For high-net-worth individuals, families, and professionals with a global footprint, cross border tax planning is the essential discipline of strategically structuring your financial life to legally minimize tax obligations across multiple countries. It transcends simple compliance, focusing on proactively preserving and growing your wealth in a world where your assets, income, and residency often span several borders.

The New Reality of Global Wealth Preservation

In today's borderless economy, managing substantial wealth is no longer confined to a single country's tax code. A reactive approach to taxes—simply filing returns as they come due—is a certain way to see your wealth eroded by double taxation and inefficient structuring.

Increased personal mobility, diverse international investment portfolios, and complex family structures have redefined the landscape. Proactive, expert-led planning is the only way to protect your legacy. This means moving beyond mere compliance to build a resilient financial architecture that accounts for your unique global connections.

Why Proactive Planning Is Non-Negotiable

Failing to anticipate the tax implications of your international life can lead to significant financial consequences. Every financial decision, from acquiring a vacation home abroad to accepting an international assignment, has a tax consequence.

Effective cross border tax planning anticipates this by:

- Preventing Double Taxation: Ensuring the same income is not taxed twice by different countries, primarily by leveraging Double Taxation Treaties (DTTs).

- Optimizing Asset Location: Strategically placing assets in jurisdictions that offer a more favorable environment for growth, protection, and eventual succession.

- Ensuring Full Compliance: Navigating the complex web of reporting requirements like FATCA and CRS to avoid severe penalties.

- Facilitating Succession: Structuring wealth transfer to the next generation in a tax-efficient manner, regardless of where they reside globally.

The core principle is powerful: A well-designed strategy considers the tax implications in every relevant country before a transaction occurs, not after. This foresight transforms tax from a punitive cost into a manageable component of your overall wealth strategy.

Understanding the specific tax environment of each country you are connected to is the critical first step. For those exploring their options, detailed resources are invaluable. You can learn more by reviewing our in-depth country guides, which provide essential information for expatriates and global citizens.

Ultimately, the difference between a sophisticated tax strategy and a passive one is measured in the tangible preservation of your wealth. It is about maintaining control over your financial destiny in a world where fiscal and regulatory lines are increasingly blurred. This guide will establish what is at stake and why a deliberate approach is essential.

Understanding Your Core Jurisdictional Footprint

Before building an effective cross-border tax planning strategy, one must map the terrain. Your global tax obligations are dictated by foundational principles that define your financial "citizenship" in the eyes of tax authorities.

Your jurisdictional footprint is a collection of connections to different countries, each with its own distinct rulebook, benefits, and, most importantly, taxes. Identifying which countries' rules apply to you is the first, non-negotiable step toward managing those obligations intelligently.

Tax Residency: Your Primary Connection

The most significant factor is tax residency. This has less to do with your passport and more to do with where a country considers you to have a substantial connection, often determined by the number of days you spend there annually.

Once a country designates you as a tax resident, it typically claims the right to tax your worldwide income. That means all earnings—whether from a business in Singapore, a rental property in London, or investments in New York—fall under its authority. For high-net-worth individuals, this makes preparing for your move abroad a critical event where you must carefully manage the transition to sidestep unexpected tax liabilities.

Domicile: The Enduring Connection

Domicile is a more permanent concept than residency. It is usually your country of origin—the place you consider your permanent home, even if you have lived elsewhere for decades.

This distinction is absolutely critical for estate and inheritance taxes. A country where you are domiciled can claim the right to tax your entire global estate upon your death, regardless of where you were a tax resident at the time. This can have massive consequences for your legacy and succession plans.

The interplay between residency and domicile is the bedrock of your tax identity. A miscalculation here can trigger substantial, unforeseen tax burdens. This is why precise, forward-looking analysis is required.

Source of Income: Where the Money Is Made

The third pillar is the source of income. This principle is straightforward: a country can tax any income generated within its borders, even if you are not a resident or domiciled there.

Common examples include:

- Rental income from a property you own in another country.

- Capital gains from selling an asset physically located in its territory.

- Business profits attributable to operations within that jurisdiction.

This is precisely why even a straightforward investment portfolio can create tax filing obligations in several countries simultaneously. The objective of intelligent planning is to manage these obligations so they do not erode your returns.

