Securing premier medical insurance with a pre existing condition can feel like a formidable challenge. However, it is entirely navigable.

For globally mobile individuals, a known health issue—from controlled hypertension to a past major illness—adds a layer of complexity. It does not, however, preclude access to elite, worldwide coverage. The key lies in understanding how international insurers assess risk and structure policies for discerning clients.

Securing Global Health Coverage With a Pre-Existing Condition

For high-net-worth individuals leading a global lifestyle, uninterrupted access to first-class healthcare is a necessity, not a luxury. A pre-existing health condition can seem like a significant obstacle to securing the international private medical insurance (IPMI) required to protect that standard of care.

It is more accurate to view this not as an obstacle, but as a complex navigational challenge that can be successfully managed.

The international insurance market operates under a different set of principles than most domestic systems. While a home country's regulations might mandate coverage for pre-existing conditions, the global arena is predicated on individual risk assessment. This is a critical distinction—it shifts the focus squarely onto transparent disclosure and strategic policy selection.

Just How Big Is This Challenge?

This is a widespread concern. Consider the United States, where analysis from the Kaiser Family Foundation indicates that approximately 54 million non-elderly adults, or 27% of that demographic, have health conditions that could lead to higher premiums or denial of coverage in an unregulated market.

These are not merely rare diseases; they include common conditions such as asthma and high cholesterol, as well as major illnesses like cancer or heart disease. This reality underscores the vital importance of a well-planned approach when seeking global coverage, where underwriting standards are often far more stringent.

The Framework for Success

Obtaining the right medical insurance with a pre-existing condition depends on understanding the process and your available options. The objective is simple: secure a policy that is as robust and mobile as your lifestyle, protecting both your health and your wealth.

This guide provides the framework to achieve that by dissecting the key areas:

- Understanding the Underwriting Process: We will detail how insurers scrutinize your medical history to determine coverage and terms.

- Decoding Policy Structures: You will learn the language of insurers—moratoriums, premium loadings, and exclusions—and what these mechanisms truly mean for your coverage.

- The Power of Expert Advice: We will demonstrate how a specialist advisor can be your greatest asset, framing your application and negotiating terms you could not achieve alone.

A critical first step is understanding the core benefits one should expect from international private medical insurance. It is also wise to consider how modern care options, such as telehealth services, can integrate with your policy, especially for managing chronic conditions while travelling. Mastering these concepts will transform a perceived obstacle into a clear path toward the protection you require.

How Insurers Define Pre-Existing Conditions

When seeking top-tier medical insurance with a pre existing condition, the most critical first step is to understand the insurer's perspective. The term may seem straightforward, but in the world of international private medical insurance (IPMI), it is a detailed concept that extends beyond a simple diagnosis.

Consider your medical history not as a list of ailments, but as a financial prospectus presented to an underwriter. They are not just examining your past; they are forecasting the future and assessing the potential for high-cost claims. Their definition of a pre-existing condition is engineered to measure that precise risk.

A pre-existing condition encompasses any medical or psychological issue, illness, or injury for which you have experienced symptoms, sought advice, or received treatment before your policy’s start date. This is a crucial point: a formal diagnosis is not a prerequisite.

The Look-Back Period

A key component of this assessment is the “look-back period.” This is a specific window of time, typically two to five years prior to your application, that the insurer will examine meticulously. Any symptom, consultation, or treatment within this period can flag an issue as pre-existing.

For example, unexplained shortness of breath 18 months ago, even if never formally investigated, would be considered a pre-existing symptom by an underwriter. Full disclosure of such events is essential to maintain the validity of your policy.

Common Categories of Pre-Existing Conditions

Insurers classify conditions into risk categories based on their stability, cost, and long-term outlook. This classification drives their final decision.

-

Easily Managed Conditions: These are chronic but stable issues that are well-controlled with routine medication and check-ups. Examples include controlled high blood pressure, high cholesterol, or mild asthma. These are often insurable, sometimes with a modest premium loading.

-

Moderate or Episodic Conditions: This category includes issues that may be stable now but have a history of flaring up or requiring specialist care. This encompasses conditions like Crohn's disease in remission, a manageable autoimmune disorder, or a history of anxiety requiring occasional consultations.

