To protect your wealth effectively, you must first understand the core financial levers in your International Private Medical Insurance (IPMI). The two most pivotal are your deductible and your out-of-pocket maximum.

Think of your deductible as the initial, pre-agreed amount you are responsible for covering for medical care before your insurer begins to contribute. In contrast, the out-of-pocket maximum is your ultimate financial safeguard—it is the absolute ceiling on what you will pay for covered medical services within a policy year.

Navigating Your Global Health Plan’s Core Financials

For high-net-worth individuals, mastering how these two figures interact is not merely an exercise in understanding insurance terminology. It is a critical component of managing your global financial architecture. These are not just policy terms; they are strategic instruments you can leverage to control cash flow and shield your assets from a high-cost medical event.

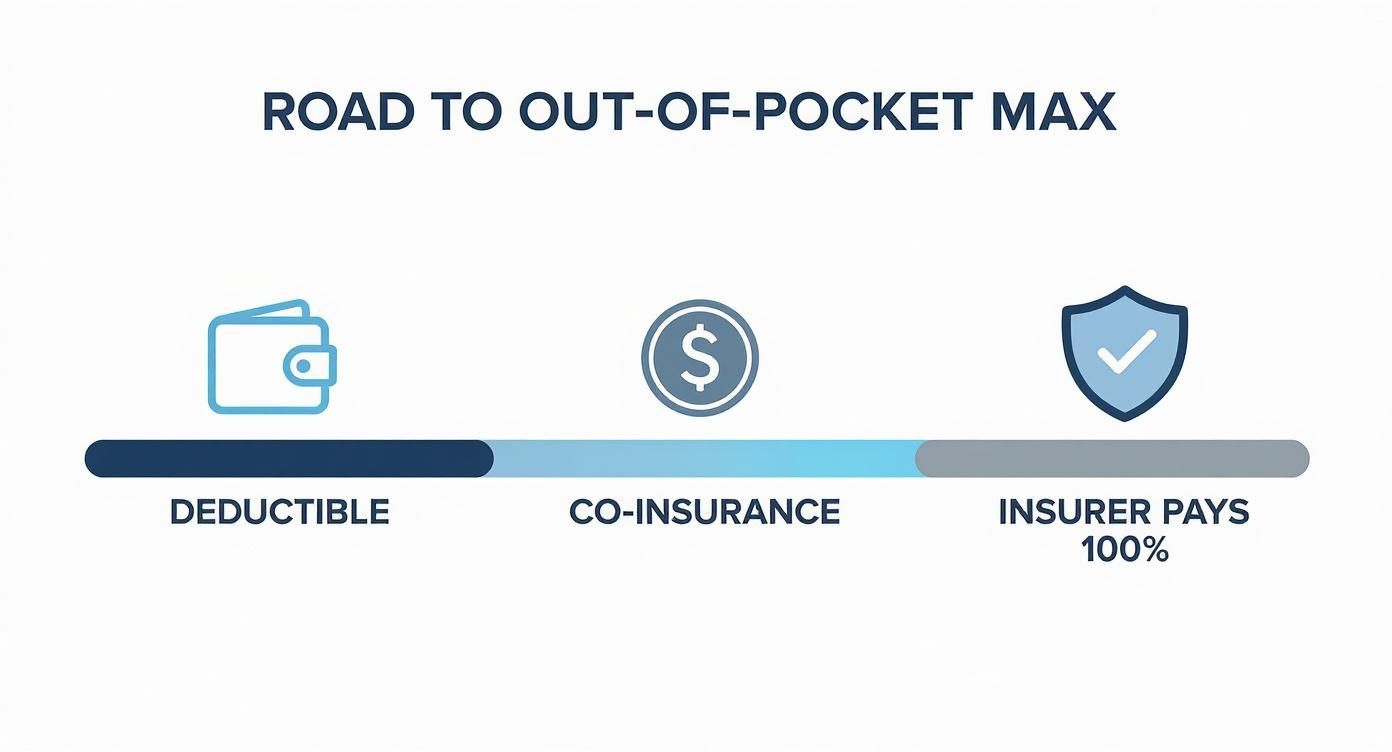

Consider it as setting the terms of a financial partnership with your insurer. The deductible represents your initial capital contribution. Once that amount is met, you enter a cost-sharing phase. This shared responsibility is not indefinite. Once your total payments reach the out-of-pocket limit, the nature of the partnership shifts decisively. The insurer then assumes 100% of the financial responsibility for any further covered care, effectively capping your risk and preserving your wealth.