To provide a sense of scale, an analysis by the U.S. Council of Economic Advisers covering the two decades from 2001 to 2021 found that over 40% of U.S. multinational companies' foreign profits were reported in low-tax jurisdictions. This is a clear indicator of how significant these cross-border financial flows have become.

Before we proceed, let us distill these core ideas. They are the absolute foundation of any international tax conversation. Understanding them is not just helpful; it is essential.

Key Jurisdictional Concepts at a Glance

| Concept | Determining Factor | Primary Implication for HNWIs |

|---|---|---|

| Tax Residency | Physical presence (e.g., day count), "center of vital interests" | Subjects your worldwide income to taxation in that country. |

| Domicile | Country of origin, long-term intent, "permanent home" | Can subject your global estate to inheritance/estate tax. |

| Source of Income | Where the economic activity or asset is physically located | Subjects specific income (rent, capital gains, etc.) to tax, regardless of your residency. |

Clarifying these three concepts is the first major step. They define where you owe, what you owe on, and why.

The Role of Double Taxation Treaties

Fortunately, you are not left to navigate these overlapping tax claims alone. Double Taxation Treaties (DTTs) are the governing rulebook. These are powerful bilateral agreements between countries designed to prevent the same income from being taxed twice.

These treaties clarify which country has the primary right to tax certain types of income. More importantly, they require the other country to provide relief, usually in the form of a tax credit. They bring a much-needed layer of order to what would otherwise be financial chaos.

Comparing Major Global Tax Systems

The world of international tax is not uniform. It is a mosaic of different systems, each with its own philosophy on how to tax individuals who live, work, and invest across borders. For anyone with significant international ties, understanding these differences is the bedrock of any sensible cross border tax planning.

The rules you must follow are dictated entirely by the type of system your country of residence uses. Broadly, these fall into three main categories. Each presents a unique set of opportunities and challenges that can dramatically affect your financial life. Gaining a handle on these nuances is the essential first step before deciding where to live or invest.

Worldwide (Residence-Based) Taxation

First is the most comprehensive—and often most demanding—system: worldwide, or residence-based, taxation. If you are a tax resident of a country with this system, that nation claims the right to tax your entire global income, regardless of where on the planet it was earned.

The United States is the primary example of this approach. A U.S. citizen or green card holder must report and potentially pay U.S. taxes on income from anywhere in the world. This holds true even if they have not resided in the U.S. for decades. This creates a lifelong tax connection that requires constant, careful management to avoid double taxation and maintain compliance.

Territorial Taxation

At the opposite end of the spectrum, a territorial tax system is geographically contained. Countries using this framework generally only tax income that is generated within their borders.

This means that foreign-sourced income—profits from an overseas business, dividends from an international stock portfolio, or rent from a property abroad—is often completely exempt from local taxes. This system is found in jurisdictions like Hong Kong, Singapore, and many nations in the Middle East. For globally mobile individuals whose main income streams originate outside their country of residence, this can be an incredibly powerful advantage.

The distinction here is significant. A worldwide system compels you to manage foreign tax credits and treaty benefits just to avoid being taxed twice on the same income. A territorial system, by contrast, is about clearly separating your domestic and foreign income.

Remittance-Based Taxation

Positioned between these two is the hybrid model known as remittance-based taxation. It is a unique middle ground offered by certain countries, most notably the United Kingdom for its non-domiciled residents.

Under this arrangement, you are taxed on your in-country income and gains, similar to a territorial system. The key difference is that your foreign income and gains are only taxed if you "remit" them—that is, bring them into the country. Any funds kept offshore remain outside the local tax authority's reach. This creates a powerful planning opportunity for individuals who can live off their local income or capital without needing to access their foreign earnings.

To see how these systems interact, you must look at tax treaties. Treaties are the rulebooks that prevent countries from over-taxing individuals and entities.

