For discerning professionals who operate on a global scale, standard U.S. health insurance is often misaligned with a lifestyle that spans multiple jurisdictions. The fundamental challenge lies in navigating a domestic system not engineered for international mobility. For this reason, specialized non us citizen health insurance becomes less of a discretionary purchase and more of a strategic asset.

This guide will delineate why International Private Medical Insurance (IPMI) offers the clarity, control, and borderless coverage your career demands.

Securing Your Health as a Global Professional

When your professional commitments require frequent travel between continents, your health coverage must be equally agile. For financial professionals, private equity partners, and business leaders who divide their time between the U.S. and other global hubs, reliance on a domestic American insurance plan can introduce significant risk. These plans are typically bound by U.S. borders and feature rigid eligibility criteria based on visa status, creating potential gaps in your protection.

This is where International Private Medical Insurance (IPMI) provides a superior solution. It is best understood not merely as an insurance policy, but as your personal global health security asset.

Why Standard US Plans Fall Short

Traditional U.S. health plans are structured for individuals residing and working exclusively within the United States. They operate within specific provider networks (such as HMOs and PPOs) that seldom extend beyond the country's borders. For an executive traveling between New York, London, and Singapore, a U.S.-based plan becomes functionally obsolete overseas, aside from limited emergency provisions.

Furthermore, enrollment often requires a specific residency or immigration status that many non-citizens do not immediately possess. This can leave you completely exposed during critical transition periods.

The IPMI Advantage for Global Citizens

IPMI, in contrast, is engineered specifically for a mobile clientele. It delivers seamless, worldwide coverage, ensuring access to premier private medical facilities whether you are in the United States, your home country, or any other location. This level of flexibility is essential for safeguarding both your health and your professional momentum.

An IPMI policy delivers the comprehensive, portable, and premium coverage demanded by professionals in finance and global business. It is designed to bypass the bureaucratic hurdles of domestic systems, offering a direct path to superior healthcare, wherever you are.

The demand for this sophisticated level of coverage is expanding rapidly. The international health insurance market's growth is a testament to this trend, reflecting the realities of an increasingly mobile global workforce.

While it is prudent to understand local healthcare provisions, such as guides on Ministry of Health (MOH) services for non-citizens in various regions, this guide focuses on providing the clarity needed to make a confident healthcare decision for your time in the U.S.

IPMI vs US Domestic Health Insurance At a Glance

To make the distinction clear, here is a direct comparison of how these two plan types serve a global professional.

| Feature | International Private Medical Insurance (IPMI) | US Domestic Health Insurance |

|---|---|---|

| Coverage Area | Worldwide; choose your region, including or excluding the US. | Typically US-only, with very limited emergency international coverage. |

| Provider Access | Access to a broad network of private hospitals and specialists globally. | Restricted to a specific in-network list of providers (HMO, PPO) within the US. |

| Portability | Fully portable. Moves with you from country to country without interruption. | Not portable. Coverage is tied to your US residency and often your state. |

| Eligibility | Designed for expatriates, global citizens, and frequent travelers. | Requires specific visa types, residency status, or employment in the US. |

| Plan Design | Highly customizable with modular benefits for evacuation, dental, and wellness. | Standardized plans, often compliant with the ACA, with less flexibility. |

| Currency | Premiums and claims can often be handled in multiple currencies (USD, EUR, GBP). | Strictly US Dollar transactions. |

As illustrated, for any individual whose life and work are not confined to a single country, the choice becomes evident. IPMI is structured for a world without borders, while domestic plans are fundamentally designed for a static location.

Comparing Your Core Coverage Options

As a non-U.S. citizen seeking health coverage in the States, you are faced with a significant decision. This is not merely about selecting a plan; it is a strategic choice that directly impacts your professional mobility and your family's financial security. The two primary paths are fundamentally different: International Private Medical Insurance (IPMI) and standard U.S. domestic health plans.