Key Distinctions for Global Professionals

The relationship between your deductible and out-of-pocket maximum directly influences your annual premiums. It is a classic financial trade-off.

Opting for a higher deductible generally corresponds to a lower premium. This is a strategy often preferred by those comfortable self-insuring for smaller medical costs in exchange for lower fixed monthly or annual payments. Conversely, a lower deductible provides more predictable, immediate cost-sharing from your insurer, but you will pay for that certainty with a higher premium.

Here is a straightforward breakdown of how these two core components of your plan compare.

Deductible vs Out-of-Pocket Max at a Glance

A direct comparison of the two primary cost-sharing components in your international health plan.

| Financial Component | What It Is | When You Pay It | Impact on Your Premium |

|---|---|---|---|

| Deductible | The fixed amount you pay first for covered medical care before your insurer begins to contribute. | At the beginning of your claim(s) until the deductible amount is met. | Higher deductible = Lower premium. |

| Out-of-Pocket Maximum | The absolute maximum you will pay for covered care in a policy year. It is your financial safeguard. | You cease paying for covered services once your combined deductible and coinsurance payments reach this limit. | A lower out-of-pocket max often leads to a higher premium. |

Understanding these mechanics is a foundational step. To make a truly informed decision, it is beneficial to grasp the full scope of IPMI terminology. For a more detailed exploration, you can review our guide on how to better understand expat medical insurance policy terms.

The core objective is to structure a plan where your known, fixed costs (premiums) and potential, variable costs (deductibles and coinsurance) align precisely with your financial strategy and risk tolerance. This ensures you have premier healthcare access anywhere in the world without compromising your financial stability.

Achieving this balance is the bedrock of a sound global health strategy. It delivers peace of mind, knowing your financial exposure is clearly defined and capped, regardless of the medical needs that may arise during your international assignments.

How Deductibles Work in Premier IPMI Plans

For a globally mobile professional, your deductible is not just a policy detail—it is a core strategic decision. This extends far beyond a simple annual figure. High-end International Private Medical Insurance (IPMI) plans present nuanced choices that directly shape your financial planning and cash flow. Making the right selection is fundamental to building a plan that truly supports your international lifestyle.

One of the first, and most critical, decisions you will face is choosing between an annual deductible and a per-condition deductible. An annual deductible is straightforward; it is a single amount that resets each policy year.

A per-condition deductible, however, is a different financial instrument. It applies a separate deductible to each distinct medical issue. This structure can fundamentally alter your financial exposure, particularly if you are managing a chronic condition requiring ongoing care year after year.

Strategic Premium Management

Your deductible level is the most direct lever you have to control your insurance premiums. It is a simple trade-off: by selecting a higher deductible, you can significantly lower your monthly or annual payments.

This is a calculated financial decision, best suited for those with sufficient liquidity to comfortably cover initial medical bills out-of-pocket. You are essentially agreeing to self-insure for smaller, manageable expenses in exchange for a much lower fixed insurance cost.

The interplay between your deductible and your premium allows you to align your insurance costs with your personal risk tolerance and cash flow. It is about paying for protection against major events, not for every routine check-up.

This strategic choice is a key part of optimizing your entire insurance portfolio. For a deeper dive into these policy mechanics, our analysis on the fine print of excesses and deductibles offers more clarity.

Family Deductible Structures

When insuring a family, the deductible calculation becomes more complex, but it also creates opportunities for sophisticated planning. Premier IPMI plans generally offer two ways to structure deductibles for families:

- Per-Person Deductible: Each member of the family has their own individual deductible. Once one person meets their specific amount, the insurance starts sharing costs for their care.

- Aggregate Deductible: This is a single, larger deductible that applies to the entire family unit. Medical expenses from all family members are pooled to meet this one shared threshold.

The aggregate option can be a highly effective strategy for families, particularly those with children who may have several smaller physician visits or minor issues throughout the year. For instance, if one family member has a single significant medical event, their expenses can satisfy the deductible for everyone, advancing the entire family to the cost-sharing phase much more rapidly. This provides the clarity needed to select a plan genuinely aligned with your family's unique healthcare needs around the world.

The Out-of-Pocket Maximum: Your Financial Backstop

If the deductible is the first financial hurdle, think of the out-of-pocket maximum as your absolute financial safeguard. It is the single most important number on your policy because it represents the absolute most you will ever pay from your own funds for covered medical care in a policy year. This figure protects your assets in a worst-case scenario.