-

High-Risk or Recent Major Conditions: This is the category that raises significant concern for underwriters due to the high potential for expensive claims. It includes recent cancer treatments (within the last 5 years), uncontrolled diabetes with complications, or a major cardiac event such as a recent heart attack or stroke.

An underwriter's primary function is to build a predictable risk pool. A well-documented, stable condition represents a manageable risk. A recent, severe, or undiagnosed problem, however, is a significant unknown and presents the most challenging profile to insure.

Securing medical insurance with a pre existing condition that falls into the high-risk category demands a highly strategic approach. It often necessitates detailed medical reports and direct negotiation, typically facilitated by a specialist advisor. Understanding how an insurer is likely to perceive your health profile is the first step in transforming a standard application into a successful negotiation for global coverage.

Navigating the Underwriting Process

Once you submit your medical history, the insurer begins the underwriting process. This critical step establishes the precise terms of your coverage. For anyone seeking medical insurance with pre existing condition, this stage is paramount. It determines whether your known health issues will be covered, excluded, or managed with special terms.

Your application will proceed down one of two distinct paths: Full Medical Underwriting or Moratorium Underwriting. The choice between them is strategic, representing a trade-off between upfront certainty and expedited policy issuance. For high-net-worth individuals requiring absolute clarity in their financial and personal planning, one path is almost invariably superior.

Full Medical Underwriting: The Path to Certainty

Full Medical Underwriting (FMU) is the most transparent and comprehensive route. It is a complete due diligence of your health history. You will complete detailed questionnaires and, if necessary, grant the insurer permission to access your medical records or request a statement from your physician.

While it requires more effort at the outset, the benefit is significant: a final, legally binding decision before your policy commences. The insurer provides a clear statement outlining precisely what is covered, what is not, and if any special terms—such as a higher premium—apply. From day one, there is zero ambiguity regarding your coverage.