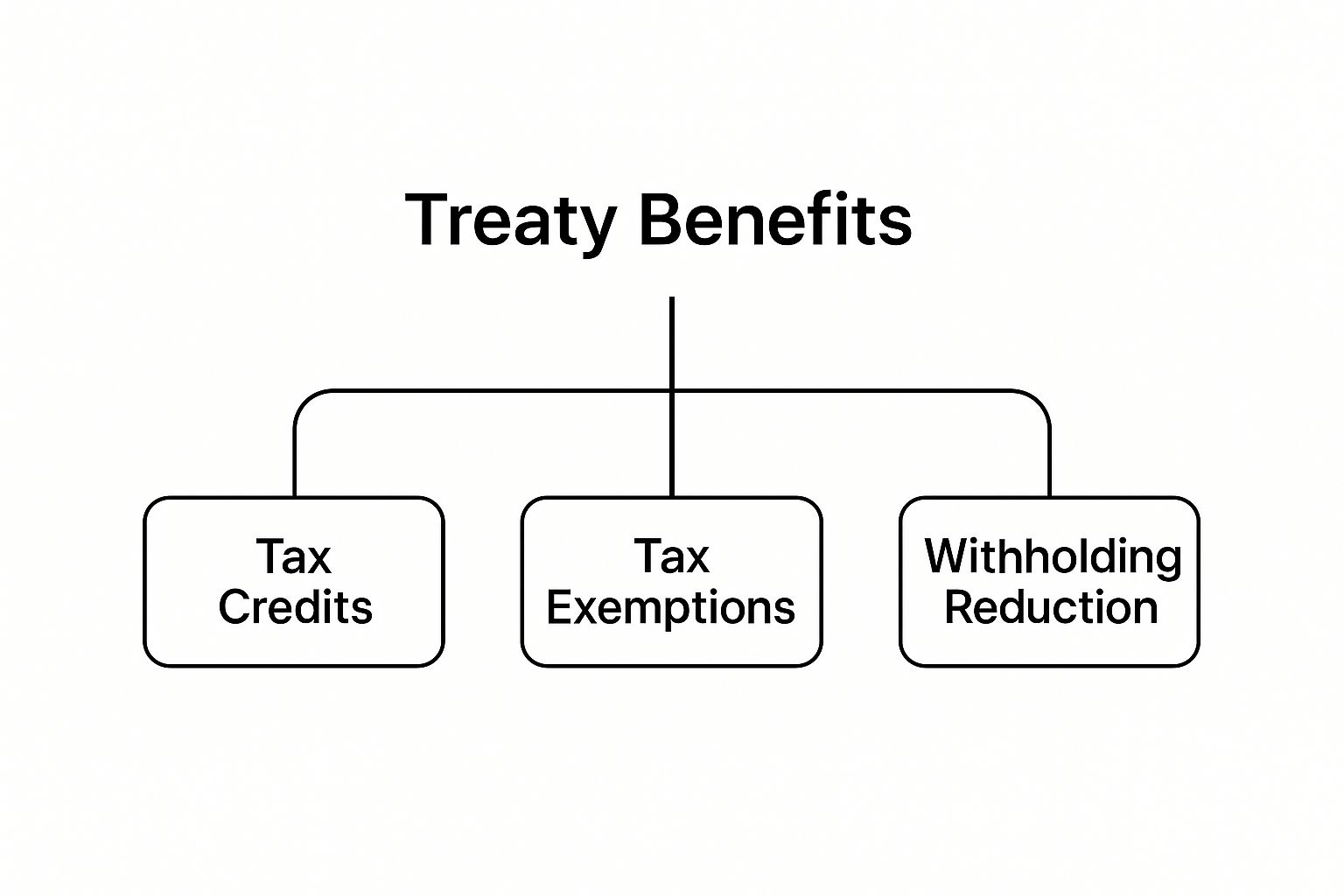

As the diagram illustrates, treaties primarily function through tax credits, exemptions, and reduced withholding taxes. These are the essential tools for navigating the complexities, especially within a worldwide tax system.

Knowing how these systems work is also crucial for practical reasons, especially in low or zero-tax jurisdictions like the UAE. While the tax benefits are clear, other essentials cannot be overlooked. For example, obtaining appropriate health insurance is a non-negotiable part of any prudent relocation. A high-net-worth individual considering a move to the UAE would need to secure a comprehensive private health insurance plan, as the public healthcare system is generally reserved for citizens. Your choice of residency can be the single most impactful financial decision you ever make.