Making the correct choice is paramount. For a high-net-worth individual whose life and business span multiple continents, your decision determines where you can receive care, the extent of your financial risk exposure, and whether your protection follows you globally.

International Private Medical Insurance: A Global Access Pass

Consider IPMI as your global access pass to premier healthcare. It was designed from the ground up for individuals who live and work internationally—expatriates, global executives, and family offices managing assets across borders. Its principal strength is its unrestricted portability. You receive consistent, high-level coverage whether you are in New York, London, Singapore, or your home country.

Crucially, this type of non us citizen health insurance is not contingent on your U.S. visa or residency status. This independence is a considerable advantage, ensuring you do not become uninsured if your immigration status changes. For professionals who travel between financial hubs, IPMI guarantees access to a network of elite private facilities worldwide, not just within the U.S.

The entire process, from application to claims, is tailored for the expatriate lifestyle. It anticipates cross-border medical emergencies, medical evacuations, and multi-currency payments—a level of service and flexibility that domestic plans are not equipped to provide.

The Limitations of U.S. Domestic Plans

U.S. domestic health plans, including those on the Affordable Care Act (ACA) Marketplace, are designed to serve a static, U.S.-based population. Their function is to provide access to a specific network of doctors and hospitals—such as an HMO or PPO—within a defined local area.

A non-U.S. citizen immediately encounters the first barrier: eligibility. A specific visa (like an H-1B or L-1) or lawful permanent resident status is often required for enrollment. This excludes a significant number of individuals, contributing to higher uninsured rates within this demographic.

Then there is the financial risk. Seeking care "out-of-network" can result in staggering medical bills. The plan might cover a small fraction of the cost, or nothing at all. This geographic constraint makes domestic plans a precarious choice for anyone who travels regularly.

The reality is, a significant number of non-citizens face challenges securing coverage under the U.S. system. To do so effectively, one must understand the profound differences between policy types. We detail this in our guide on how to find the right policy type for your specific situation. This knowledge is essential to avoid dangerous gaps in your protection.

Understanding the Coverage Disparity

The structural differences between these two systems create a significant gap in healthcare access. The data is unambiguous: according to a 2023 KFF analysis, 15% of immigrant adults in the United States are uninsured. This is substantially higher than the 6% rate for U.S.-born adults. The disparity is even more pronounced for those without a formal immigration status, highlighting the domestic system's reliance on legal documentation.

This is precisely why a specialized non us citizen health insurance like IPMI is so critical. It sidesteps these eligibility roadblocks, offering a direct, reliable path to comprehensive coverage that is not dependent on the intricacies of U.S. immigration law. It is designed to provide security and peace of mind, allowing you to focus on your professional and personal life without concern for healthcare access.

Navigating Visa and Residency Eligibility

Your legal status in the United States is the primary determinant of your health insurance options. For high-net-worth individuals and professionals in constant motion, understanding the intricate link between your visa, residency, and ability to secure coverage is not a mere administrative task—it is the cornerstone of your healthcare strategy.

The U.S. healthcare system establishes a firm distinction based on immigration status. Certain visas and residency types provide access to domestic plans, while others may leave you with few local options. This is a critical distinction, as it determines whether you can apply for plans on the Affordable Care Act (ACA) Marketplace or must pursue an alternative solution.

How Your Visa Impacts Your Insurance Path

For professionals holding common work visas, the path is often clearer. If you possess an H-1B (Specialty Occupations), L-1 (Intracompany Transferees), or O-1 (Extraordinary Ability) visa, you are generally considered "lawfully present." This status makes you eligible to purchase domestic health insurance, often through an employer or the ACA Marketplace.

However, eligibility does not equate to suitability. While you may have access to these plans, they are geographically bound to the U.S., which presents a significant challenge for anyone who travels frequently for business or personal reasons. For many, this is where the discussion shifts from simple eligibility to strategic necessity. Knowing your visa and residency options is key for any long-term planning, and resources like this guide on Europe's Golden Visa programs can offer a broader perspective on pathways to securing legal status.

