Your health insurance policy number is the definitive key to accessing your healthcare benefits and financial protection. Consider it the unique identifier for your bespoke health plan—the specific credential required to arrange consultations, process claims, and verify your coverage with premier medical providers and institutions.

Your Health Insurance Policy number Demystified

This policy number, typically an alphanumeric sequence presented on your insurance card, is a unique identifier your insurer assigns to your policy. It serves as the primary reference for managing every aspect of your healthcare, from routine wellness checks to complex surgical procedures. This number directly links you to your specific schedule of benefits, ensuring all medical services are billed with precision.

When you present this number to a provider's office or hospital administration, they can instantly confirm your eligibility and review the scope of your plan's coverage. This simple action initiates the sophisticated back-office process of submitting claims and coordinating payments between the medical provider and your insurance carrier.

The Function of Your Policy Number

At its core, your policy number is the central reference point for every administrative and financial transaction throughout your healthcare journey. It introduces precision and accountability into what is an inherently complex system.

This identifier is more than a mere sequence of characters; it is your official credential within the healthcare ecosystem. It validates your entitlement to care and activates the financial safeguards defined within your plan.

Familiarity with this number and other key policy details is the first step toward managing your health affairs with confidence. For a more profound understanding of your plan's terminology, our detailed guide on how to interpret different expat medical insurance policy terms explained offers invaluable insights. Without your policy number, the seamless processing of your benefits is simply not feasible.

Why Your Policy Number Is of Paramount Importance

Regard your health insurance policy number as more than a mere administrative detail. It is the master key to your healthcare and financial security. This single piece of information validates your coverage, facilitates the dispensing of prescriptions, and instructs medical facilities to direct billing to your insurer rather than to you personally.

In today's intricate healthcare landscape, this number is your primary instrument for managing your benefits. From a private clinic to a leading hospital, it is the first credential requested to initiate the entire administrative workflow—from verifying eligibility to processing claims.

Understanding its significance and proper use enables you to avoid significant out-of-pocket expenses and ensures a frictionless care experience. Its importance is underscored by stringent regulations such as HIPAA, which are designed to protect the confidentiality of this sensitive data. You can learn more about HIPAA regulations and patient health information privacy to appreciate the rigorous standards governing its security.

Your Financial Safeguard

Fundamentally, your policy number is a financial instrument. It provides the direct link to the benefits for which you—or your organisation—are paying a substantial premium.

To illustrate, consider that for employer-sponsored family plans, the average annual premium reached $23,968 in 2023, representing a 7% increase from the previous year, according to KFF research. Your policy number is the mechanism that activates this considerable investment when you require medical attention.

Your policy number is not merely an administrative detail; it is the switch that converts your premium payments into tangible financial protection at the point of care.

Without it, you are, for all practical purposes, uninsured. You would be liable for the full, undiscounted cost of any service rendered, potentially leading to significant financial exposure and administrative complications. Every interaction—with a physician, a pharmacy, or your insurance carrier—is predicated on this specific number. Keeping it accessible is not just a best practice; it is an essential component of prudent health and financial management.

How to Locate Your Policy Number Efficiently

When the need for medical care arises, the last thing one desires is to embark on a search for a policy number. Access must be immediate and effortless. Fortunately, insurers place this critical identifier in several standardised, easily accessible locations.

Your health insurance card is the primary repository for this information, whether it is a physical card or a digital version accessible via a mobile application. Insurers design these cards for precisely this purpose. Your policy number is typically the most prominent identifier on the front, often designated as “Policy ID,” “Member ID,” or “Subscriber ID.” It is crucial not to confuse it with other numbers on the card, such as a group number—the policy or member ID is the unique identifier for your coverage.

Consulting Your Plan Documentation

Should your card not be immediately available, there are other official documents that contain the required information. Your initial enrollment paperwork is a definitive source, as it confirms your plan selection and codifies all pertinent details.

Another reliable source is any Explanation of Benefits (EOB) statement you have received following a medical consultation or service. Whether delivered by post or accessed online, the EOB uses your policy number to link specific claims to your account, making it an ideal reference point.

Alternatively, you can log into your insurer's secure online portal or mobile application. These digital platforms are designed for self-service and almost invariably display your policy number prominently on the user dashboard or within a digital facsimile of your insurance card. This offers an indispensable convenience when your physical documents are not at hand.