Sophisticated Tools for Wealth Structuring

Once the appropriate jurisdictions are identified, we can pivot from the foundational "why" to the practical "how." This is where cross border tax planning evolves from compliance into strategic wealth architecture. For high-net-worth individuals, this means employing specialized legal and financial instruments designed for one core purpose: to protect, grow, and transfer your wealth.

These are not standard, off-the-shelf products but custom-engineered components for your financial life. An architect would not use standard materials for a skyscraper's foundation, and a global wealth advisor will not use a simple corporate structure for a complex international estate. Instead, we deploy tools like trusts, foundations, and specialized holding companies to build a resilient and lasting structure for your assets.

The objective is always a framework that mirrors your long-term goals, whether preserving capital for the next generation, shielding assets from unforeseen liabilities, or managing a sprawling international investment portfolio.

The Strategic Role of International Trusts

The international trust is a cornerstone of this field. At its core, a trust is a legal arrangement: you (the settlor) transfer assets to a trusted third party (the trustee). The trustee's duty is to manage those assets for the benefit of designated individuals (the beneficiaries).

The strategic advantage arises when you establish that trust in a carefully chosen jurisdiction. Doing so creates a powerful legal separation between you and your assets.

This separation is paramount. By placing assets into a well-structured irrevocable trust, they are generally insulated from personal liabilities, creditor claims, and even certain tax authorities. This provides a level of asset protection that is nearly impossible to achieve otherwise.

Beyond protection, trusts are phenomenal tools for succession planning. They allow wealth to pass to your heirs seamlessly and privately, completely bypassing the often lengthy, public, and costly probate process. You establish the rules for how and when distributions are made, ensuring your legacy is managed precisely as you intended.

Foundations and Their Unique Advantages

While trusts are prevalent in common-law countries, foundations serve a similar role in civil-law jurisdictions. A foundation is a distinct legal entity—akin to a corporation—created to hold and manage assets for a specific purpose detailed in its charter.

Foundations offer their own compelling advantages:

- Longevity: A foundation can, in principle, exist indefinitely, making it an exceptional vehicle for preserving wealth across multiple generations.

- Control: The founder can often retain influence by serving on the foundation's governing council, providing input on its activities.

- Privacy: They generally offer a very high degree of confidentiality regarding the assets they hold and the identity of the ultimate beneficiaries.

The choice between a trust and a foundation often depends on your legal ties, the nature of your assets, and your ultimate objectives.

The core principle behind both trusts and foundations is control and separation. By legally separating assets from personal ownership, you create a structure that is more resilient to legal, financial, and geopolitical risks, forming a critical component of advanced cross border tax planning.

The Importance of Specialized Holding Companies

Beyond personal wealth, specialized holding companies are crucial for managing active business assets, such as international company shares or real estate portfolios. These are not standard corporate entities; they are strategically domiciled in jurisdictions that offer specific tax or legal advantages. Understanding the mechanics of an offshore company setup in locations like the UAE, for example, is essential for anyone involved in international trade or asset management.

These structures are ideal for centralizing management, consolidating dividends from subsidiaries around the globe, and creating a liability shield between your different business operations.

Choosing the Right Jurisdiction

The effectiveness of any of these tools—be it a trust, foundation, or holding company—is almost entirely dependent on its jurisdiction. Selecting the right domicile is the most critical decision in this process. It is a meticulous exercise that involves weighing several key factors.

Critical Jurisdictional Factors for Wealth Structures

| Factor | Description | Why It Matters for HNWIs |

|---|---|---|

| Legal Stability | A long, proven history of respecting the rule of law, property rights, and established legal precedents. | This provides confidence that the rules will not change unexpectedly, guaranteeing the long-term security of your structure. |

| Tax Treaty Network | A wide network of Double Taxation Treaties (DTTs) with other countries where you have assets or conduct business. | This is essential for reducing withholding taxes on dividends, interest, and royalties, thereby protecting your returns. |

| Privacy Regulations | Strong, legally enforced confidentiality laws that protect the details of the structure and its beneficiaries. | It shields your sensitive financial data from public view while ensuring compliance with global reporting standards. |

| Asset Protection Laws | Specific legislation designed to protect assets within trusts or foundations from foreign judgments or creditors. | This creates the legal firewall that secures your assets and your legacy from external threats. |

Ultimately, these instruments are just the building blocks. Their true power lies not in any single tool, but in how they are integrated to create a cohesive, compliant, and forward-thinking plan tailored to your unique circumstances.