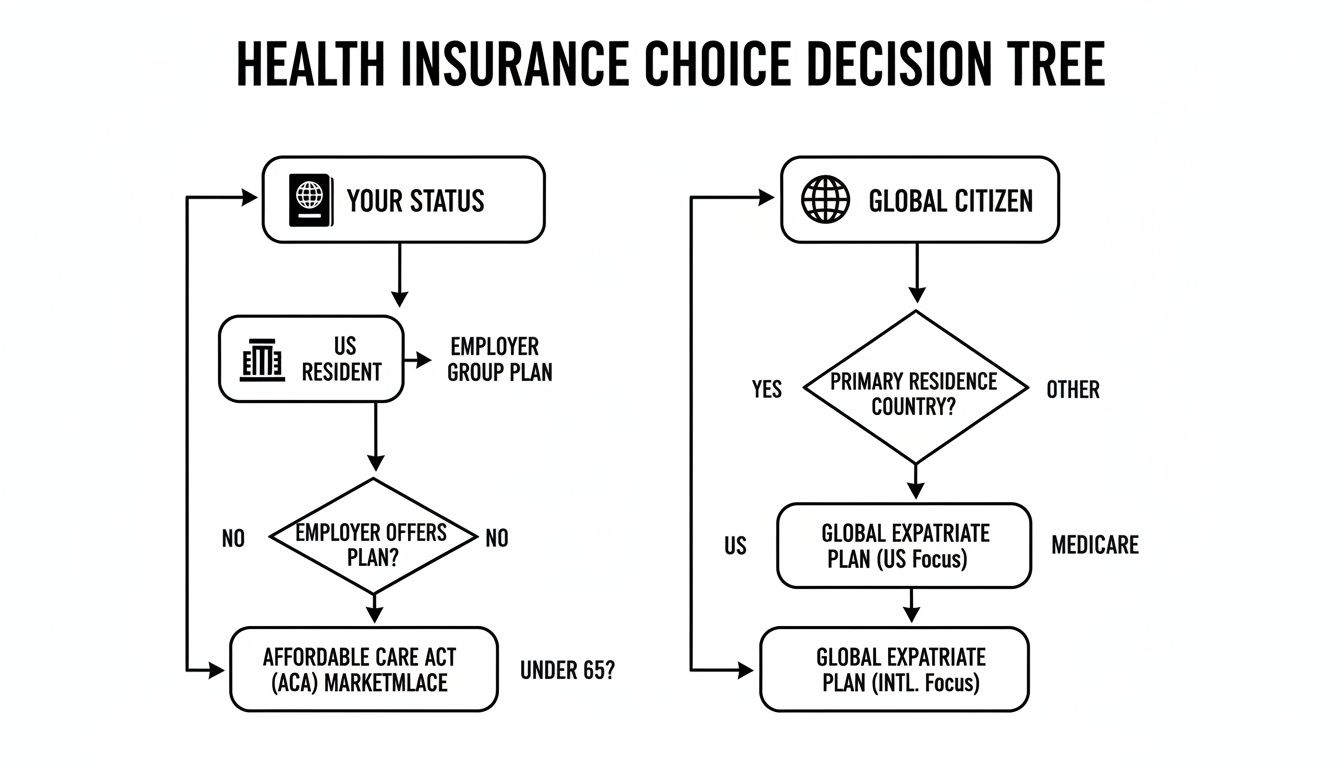

This decision tree helps visualize the core choice between a U.S.-based plan and a global one, depending on your primary status.

The main takeaway? While a U.S. residency status unlocks domestic plans, a global lifestyle almost always demands a more flexible, international approach to your health security.

Lawful Permanent Residents vs. Non-Immigrants

A significant distinction exists between being a lawful permanent resident (a Green Card holder) and a non-immigrant visa holder. Green Card holders have nearly the same access to health insurance as U.S. citizens, including eligibility for ACA Marketplace plans, subsidies, and, after a five-year waiting period, programs like Medicaid.