Once the sum of your payments for the deductible, co-payments, and any coinsurance reaches this pre-set cap, your insurance company intervenes and covers 100% of all eligible medical costs for the remainder of the policy year. This feature is specifically designed to prevent a catastrophic medical event from becoming a catastrophic financial one. It places a finite, predictable limit on your financial risk.

A Major Medical Event in Action

Let us walk through a real-world scenario to illustrate this mechanism. Imagine an expat executive requires major surgery with a total cost of $150,000. Their health plan specifies a $5,000 deductible and a $15,000 out-of-pocket maximum.

Here is how the costs would be allocated:

-

Meeting the Deductible: The executive pays the first $5,000 of the bill directly. This satisfies the deductible.

-

The Cost-Sharing Phase: After the deductible, their plan might stipulate a 20% coinsurance. This means they pay 20% of subsequent bills, and the insurer pays 80%. This continues until their total personal payments reach the out-of-pocket limit.

-

Activating the Safeguard: The executive pays an additional $10,000 through these 20% coinsurance payments. At this point, their total expenditure ($5,000 deductible + $10,000 coinsurance) reaches the $15,000 out-of-pocket maximum.

-

Full Insurer Responsibility: For the remaining $135,000 of the surgical costs, the insurer pays the full amount. The executive pays nothing more for covered services for the rest of that policy year.

This progression demonstrates how the out-of-pocket limit acts as a hard stop on your expenses, ensuring a serious health crisis does not deplete your broader financial portfolio.

The out-of-pocket maximum is what transforms unpredictable, potentially limitless medical bills into a calculable, capped risk. It is the most critical feature for safeguarding your long-term financial stability.

IPMI Considerations for Global Citizens

For those living and working across borders, several additional factors come into play. For instance, if you receive care outside your insurer’s direct billing network, you may face different cost-sharing rules, which could affect how quickly you reach that protective ceiling.

Managing claims in different currencies also adds a layer of complexity. It is imperative to have absolute clarity on how your insurer handles currency conversions when calculating your contributions toward the out-of-pocket maximum. Familiarizing yourself with these processes, particularly mechanisms like pre-authorisation and direct settlement for medical procedures, is essential for a seamless experience. This clarity ensures your financial safeguard functions precisely as intended, regardless of your location.

Comparing Real-World Expat Scenarios

Theory is one thing, but observing how these figures perform in real-world situations is where true understanding is achieved. The “best” plan structure is not a universal solution; it is a deeply personal financial decision contingent on your health, cash flow, and risk tolerance.

To illustrate exactly how these choices impact your bottom line, let us examine three distinct high-net-worth expat profiles. We will use specific figures to see how their plan structure dictates their total annual healthcare spending.

This simple infographic breaks down the financial journey. You begin by covering all costs yourself until you meet your deductible. Then, you share costs with the insurer. Finally, you reach your out-of-pocket maximum, and the insurer assumes 100% of the cost.

It is an excellent mental model for visualizing how your financial risk diminishes as you progress through these stages.

The Young Entrepreneur in Dubai

First, a 32-year-old fintech founder in Dubai. He is in excellent health with substantial liquid assets. His primary objective is to minimize his fixed annual costs. He views a high-deductible health plan (HDHP) as a prudent, calculated risk.

- Plan Structure: $10,000 deductible / $20,000 out-of-pocket maximum

- Annual Premium: A lean $4,000

- Medical Needs: A minor sports injury resulted in a specialist visit and imaging, with total bills of $3,500.

Since his medical bills were well below his $10,000 deductible, he paid the full $3,500 himself. The key takeaway: his total cost for the year was just $7,500 (his $4,000 premium plus the $3,500 he paid for care). The strategy was executed perfectly, keeping his fixed premium low while still protecting him from a true financial catastrophe.

The Relocating Family in Singapore

Next, consider a family moving to Singapore with two young children, ages 4 and 7. They anticipate routine check-ups, vaccinations, and the inevitable minor injuries associated with young children. Their priority is to find a balance: affordable premiums with predictable costs for their frequent, smaller medical bills.

They intelligently select a plan with a mid-range aggregate family deductible. This means every expense for every family member—from a pediatrician visit to an emergency room trip—contributes to the same deductible, moving them to the cost-sharing phase much faster.