Navigating the New Era of Tax Transparency

The era of discreet international banking has concluded. A seismic shift has transformed global finance, replacing the old paradigm of secrecy with unprecedented cooperation and automatic information sharing. For high-net-worth individuals, this represents a complete rewrite of the rules for cross-border tax planning.

This new reality is defined by two landmark initiatives: the Foreign Account Tax Compliance Act (FATCA) from the United States and the global Common Reporting Standard (CRS). Together, they have created a global surveillance network for financial data, making it nearly impossible for assets to remain hidden from tax authorities.

The practical consequences for you are direct and immediate. Financial institutions worldwide are now legally obligated to identify accounts held by foreign tax residents and automatically report this information to their home tax authorities. This is not a choice; it is a condition of doing business.

The End of Financial Secrecy

FATCA and CRS have effectively dismantled the barriers that once separated national tax systems. They operate on the principle of automatic exchange of information (AEOI), meaning data flows between countries continuously, without requiring a specific request.

Here is a snapshot of what is reported annually:

- Your identity: Your name, address, date of birth, and taxpayer identification number.

- Account location: The account number and the name of your financial institution.

- Account details: The year-end account balance, plus gross interest, dividends, and other income credited to the account.

This relentless stream of data provides tax authorities with a transparent view of your global financial footprint. Any discrepancy between your tax return and what your foreign bank reports will trigger an immediate red flag, likely prompting an audit.

Heightened Scrutiny on Offshore Structures

This demand for transparency extends far beyond simple bank accounts. Offshore structures, such as trusts and foundations, are now under intense scrutiny. Tax authorities are becoming more adept at looking through these entities to identify the ultimate beneficial owners—the real individuals who control and benefit from the assets.

In this environment, the concept of "hiding" assets offshore is obsolete. The only viable strategy is one built on meticulous compliance, robust documentation, and full transparency. Your international tax plan must be resilient enough to withstand intense scrutiny.

This shift has also increased pressure in related areas. Financial institutions, for example, are more rigorous than ever with their due diligence. Understanding and adhering to strict AML and KYC compliance standards is no longer just good practice—it is essential for operating in this new era.

The Rise of Global Tax Standards

This trend is not limited to individual taxpayers; it has profoundly reshaped the corporate world, impacting private investment companies and family offices. Governments are collaborating to eliminate profit shifting and tax avoidance, making cross-border tax planning a critical focus for multinational enterprises (MNEs).

Following frameworks like the OECD's BEPS (Base Erosion and Profit Shifting) initiative, MNEs with global revenues exceeding €750 million now face a global minimum tax rate of 15%. This has fundamentally altered the landscape, neutralizing many of the tax rate arbitrage strategies that were once commonplace.

For high-net-worth individuals, this corporate crackdown is a clear signal. The same political will driving global corporate tax reform is fueling the demand for transparency in personal wealth. The message is unequivocal: every component of your financial life must be compliant, justifiable, and transparent. Impeccable records and a proactive approach to reporting are no longer optional—they are the cornerstones of modern wealth preservation.

Assembling Your Cross-Border Advisory Team

Effective cross-border tax planning is not a product you can purchase off the shelf. It is a coordinated, dynamic effort managed by a team of highly specialized professionals. Attempting to navigate this complexity alone, or relying on a single generalist advisor, places your wealth at unnecessary risk.

Consider it as assembling a personal board of directors for your family's global wealth. Each member must bring a unique, non-overlapping skill set, yet they all must work in perfect harmony. Your role is that of the chairman—selecting the right people, setting the vision, and ensuring they communicate effectively.

The Core Professional Roster

While your specific situation will dictate the final lineup, any serious international advisory team has three non-negotiable roles. Each is critical for creating a comprehensive and resilient strategy.