Non-immigrant visa holders, even if "lawfully present," are in a more complex position. Their eligibility is directly tied to maintaining an active visa status. Any change, lapse, or transition period can create dangerous gaps in coverage if you rely solely on a domestic plan.

International Private Medical Insurance (IPMI) offers a powerful solution by completely decoupling your health coverage from your U.S. immigration documentation. It provides a consistent, reliable safety net that remains active regardless of visa changes, travel, or transitions between countries.

This independence is a core benefit for any professional whose career path is not static. The right non us citizen health insurance plan should support your global mobility, not impede it. You can explore our detailed country guides to see just how much insurance requirements differ across major international hubs.

For a successful international professional, health insurance is not just another line item on a budget; it is a strategic investment in your personal security and a tool for mitigating significant financial risk.

When evaluating premier health plans, one must look beyond the monthly premium and dissect the entire financial architecture of the policy. This is the only way to ensure the value received aligns with the capital invested in your well-being.

The true differentiator between plans is your financial exposure in the event of a significant medical event. For both premier International Private Medical Insurance (IPMI) and high-end U.S. domestic plans, the cost structure has several key components. Understanding how they function is key to making an informed decision.

Deconstructing Premium Plan Costs

The true cost of any health plan is a combination of its fixed monthly premium and the variable, out-of-pocket costs incurred when you access care. These variables are what separate a standard plan from one engineered for serious asset protection.

Here is what you need to focus on:

- Deductibles: This is the amount you pay out of pocket before the insurance company begins to pay. Premium plans often allow you to select a higher deductible to lower your monthly premium—a prudent strategy if you prefer to self-insure for minor medical issues.

- Co-insurance: After you have met your deductible, you and the insurer share the cost. A common 80/20 split means the insurer pays 80% of the bill, and you are responsible for the remaining 20%.

- Out-of-Pocket Maximum: This is the most critical figure in the policy. It is the absolute ceiling on what you will pay for covered medical care in a given year. Once this limit is reached, the insurance plan pays 100% of all subsequent covered costs. This is your financial backstop against a catastrophic medical event.

For high-net-worth individuals, a plan without a robust out-of-pocket maximum is a non-starter. It is what transforms an unpredictable, potentially ruinous financial risk into a calculable, manageable figure.

Geographical Cost and Risk Mitigation

Where you receive care profoundly impacts the cost. This is especially true when securing non us citizen health insurance for use in the United States.

Major metropolitan areas like New York, San Francisco, and Los Angeles have some of the highest healthcare costs globally. Insurers recognize this and apply "geographical rating factors" to increase premiums for coverage in these areas.

This is where a premium IPMI plan demonstrates its strategic value. While the upfront cost may be higher than a domestic plan, it is structured to absorb the astronomical costs of the U.S. system. A single emergency visit or complex surgery at a major out-of-network U.S. hospital can easily reach six or even seven figures.

A higher IPMI premium is not an expense; it is a calculated investment to neutralize a potentially catastrophic financial liability. You are effectively purchasing immunity from the risk of a multi-million-dollar medical bill that could otherwise jeopardize your personal assets.

A U.S. domestic plan, confined to its network, can leave you dangerously exposed if you require a top specialist who is not on their approved list. IPMI, conversely, provides broad access to the best doctors and hospitals, ensuring your financial protection is as mobile and flexible as your lifestyle.

The Nuances of Medical Underwriting

Finally, for any plan that is not ACA-compliant—which includes most IPMI policies—you will undergo medical underwriting. This is the process where the insurer reviews your health history, including any pre-existing conditions, to determine the terms of your coverage.

For high-net-worth individuals and their families, this should be viewed not as an obstacle, but as an opportunity to secure complete peace of mind. By being fully transparent about your medical history, you enable the underwriters to craft a policy that provides explicit, ironclad coverage.

Depending on the condition, they might offer full coverage, add a surcharge to the premium, or exclude that specific condition. The purpose is to eliminate ambiguity. You will know precisely what is covered long before you ever need to use the policy. This process ensures your non us citizen health insurance functions as the powerful protective asset it is intended to be.