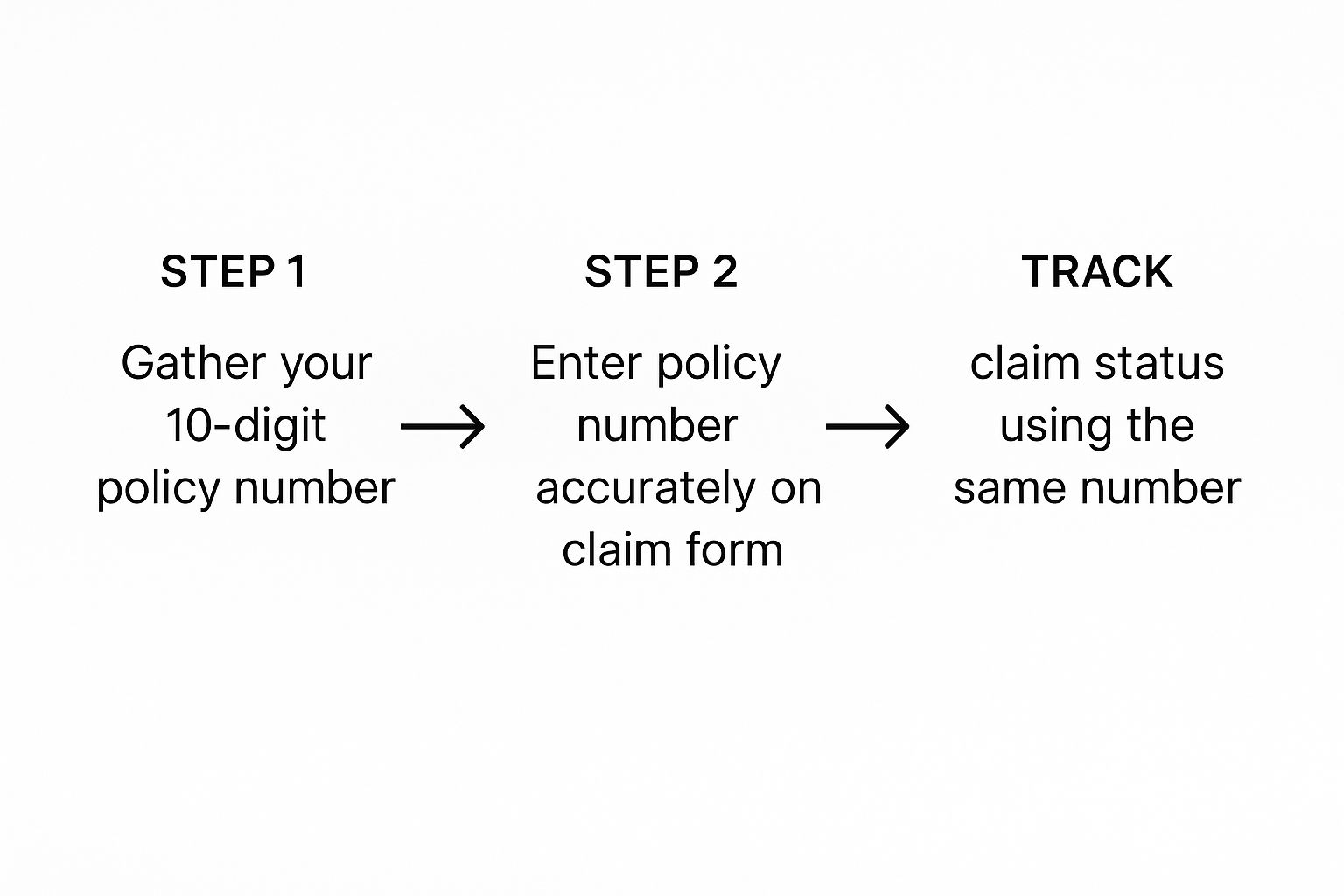

This visual illustrates how your policy number functions as the central tracking code for the entire claims process, from your medical appointment to final payment settlement.

As the infographic clarifies, your policy number is the common thread connecting every financial transaction, ensuring all activities are tracked accurately from inception to completion.

Your Go-To Sources for Quick Reference

To streamline your access, here is a quick-reference guide to the most common locations where you will find your health insurance policy number and other key identifiers.

| Document or Location | Information to Look For | Pro Tip for Access |

|---|---|---|

| Your Insurance Card | The most prominent number, usually labeled "Member ID," "Policy ID," or "Subscriber ID." | Maintain a high-resolution photograph of the front and back of your card in a secure digital vault on your smartphone. |

| Insurer’s Online Portal | Navigate to a "My Profile" or "My Plan" section, or locate a link to a digital version of your card. | Utilise a secure password manager for your login credentials to ensure seamless access. |

| Explanation of Benefits (EOB) | Your policy number will be clearly listed at the top, along with your name and claim details. | Search your secure email archive for "Explanation of Benefits" to quickly locate digital copies. |

| Welcome & Enrollment Docs | Review the initial confirmation letter or email you received upon enrollment. | Maintain a dedicated digital or physical file for all your initial insurance documentation. |

By consulting these key sources first, you can locate your policy number health insurance information with minimal effort, ensuring you are prepared for any healthcare eventuality.

A Deeper Look at Your Health Insurance Card

While your health insurance policy number is undoubtedly the central element—your unique key to accessing benefits—it is wise not to overlook the other important codes and data points presented on your insurance card.

Consider your insurance card not merely as a form of identification, but as a condensed summary of your entire benefits package. It is a powerful instrument for managing your healthcare finances, provided you understand its contents.

