room, board, and general nursing care.

- Intensive Care Unit (ICU): With ICU costs easily exceeding $10,000 per day, full coverage up to the policy maximum is critical.

- Prescription Drugs: The plan must cover medications administered during a hospital stay and any prescriptions required upon discharge for the covered condition.

These three pillars form the foundation of any high-quality medical plan for visiting parents, ensuring the most significant potential expenses are managed effectively.

The Overlooked Lifelines: Medical Evacuation and Repatriation

Finally, two often-overlooked benefits provide a crucial safety net for worst-case scenarios: medical evacuation and repatriation of remains.

Medical evacuation covers the cost of transporting your parent to the nearest facility capable of properly managing their condition if the local hospital is inadequate. This is particularly vital if they are traveling in a more remote area. In a serious situation, this could involve an air ambulance, a service that can cost $25,000 to $50,000 or more.

Consider this scenario: Your parent suffers a serious fall while visiting a national park, far from a major urban center. The local clinic is not equipped for the complex surgery required. A medical evacuation benefit would cover the emergency helicopter transport to a leading metropolitan hospital, an expense that would otherwise be your full responsibility.

Repatriation of remains is a benefit that manages the complex logistics and significant costs of returning a deceased person to their home country. While difficult to contemplate, having this coverage in place relieves your family of a substantial financial and emotional burden during an already tragic time. Both benefits are designed to provide complete care and dignity for your family, regardless of the circumstances.

As a high-achieving professional, your time is your most valuable asset. The last thing you need is another complex, time-consuming administrative task—like researching, comparing, and securing premier medical insurance for your parents' US visit.

This is precisely why we created our white-glove brokerage service. We exist to lift this entire burden from your shoulders, managing the process with the discretion, efficiency, and clarity you expect in all your professional dealings. Our objective is not merely to sell a policy, but to instill complete confidence in the protection you have arranged for your family.

A Consultation-Led Approach

Our process begins not with a product list, but with a personal consultation to understand the unique details of your situation.

- What is the duration of your parents' visit?

- What is their specific medical history, including any pre-existing conditions?

- What are your expectations regarding network access and standards of care?

This initial conversation is the foundation of our work. It allows us to build a precise client profile, ensuring the solutions we propose are perfectly aligned with your family’s needs. A one-size-fits-all approach is inadequate; only a tailored solution is acceptable.

Unbiased Analysis with Our Proprietary Engine

Once we have a clear understanding of your requirements, we utilize our proprietary comparison engine. This is not a superficial price check. Our system performs a deep analysis of top-tier policies from the world's most reputable global insurers, focusing on the criteria that matter to discerning families:

- The precise scope of pre-existing condition coverage.

- The strength and breadth of their US PPO network.

- Policy maximums and sub-limits for critical services like intensive care.

- The insurer's documented track record for efficient claims processing.

We distill this complex data into a clear, unbiased presentation of your best options. You will receive a concise summary of two or three leading policies, with a straightforward explanation of why each is a strong candidate for your parents. This objective guidance is central to our philosophy; you can learn more about our commitment to clarity and client success. Our role is to empower you to make an informed decision with minimal effort.

Seamless End-to-End Management

Selecting the right policy is just the first step. We then manage the entire administrative process on your behalf, providing a seamless experience from application to policy issuance. This includes handling the application, liaising directly with underwriters regarding medical disclosures, and ensuring the final policy is issued correctly and on time.

Our value lies in managing the intricate details so you don't have to. From navigating underwriting queries to confirming that policy documents are in your hands before your parents’ travel, we manage every touchpoint.

This hands-on management eliminates the risk of costly errors or delays. Your involvement is minimal, yet you remain fully informed. By entrusting this process to Riviera Expat, you are not just purchasing an insurance policy; you are investing in peace of mind, freeing you to focus on what truly matters—enjoying precious time with your parents during their visit.