How to Select Your Ideal Health Insurance Plan

Selecting the right health insurance plan is a strategic decision, not an exercise in guesswork. For a globally mobile professional, this choice requires a clear, methodical approach that aligns with your unique lifestyle and financial objectives. This is about securing genuine confidence and control over your health security, regardless of your location.

The optimal way to approach this is to systematically weigh your personal and professional needs against the offerings of potential plans. This ensures your final choice is not merely adequate, but perfectly suited to your requirements.

Assess Your Global Footprint

First, map your lifestyle. Where do you spend the majority of your time? How frequently do you travel between the U.S., your home country, and other international hubs? A plan’s value is directly correlated with its geographical reach.

Consider your travel patterns over the next two to three years. If you anticipate frequent cross-border travel, a plan with a robust global network and seamless portability is non-negotiable. A U.S.-centric plan, even a premium one, becomes ineffective the moment you embark on an extended trip abroad.

This assessment is the foundation for any non us citizen health insurance decision. It defines the core requirement of your coverage—whether it needs to be locally focused or globally comprehensive.

Evaluate Your Family's Healthcare Needs

Next, consider your personal and family health requirements. Do you or a family member have a pre-existing condition that requires specialized, ongoing care? Are you planning to start or expand your family?

Create a list of your specific medical needs:

- Routine Wellness: Check-ups, preventative screenings, and vaccinations.

- Specialist Care: Access to top-tier specialists for disciplines like cardiology or oncology.

- Maternity and Newborn Care: Comprehensive coverage for prenatal, delivery, and postnatal stages.

- Dental and Vision: Optional modules, but crucial for complete family well-being.

A superior health plan offers more than just emergency coverage; it provides access to world-class preventative and specialized care. Your policy should empower you to proactively manage your health, not just react to crises.

Analyzing these details ensures the plan you choose can handle both routine care and complex medical events without causing financial or logistical distress. To better understand the policy specifics, you can learn more about how to interpret expat medical insurance policy terms in our detailed guide.

Scrutinize Provider Networks and Service Levels

For high-net-worth individuals, access to premier medical facilities is a primary concern. Do not just evaluate the size of a provider network; examine its quality. Does the plan have direct-billing arrangements with leading hospitals and clinics in the cities you frequent most?

The level of service is equally important. When a medical issue arises, you require a responsive, expert team. Look for insurers that provide:

- 24/7 Multilingual Assistance: A dedicated concierge service for emergencies and inquiries.

- Efficient Claims Processing: A streamlined, digital process for reimbursements.

- Medical Evacuation and Repatriation: Robust support for worst-case scenarios.

This type of white-glove service is a hallmark of premium IPMI plans and a critical feature that distinguishes them from standard domestic options.

Prepare Your Essential Documentation

A smooth application process hinges on preparation. Assembling your documents in advance will prevent delays and help you secure coverage efficiently.

Below is a checklist of the documents you will likely need. While specific requirements can vary between insurers and plan types, having these ready is a prudent step.

Essential Documentation Checklist for Application

| Document Type | Purpose | Common Requirement For |

|---|---|---|

| Passport & Visa | Proof of identity and legal status in the U.S. | All plan types |

| Proof of Address | Verification of residency (e.g., utility bill) | Primarily U.S. domestic plans |

| Medical History | Required for underwriting pre-existing conditions | Primarily IPMI plans |

| Proof of Income | Sometimes required to verify financial standing | Certain high-limit plans |

Having these items organized allows you to move decisively once you have identified the ideal non us citizen health insurance policy. This methodical approach ensures your final decision is informed, strategic, and perfectly aligned with your global lifestyle.

Finding Your Global Health Security Partner

For a non-U.S. citizen operating at the highest levels of global finance, health insurance is not a mere compliance item; it is the foundation of your personal and financial security. As we have detailed, International Private Medical Insurance (IPMI) is structured for a life without borders, offering the flexibility and comprehensive coverage that domestic systems cannot provide.