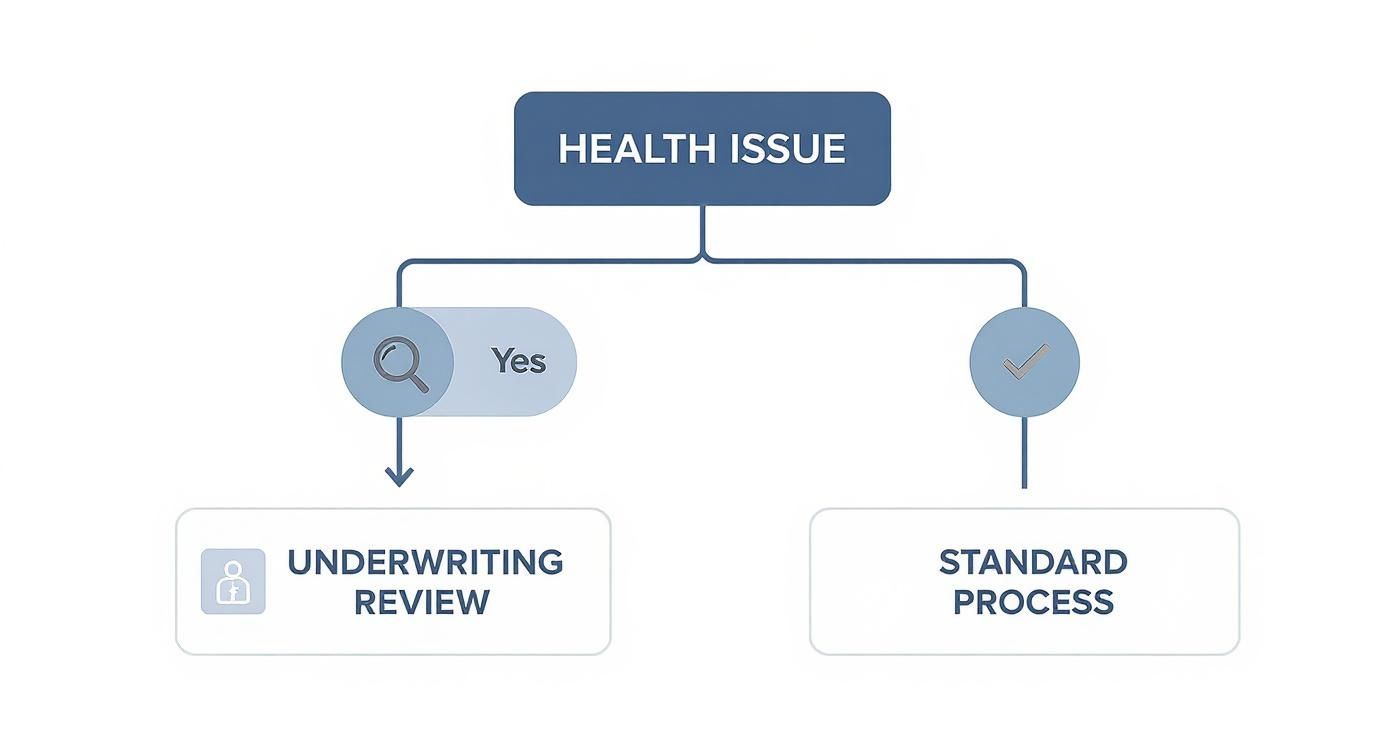

This flowchart illustrates the process when a health issue is identified.

As shown, any health issue deemed pre-existing triggers a formal underwriting review. If no issues are present, the application proceeds through the standard process.

Moratorium Underwriting: The Wait-And-See Approach

Moratorium underwriting offers an expedited path to policy issuance. It forgoes an upfront review of your history, instead postponing the decision on pre-existing conditions. Under this model, any condition for which you have had symptoms or received treatment recently (typically within the last 24 to 60 months) is automatically excluded from coverage at the policy's start.

It is possible to have these conditions covered later, but only after completing a continuous "moratorium period"—usually 24 months—without any symptoms, advice, or treatment for that specific condition. It is a passive, “wait-and-see” approach that prioritizes speed over certainty.

The core trade-off is clear: FMU delivers absolute certainty from the outset, while a moratorium offers immediate policy issuance at the cost of future coverage ambiguity. For those managing significant personal and financial assets globally, certainty is almost always the more valuable commodity.

A Real-World Scenario: Controlled Type 2 Diabetes

Consider an expatriate executive in Singapore diagnosed with Type 2 Diabetes three years ago. His condition is well-managed with medication and diet.

Here is how the two underwriting paths would likely affect him:

-

Under Full Medical Underwriting (FMU): He discloses his full medical history, recent blood glucose readings, and a report from his endocrinologist. The underwriter assesses the stability and control of his diabetes. The most probable outcome is that they accept the condition but apply a premium loading—a calculated increase to his premium (e.g., 25-50%) to account for the managed risk. He knows exactly what his policy costs and that his diabetes care is covered from day one.

-

Under Moratorium Underwriting: His policy is issued quickly, but his Type 2 Diabetes is automatically excluded for the first 24 months. During this period, he must pay for all diabetes-related consultations, medications, and tests out-of-pocket. If he were able to remain treatment-free (which is not feasible for his condition), the exclusion might be lifted after two years. In practice, this approach is entirely unsuitable for any chronic condition requiring ongoing management, leaving him with a substantial and predictable gap in coverage.

How Insurers Actually Handle Pre-Existing Conditions

Beyond the application process, it is essential to understand the practical tools insurers use to manage risk. When securing medical insurance with a pre existing condition, knowledge of these policy structures is key to obtaining a plan that provides genuine security. Insurers utilize several mechanisms, each significantly impacting your coverage and costs.

For a discerning individual, the objective is not merely to be accepted for a policy, but to obtain coverage that is truly meaningful. This requires knowing precisely how your plan will respond when needed for your known health issues. The three primary tools are premium loadings, specific exclusions, and waiting periods. Understanding these allows you to work with an advisor to construct a plan that offers robust protection.

Premium Loadings: Paying for Peace of Mind

A premium loading is an additional amount added to your standard premium. The insurer calculates this increase to cover the higher perceived risk associated with your pre-existing condition. While no one prefers to pay more, for many, this is the optimal way to secure comprehensive coverage.

Consider it a direct investment in certainty. You pay an additional amount, and in return, your condition is fully covered by the policy from day one, without surprises.

Insurers do not arbitrarily set this figure. It is based on a detailed risk assessment, considering the stability of your condition, typical treatment costs in your primary country of residence, and your long-term prognosis. A loading can range from 25% to over 100%, depending on the situation. For a stable condition like well-managed hypothyroidism, the loading may be minor. For a more complex history, such as recovery from a major cardiac event, it will be substantially higher. This is an excellent route for chronic conditions requiring ongoing care, ensuring all consultations and prescriptions are covered seamlessly.