-

The International Tax Attorney: This is your strategist and legal shield. Their expertise lies in structuring—designing trusts, foundations, and holding companies that are not only tax-efficient across multiple jurisdictions but also legally robust. They delve into the fine print of tax treaties to ensure your wealth preservation plan is built on solid legal ground.

-

The Global Wealth Manager: This professional is your financial quarterback. They manage your investments with a cross-border perspective, continually assessing factors like currency exposure, asset location, and the tax implications of different investment vehicles in various countries. Their objective is to grow your wealth within the legal framework your attorney has constructed.

-

The Specialized Accountant: This is your compliance expert. Their role involves the painstaking work of preparing and filing tax returns in every required jurisdiction. They ensure every transaction is documented correctly and that you remain compliant with ever-changing regulations like FATCA and CRS, safeguarding you from disastrous penalties.

The most common error high-net-worth individuals make is assuming one professional can fulfill all these roles. A tax attorney is not an investment advisor, and an accountant proficient in one country's tax code is often unequipped to handle another's. True expertise is deep, not wide.

Vetting and Leading Your Team

Selecting these professionals requires diligence. You are looking for individuals with a proven track record of handling cases as complex as yours. During interviews, be specific. Ask pointed questions about their experience with your countries of interest, the types of assets you hold, and their approach to collaborating with other advisors.

You also need a team that is forward-looking. The advisory world is constantly evolving, with new technologies and regulations emerging regularly. For example, a recent Deloitte survey found that 75% of tax leaders view AI skills as important for their teams to possess today. This underscores the need for a team that is not only experienced but also embraces modern tools. You can gain a better understanding of how technology is reshaping the industry by reviewing Deloitte's tax transformation trends report.

Ultimately, assembling this team is the final, crucial piece of the puzzle. It elevates cross-border tax planning from a reactive burden to a proactive, strategic advantage. It provides the confidence to manage your international financial life with precision and foresight.

Frequently Asked Questions

Engaging with the world of international finance naturally raises many questions. Here are straightforward answers to the queries we most frequently hear from high-net-worth individuals navigating cross border tax planning.

When Should I Start Cross Border Tax Planning?

The short answer is: as early as possible. The optimal time to begin planning is well before you make any significant international move, investment, or business transaction.

Think of it as designing a house—you would not begin construction without a detailed blueprint. Proactive planning allows you to build an optimal financial structure from the outset, helping you avoid costly mistakes that are nearly impossible to rectify later.

For example, certain planning opportunities, such as addressing Canada's "departure tax" or establishing a step-up in the cost basis of your assets before becoming a U.S. tax resident, are time-sensitive. The moment you cross that border, many of the most valuable strategies may no longer be available.

What Is the Biggest Mistake HNWIs Make?

By far, the most common and costly mistake is assuming a skilled domestic advisor can handle international tax complexities. They cannot. A cross-border financial life operates under a different set of rules, governed by complex tax treaties, contradictory national laws, and unique reporting regimes like FATCA and CRS.

Placing your trust in a professional who lacks specific cross-border credentials is a recipe for disaster. It can lead to:

- Significant double taxation when treaty benefits are overlooked.

- Substantial penalties for non-compliance with foreign account reporting.

- Highly inefficient estate plans that trigger large, avoidable inheritance taxes in multiple countries.

The most prudent course of action is always to engage a team specifically credentialed and deeply experienced in the jurisdictions where you have a financial footprint. Their expertise is not a luxury; it is a non-negotiable requirement for preserving your wealth.

How Often Should I Review My Plan?

Your cross border tax strategy is a living document, not a static one. It requires a thorough review at least annually and should be revisited immediately following any major life event or financial shift.

A change in your residency, a marriage, a significant shift in your investment portfolio, or the birth of a child can fundamentally alter your global tax profile. Furthermore, tax laws and treaties are constantly in flux. Your strategy needs regular adjustments to remain compliant and effective. A dynamic approach is the only viable approach.

Navigating international healthcare is as vital as managing your finances. For expert, objective guidance on securing premium international private medical insurance tailored to your global lifestyle, trust Riviera Expat. Discover clarity and confidence by visiting us at https://riviera-expat.com.