IPMI offers a direct line to elite medical care, bypassing the bureaucracy and geographical limitations inherent in U.S. domestic plans. This is a critical advantage for professionals whose careers and lives span multiple continents. Your health security must be as mobile and dependable as you are.

Your Definitive Advisory Partner

Making this decision correctly requires more than a simple product comparison; it demands expert, objective guidance. This is our area of expertise. Our firm focuses exclusively on serving high-net-worth professionals in the global financial sector. We understand the unique pressures and expectations of your world.

Our model is built on objectivity. We provide a white-glove service that matches the standard you demand in every other aspect of your professional life. Our purpose is not to sell a policy, but to design a health security solution that provides absolute clarity and control.

We commit to a meticulous, personalized assessment of your unique global footprint. Our goal is to ensure the plan you select is not just adequate, but optimal for you and your family’s well-being. This is our pledge of confidence and partnership.

Securing the right non us citizen health insurance is a decisive step toward safeguarding your future. Let our experts provide the definitive guidance you need to make this choice with complete confidence. We invite you to connect with us for a personalized consultation to build your global health security strategy.

Frequently Asked Questions

When discussing U.S. health insurance for non-citizens, the questions are invariably specific and sharp. For high-net-worth individuals who value precision, direct answers are essential for making sound decisions about your family's health and financial well-being. Here are the answers to the most common inquiries we receive.

Can I Use My Home Country Insurance in the United States?

In nearly all scenarios, this is not a viable strategy. Your national health plan is designed for your home country's healthcare system and does not translate to the distinct and exceptionally expensive U.S. environment.

Any cross-border coverage is typically limited to acute emergencies and will likely leave you with significant out-of-pocket costs. Relying on a foreign plan in the U.S. constitutes a substantial financial risk. A dedicated non us citizen health insurance plan, such as a premium IPMI policy, is structured to navigate and cover care within the U.S., effectively neutralizing this risk.

What Happens If My Visa Status Changes?

This is a critical consideration. A change in your visa status can instantly render you ineligible for a U.S. domestic health plan, creating a sudden and dangerous gap in your coverage at a time when stability is most needed.

This is where International Private Medical Insurance (IPMI) demonstrates its superior design. Your IPMI policy is completely independent of your immigration documentation. As it is built for global citizens, it provides seamless, continuous protection regardless of changes to your visa, residency, or employment status. It is a layer of stability you can depend on.

Are My Pre-Existing Conditions Covered?

This is a paramount question, and the answer depends entirely on the plan type. While ACA-compliant domestic plans are required to cover pre-existing conditions, the challenge is that eligibility for these plans is often restricted for non-citizens.

For IPMI plans, your coverage terms are determined through a process called medical underwriting. The process is as follows:

- The insurer conducts a thorough review of your complete medical history.

- Based on this review, they may offer full coverage, sometimes with an adjusted premium.

- Alternatively, they could offer a policy that excludes a specific condition or imposes a waiting period before that condition is covered.

Full transparency during underwriting is non-negotiable. Disclosing all pertinent information allows a specialist broker to identify the precise plan that will protect you and your family without future complications.

This detailed process removes all ambiguity, providing you with absolute certainty about what is and is not covered from the outset.

How Does IPMI Handle High-Cost Medical Care in the US?

Premium IPMI plans are engineered specifically to manage the high costs of the U.S. medical system. They feature exceptionally high benefit limits, often in the multi-millions, ensuring that even the most complex and expensive treatments are fully covered.

Crucially, these insurers maintain direct payment agreements with premier U.S. hospitals. This means they settle the bills directly with the provider, so you are not required to pay a massive bill upfront and await reimbursement. This arrangement ensures you receive the best possible care without the threat of debilitating medical debt.

At Riviera Expat, we specialize in providing objective, expert guidance to secure the health insurance that aligns with your global lifestyle. Consult with our experts for a personalized assessment of your needs.