Condition-Specific Exclusions: The Surgical Approach

In some cases, an insurer will offer a policy but place a permanent exclusion on your pre-existing condition and anything related to it. This means the plan covers you for everything else—accidents, new illnesses, unrelated health problems—but will never pay for claims connected to that specific issue.

An exclusion is a very precise tool. For instance, if you have a history of degenerative disc disease in your lower back, the insurer might exclude any treatment for your lumbar spine. However, you would remain fully covered for a broken arm, influenza, or even a different spinal problem in your cervical region.

An exclusion is often the solution when a condition is too risky or unpredictable for the insurer to price with a loading. It provides a means to obtain broad health coverage while you agree to self-insure that one specific risk.

Waiting Periods: A Temporary Pause on Coverage

Finally, some policies may apply a waiting period for certain conditions. Unlike an exclusion, this is temporary. It is a set period, typically 12 to 24 months after the policy starts, during which you cannot claim for that specific health issue.

Waiting periods are most common for predictable, non-emergency treatments. Maternity benefits, for example, almost always have a waiting period to prevent individuals from purchasing a policy only after becoming pregnant. They can also be applied to pre-existing conditions that an underwriter believes may stabilize or improve over time. Once the waiting period is completed without issue, the condition may become eligible for full coverage.

This is less common for chronic conditions in the international private medical insurance market but serves as an example of the tools available to insurers.

Understanding Premium Calculations and Costs

When securing medical insurance with a pre existing condition, the premium is not merely a price; it is a carefully calculated reflection of risk. For high-net-worth individuals, the goal is not to find the lowest price but to secure the best value—a policy that offers a financial firewall against health-related events. Insurers utilize precise risk-pricing models to determine these figures.

These models analyze several key variables to construct your premium. The stability of your condition is a primary factor. A well-managed, predictable issue like controlled hypertension presents a much lower financial risk than a condition with a volatile history. The long-term prognosis for your health and the typical cost of treatment in your main country of residence are also critical components.

The Core Factors Driving Your Premium

An underwriter's calculation is a sophisticated blend of your personal health data and broader market forces, creating a financial forecast of your potential healthcare needs.

- Condition Stability and Control: The most compelling evidence you can provide is a clear record of a stable, well-managed condition. Consistent medical records demonstrating effective treatment are far more reassuring to an insurer than a history of frequent, unscheduled medical interventions.

- Long-Term Prognosis: Insurers assess the likelihood of future high-cost claims. A condition with a low probability of requiring major surgery or advanced therapies will result in a more favorable premium.

- Jurisdictional Treatment Costs: This is a significant factor. The cost of medical care varies dramatically between global hubs like Singapore, London, and Dubai. Your premium will be directly influenced by the expected cost of managing your condition in these high-cost locations.

The Impact of Global Medical Inflation

Beyond your personal health profile, global economic trends exert significant pressure on premiums. Medical inflation consistently outpaces standard inflation, a trend fueled by advancements in medical technology, new pharmaceuticals, and an increasing focus on wellness.

Securing a stable, long-term policy is a core component of wealth preservation. Your health plan should function as a protected asset that shields you from financial shocks, not a liability that introduces new ones.

This trend is not decelerating. Projections from WTW's 2025 Global Medical Trends Survey indicate that global medical costs are expected to rise by 9.9% in 2025, holding steady from the 10.1% increase in 2024. With 64% of insurers anticipating these high trends will persist, locking in comprehensive coverage now is a strategic financial move. For a deeper analysis, you can review the full global medical trends survey.

When considering the long-term impact of these rising costs, it is vital to be proactive in setting clear financial goals to ensure these expenses align with your overall wealth management strategy. This includes understanding how deductibles and excesses can be used to manage costs, a topic detailed in our guide on the fine print of excesses and deductibles. By viewing your insurance premium as a calculated investment in risk mitigation, you can make a decision that protects both your health and your financial legacy.

The Value of a Specialized Insurance Advisor

Attempting to secure premier medical insurance with a pre existing condition independently is analogous to representing oneself in a complex legal proceeding. While technically possible, it positions you at a distinct disadvantage and exposes you to unnecessary risk.