From Application to Claims: Making Your Policy Work

A policy is merely a document until it is needed. A medical event is the true test of its value. Understanding how to navigate the final steps—from policy issuance to filing a claim—is what transforms your investment into tangible protection for your parents.

Timing is critical. You should aim to secure the insurance approximately two to four weeks before your parents' travel date. This provides a comfortable buffer for any underwriting reviews and ensures you have all essential documents—such as ID cards and claims contact numbers—in hand well before their departure.

How the Claims Process Actually Works

When your parent requires medical care, the subsequent process depends entirely on the provider they visit. The path diverges based on whether the hospital or clinic is part of the insurer’s PPO network.

- Direct Billing (The Seamless Path): If you utilize an in-network provider, they will bill the insurance company directly. This is the most efficient method. Your financial responsibility will be limited to the deductible or copay, and the administrative burden is minimal.

- Reimbursement (The Manual Path): If you opt for an out-of-network provider, you will almost certainly be required to pay the full bill upfront. You will then be responsible for collecting all itemized bills and medical records, completing a claim form, and submitting it to the insurer for reimbursement.

My professional advice is to maintain both digital and physical copies of all documentation. A complete and promptly filed claim is crucial for securing reimbursement without protracted disputes.

A robust, US-based PPO network is a critical feature, not a luxury. It does more than secure negotiated rates; it fundamentally simplifies the entire process during an already stressful time by enabling direct billing.

Identifying Red Flags and Exclusions Before Purchase

Every policy contains limitations, and the fine print is where unwelcome surprises are often found. Before committing, it is essential to scrutinize the document for common exclusions.

Pay extremely close attention to the language surrounding pre-existing conditions. Ambiguous or convoluted definitions can be a deliberate tactic that may lead to a claim denial.

Also, be vigilant for sub-limits. A policy might offer a $500,000 overall maximum but cap coverage for prescription drugs or physical therapy at a much lower, easily exhaustible amount. Identifying these limitations before a claim arises is the difference between a policy that performs as expected and one that leaves you with an unforeseen five-figure bill.

A Few Common Questions We Hear

Arranging medical insurance for parents visiting the USA invariably raises several key questions. Here are direct answers to the most common inquiries from our clients.

Can I Add My Parents to My Own US Health Insurance Plan?

This is a frequent initial question, and the answer is almost universally no.

Domestic US health insurance plans are structured for legal residents, with enrollment typically restricted to tax dependents. As your parents are visiting on a tourist visa, they do not meet the eligibility criteria to be added to your plan. A dedicated visitor medical insurance policy or a short-term international plan is required to provide them with appropriate protection.

What is the Real Difference Between a Fixed-Benefit and a Comprehensive Plan?

Understanding this distinction is absolutely critical, as it directly impacts the level of financial protection your parents will receive.

- A fixed-benefit plan is inexpensive for a reason. It pays a set, predetermined dollar amount for each medical service (e.g., $1,000 for a hospital day). This amount is often only a small fraction of the actual cost in the US, leaving you responsible for a significant financial shortfall.

- A comprehensive plan is the superior choice. It pays a percentage of eligible medical bills (typically 80-100% after the deductible) up to the policy limit.

Given the exceptionally high cost of US healthcare, a fixed-benefit plan represents a financial risk we would never advise our clients to take. Comprehensive coverage is the only responsible choice for meaningful security.

How Soon Should I Buy the Insurance Before They Travel?

We consistently recommend purchasing the policy at least two to four weeks before your parents' scheduled departure.

This timeframe allows sufficient opportunity to handle all processing, manage any necessary underwriting reviews, and ensure you have all policy documents in hand well before their trip begins. Waiting until the last minute—or after their journey has commenced—severely limits your options and could leave them unprotected. Proactive planning ensures their coverage is active from the moment they arrive.

At Riviera Expat, we eliminate the complexity and stress from securing the right medical protection for your family. Our white-glove service provides the expert, unbiased guidance you need to compare and select the best possible policy. Schedule your complimentary consultation with Riviera Expat today and ensure this critical detail is handled correctly the first time.