- Plan Structure: $5,000 aggregate family deductible / $12,000 aggregate out-of-pocket maximum

- Annual Premium: A moderate $14,000

- Medical Needs: Multiple pediatrician visits and one child's minor emergency room trip, totaling $6,200.

The family paid the first $5,000 out-of-pocket to satisfy their deductible. For the subsequent $1,200 in bills, their 20% coinsurance applied, so they paid only $240. Their total out-of-pocket spending was $5,240. Added to their premium, their total expenditure for the year was $19,240. They achieved predictable costs without an exorbitant premium.

The Senior Executive with Pre-Existing Conditions

Finally, consider a 58-year-old senior executive in London who is actively managing a chronic condition. This involves regular appointments with specialists and ongoing prescription medication. For him, predictability and minimizing out-of-pocket shocks are paramount. He does not view a higher premium as an expense, but as an investment in his financial peace of mind.

- Plan Structure: $1,000 deductible / $5,000 out-of-pocket maximum

- Annual Premium: A higher $18,000

- Medical Needs: Consistent specialist care and prescriptions that totaled $25,000 for the year.

He met his low $1,000 deductible almost immediately. From there, he paid 20% of his bills until his total contribution reached the $5,000 out-of-pocket maximum. The insurer covered the remaining $20,000 of his medical costs. His total annual healthcare spend was capped at precisely $23,000 (the $18,000 premium + his $5,000 max). He knew his absolute worst-case scenario from day one, providing complete financial certainty.

To make these comparisons even clearer, let us examine the numbers side-by-side.

Annual Healthcare Cost Scenarios

This table summarizes how the interplay between premiums, deductibles, and medical needs affects the total annual cost for each of our expat profiles. It is a powerful illustration of how the right plan structure is entirely dependent on your personal situation.

| Scenario Profile | Plan Structure (Deductible / OOP Max) | Annual Premiums | Medical Bills | Total Out-of-Pocket Paid | Total Annual Cost |

|---|---|---|---|---|---|

| Young & Healthy Entrepreneur | $10,000 / $20,000 | $4,000 | $3,500 | $3,500 | $7,500 |

| Family with Young Children | $5,000 / $12,000 | $14,000 | $6,200 | $5,240 | $19,240 |

| Executive with Chronic Needs | $1,000 / $5,000 | $18,000 | $25,000 | $5,000 | $23,000 |

As you can see, the plan with the lowest premium is not always the most cost-effective. The best value comes from aligning your insurance structure with your anticipated healthcare needs, creating a financial strategy that protects both your health and your wealth.

Structuring Your IPMI Plan for Global Realities

For a high-net-worth expat, an International Private Medical Insurance (IPMI) plan is not just a safety net; it is a core financial instrument. However, many individuals treat it like a domestic plan, overlooking the cross-border complexities that can turn a medical event into a financial crisis. Your decisions on currency, provider networks, and benefit limits are the bedrock of a solid global risk strategy.

One of the most common—and costly—errors is selecting the wrong currency for your plan. It is a simple choice with significant implications. Always endeavor to align your plan's currency with your primary income stream or primary country of residence. This action alone neutralizes foreign exchange risk, preventing a major claim paid in a volatile currency from leaving you with an unexpected and substantial shortfall.

Aligning Your Plan with Your Global Footprint

Equally crucial is a rigorous assessment of the insurer’s provider network. The distinction between in-network and out-of-network care is not merely about convenience; it directly impacts your wallet through your deductible and out of pocket costs. Seeking care outside the preferred network often results in higher coinsurance rates or even separate, much higher deductibles. This can accelerate your cash expenditure significantly.

Before committing, you must confirm that the insurer maintains a robust, direct-billing network in the locations where you spend your time. This is not just about avoiding paperwork; it is about cost control and having the ability to access a top-tier hospital without first fronting thousands of dollars in cash.

This is not a minor detail. Globally, reliance on out-of-pocket payments is increasing. According to the WHO Global Health Expenditure Database, these direct household payments—which include deductibles—accounted for approximately 18% of total global health spending in recent years. This trend places a growing financial burden on individuals, making a well-structured plan more critical than ever. You can delve into the data on global healthcare funding inequalities to see the full scope of this issue.

Understanding Benefit Sub-Limits

Finally, a common oversight is assuming the out-of-pocket maximum covers absolutely everything. It does not. Many IPMI plans have specific benefit sub-limits for certain categories of care, such as complex dental work, maternity services, or vision care.