The international insurance market is intentionally complex, replete with policy nuances and unwritten underwriting guidelines. This is precisely where a specialized insurance advisor becomes your most critical asset.

View an advisor not as a salesperson, but as a strategic partner, akin to your wealth manager or legal counsel. Their function is to eliminate ambiguity, comprehend your specific health profile, and translate it into the most favorable terms available from the global market. For a high-net-worth individual, time and certainty are invaluable commodities. An expert advisor delivers both.

They possess access and influence that are unattainable on your own. Direct lines to senior underwriters at top-tier global insurers allow them to informally vet your case, ensuring your formal application has the highest probability of success from the outset.

Strategic Advantages of Expert Representation

Engaging an advisor transforms the process from a reactive task into a proactive strategy. They provide tangible value at every stage, from the initial consultation to the final policy issuance.

This includes:

- Anonymous Pre-Screening: We can discuss the specifics of your medical history with senior underwriters without disclosing your identity. This allows us to assess potential outcomes before a formal application is submitted, protecting your official application history from any rejections.

- Favorable Case Framing: An experienced advisor knows precisely what information underwriters require. They assist in framing your medical history in a manner that is clear, compelling, and emphasizes the stability and responsible management of your condition.

- Bespoke Term Negotiation: This is where their relationships and market expertise yield significant returns. An advisor can negotiate directly on your behalf for improved terms, such as advocating for a lower premium loading or a more precisely worded, less restrictive exclusion.

An expert advisor’s true value lies in their ability to convert an insurer’s rigid, standard process into a flexible, bespoke negotiation. They ensure the final policy is not merely adequate, but perfectly aligned with your health needs, global lifestyle, and long-term financial objectives.

Ultimately, an advisor removes the guesswork and administrative burden from your purview. They manage the entire process, from gathering the appropriate medical evidence to comparing confidential offers from multiple insurers. This level of service ensures you secure the best possible medical insurance with a pre existing condition, providing the clarity and control necessary to protect your health and wealth, wherever you are in the world.

Frequently Asked Questions

When addressing medical insurance with a pre existing condition, the questions are invariably specific, and the stakes are high. For individuals accustomed to precision in their financial planning, ambiguity is unacceptable. Here are direct, clear answers to the most common questions we receive, providing the clarity required to proceed with confidence.

Can an Insurer Cancel My Policy if My Condition Worsens?

This is a significant concern, but the answer should provide reassurance. Once you have been accepted onto an annually renewable international medical plan—with full and honest disclosure—the insurer cannot legally cancel your policy solely because your health deteriorates.

These policies are "guaranteed renewable." This means that regardless of the number of claims you make, you will be offered renewal terms each year. While the overall premium for the entire insurance pool may increase due to medical inflation, they cannot single you out for cancellation because of a change in your personal health status.

Which Is Better: Full Medical Underwriting or a Moratorium?

The choice is not about which is intrinsically "better," but about what you value more: absolute certainty from day one or rapid policy issuance. For high-net-worth individuals who demand predictability in their affairs, Full Medical Underwriting (FMU) is almost always the superior strategic choice.

FMU provides a definitive decision on your coverage from the outset. There are no surprises or grey areas. A Moratorium policy, while faster to establish, introduces significant uncertainty. Your pre-existing conditions will not be covered until you have completed a specified period—typically 24 months—without symptoms, treatment, or advice for that issue. For anyone actively managing a chronic condition, this creates a predictable and unacceptable coverage gap.

For those who view health insurance as a non-negotiable component of risk management, the upfront clarity of Full Medical Underwriting provides genuine peace of mind. It is the path we consistently recommend.

Will My Premium Loading Ever Decrease?

It is possible, but it is not an automatic process. A premium loading applied for a pre-existing condition can be reviewed and potentially reduced or removed. This typically occurs at your annual renewal and only upon submission of strong medical evidence demonstrating a significant and sustained improvement in your health.

For instance, a loading for a high Body Mass Index (BMI) might be reconsidered after you have documented and maintained long-term weight loss. A condition that has been in remission for several years could also qualify for a review. This must be formally requested from the insurer, and it is a process best managed by your specialist advisor, who knows how to present the medical evidence most effectively.

Finding the right international health plan is complex. The specialists at Riviera Expat deliver the objective advice and market access you need to secure coverage that truly fits your health profile and global lifestyle. Contact us for a complimentary consultation.