The global health insurance market is a significant economic force, with insurers collecting approximately EUR 7.0 trillion in premiums. The industry’s recent 8.4% growth, as detailed in these global insurance market insights from Allianz.com, highlights the increasing importance of this coverage worldwide. Your card serves as your personal access point to this sophisticated system.

Decoding Key Information on Your Card

To fully leverage your benefits, it is essential to understand the function of each number on your card. While they may appear to be a random assortment of characters, each has a specific, non-interchangeable purpose.

Your insurance card is not just for identification; it is a financial instrument. Each number and code on it corresponds to a specific administrative pathway for billing, coverage verification, and payment.

Familiarising yourself with these details places you in a position of control during any healthcare interaction. Here is what you will typically find:

- Group Number: This identifies the specific plan you are enrolled in, typically through an employer or organisation. It informs the hospital or clinic which schedule of benefits, co-payments, and deductibles applies to your visit.

- Rx BIN and PCN: These codes are exclusively for pharmaceutical transactions. The Rx BIN (Bank Identification Number) acts as a routing number, directing your prescription claim to the correct processing entity. The PCN (Processor Control Number) serves as a secondary identifier, adding a layer of verification to ensure accurate claims processing.

- Co-pay Amounts: Your card often displays the fixed fees for common services directly on its face. This provides a quick reference for your out-of-pocket costs for a standard physician consultation, a specialist visit, or emergency care.

Understanding how these components function in concert is vital. To explore this further, you can learn more about the role of medical networks in your insurance coverage. This knowledge ensures you can manage your benefits with the utmost confidence.

What to Do If Your Policy Number Is Not Readily Available

It is an unsettling experience: you require medical attention, but your insurance card is missing or the policy number is illegible. This can feel like a significant obstacle, but there is a clear and efficient protocol to resolve the issue so you can refocus on your health.

The most expedient solution is almost always digital. Log into your insurer’s secure online portal or launch their mobile application. Insurers have made substantial investments in these platforms for precisely such situations. Your policy number should be displayed prominently on the main dashboard or within a digital version of your ID card. This should be your first course of action.

If you are unable to access your digital account and your insurance is provided through your employer, your next point of contact should be your company’s benefits administrator or Human Resources department. They serve as the custodians of the group plan and maintain comprehensive enrollment records, including your policy number.

Going Straight to the Source: Contacting Your Insurer

When other methods are not viable, it is time to contact your insurer’s member services line directly. This is a dependable option, but preparation will ensure a more efficient call. To enable the representative to verify your identity securely and swiftly, have the following information at hand:

- Your full legal name and date of birth

- The primary address associated with your policy

- Your Social Security Number for final identity confirmation

Having these details prepared before you call will prevent delays and allow the representative to access your policy number health insurance details promptly. It is also prudent to familiarise yourself with other key insurance processes in advance. For example, understanding the nuances of pre-authorisation and direct settlement can prevent future complications. By following these steps, you can retrieve your information efficiently and return your focus to what truly matters.

Common Questions Regarding Your Policy Number

Health insurance cards can present a confusing array of numbers and codes. It is easy to misinterpret them, but using the incorrect number can lead to claim denials, billing complications, and delays in receiving care.

To ensure you are maximising the utility of your plan, let us clarify some of the most common points of confusion. Consider this an essential guide to decoding your access to healthcare.

Clarifying Common Policy Number Questions

Establishing these details correctly from the outset can prevent a host of potential issues. Here is a breakdown of what you need to know.

Is My Policy Number the Same as My Group Number?

No, and this is a critical distinction. Your policy number—often referred to as your member ID or subscriber ID—is your personal identifier. It is unique to you and any dependents covered under your plan.

The group number, conversely, identifies the specific health plan purchased by your employer or organisation. A provider's office requires both: the group number to identify which plan to bill, and your policy number to specify for whom they are billing.

Will My Policy Number Change If I Switch Employers?

Almost certainly, yes. When you commence a new role, you are enrolling in an entirely new group health plan, even if the insurance carrier remains the same.

Because you are part of a new plan, the insurer will issue a new policy number health insurance card with a new ID. It is imperative that you begin using this new card immediately for all medical services to prevent claim denials.

While your Social Security Number was once used as a common identifier, this practice has been discontinued for significant privacy and security reasons. Providers no longer use it for routine verification. Although your insurer may request it to confirm your identity via telephone, it is not a substitute for your policy number at a medical facility.

While navigating these systems may seem complex, having such coverage is a distinct advantage. Globally, access to care remains a formidable challenge. Approximately 4.5 billion people lack full coverage for essential health services, and nearly 2 billion face severe financial hardship due to medical expenses, according to the WHO. You can learn more about the global effort for Universal Health Coverage from the World Health Organization). This stark reality underscores the profound value of a well-managed private health plan.

At Riviera Expat, our mission is to bring clarity and expertise to the world of international private medical insurance. We provide discerning, unbiased advice to help you secure a plan that aligns perfectly with your life abroad. Contact us for a complimentary consultation today.