These sub-limits act as micro-maximums within your main policy. For example, your plan might have a $15,000 out-of-pocket maximum, but a separate, hard cap of $10,000 per year for maternity care.

This means once you reach that $10,000 maternity sub-limit, you are responsible for 100% of any further costs in that category for the rest of the year. This applies even if you are nowhere near your overall out-of-pocket maximum. Gaining absolute clarity on how these sub-limits interact with your main deductible and out-of-pocket framework is non-negotiable. Each of these elements—currency, network, and sub-limits—must be deliberately chosen to build a plan that truly serves your international lifestyle.

How to Think Strategically About Your Plan Structure

Choosing the right plan is not just an insurance decision; it is a fundamental component of your personal financial strategy. The key is to view your deductible and out-of-pocket maximum as financial levers. Adjusting one can lower your fixed monthly premiums; adjusting the other caps your worst-case-scenario expenditure. It is an exercise in balancing what you pay on a recurring basis against what you might have to pay in a single, high-cost event.

The core question boils down to liquidity and foresight. Can you comfortably cover the full deductible tomorrow without liquidating investments or disrupting your cash flow? This requires a candid assessment of your liquid assets versus your comfort level with unpredictable expenses. For many high-net-worth individuals, accepting a higher deductible is a prudent, calculated risk—a method to reduce fixed overhead in exchange for a potential one-time payment they know they can manage.

Key Questions for Your Advisor

This decision is more critical than ever, especially given the global trend of shifting more healthcare costs onto the individual. For perspective, according to the OECD, in the U.S. for 2023, the average deductible for an individual on an employer-sponsored plan was $1,735, with out-of-pocket maximums averaging $4,527. To ensure your IPMI plan is truly built for your life, you need to be asking precise questions:

- Based on my family’s health history over the last few years, would we realize a net financial saving with a lower deductible, even with a higher premium?

- What is my true risk tolerance? Do I derive more peace of mind from low, fixed premiums, or from the certainty that I am protected from a massive, unexpected bill?

This line of thinking transforms your conversation with an advisor from a simple transaction into a strategic planning session. It ensures the plan you choose is a perfect match for your global lifestyle and financial architecture. If you wish to examine the data more closely, you can read the full report on healthcare coverage trends to see the broader context.

Your Questions, Answered

When structuring your international health plan, a few common questions consistently arise. Let us address them to provide you with clarity and confidence.

Can I Change My Deductible Annually?

Yes, in most cases. The majority of IPMI providers permit you to adjust your deductible at the time of your annual policy renewal.

This provides an excellent opportunity to fine-tune your plan. Perhaps your financial situation has evolved, your health needs have changed, or you have relocated to a new country. This flexibility ensures your coverage remains aligned with your life.

Do All My Payments Count Towards My Out-of-Pocket Maximum?

No, and this is a critical distinction. Only your payments for eligible, in-network covered services contribute toward your out-of-pocket maximum. This includes what you pay for your deductible, coinsurance, and any co-payments.

Your monthly premiums and any costs for services not covered by your plan do not count toward this limit.

How Do These Concepts Apply in Different Countries?

While the core principles of a deductible and out-of-pocket limit are universal, their practical impact can vary dramatically based on the local healthcare system. The financial burden placed on an individual differs significantly from one country to another.

Consider the United States, for example. The environment there has become increasingly challenging for individuals. According to the Commonwealth Fund, in 2023, 11% of adults with marketplace plans had deductibles of $7,000 or more, with average deductibles for silver plans around $5,223 and out-of-pocket maximums near $8,642. For some individuals, such a deductible can represent a substantial portion of their annual income. You can discover more insights about these high US healthcare deductibles to appreciate the nuances of that market.

This is a stark contrast to countries with more comprehensive government-funded coverage, and it perfectly illustrates why a well-designed IPMI plan is so essential for expatriates.

Think of your out-of-pocket maximum as your definitive financial shield. It protects you from the unpredictable, often staggering, costs of global healthcare, regardless of the local system's structure.

Mastering these key mechanics empowers you to engage in a strategic, informed conversation with your advisor. It is the only way to ensure your plan is a perfect fit for your financial architecture.

At Riviera Expat, this is our area of expertise. Our role is to bring this level of clarity to high-net-worth professionals like you. We provide expert, objective guidance to help you select a plan that protects both your health and your wealth. Secure your financial peace of mind by exploring your IPMI options with us at https://riviera-expat.com.