A medical insurance deductible is the specific amount you are responsible for paying for covered healthcare services before your insurance plan begins to contribute.

Consider it the initial financial threshold you must cross each policy year. Once you have personally paid this predetermined amount for eligible medical care, your insurer assumes its role in sharing subsequent costs. It is a foundational component of any sophisticated health insurance portfolio.

Demystifying The Medical Insurance Deductible

At its core, a deductible represents your initial share of the financial risk. It is the precise sum you must personally cover for medical care before accessing your plan’s comprehensive financial safety net.

This mechanism directly and powerfully influences your monthly premiums. As a general principle, a higher deductible corresponds to a lower premium, and conversely, a lower deductible results in a higher premium.

The underlying principle is to foster a sense of shared financial responsibility. By requiring policyholders to cover initial costs, there is a greater incentive for the prudent use of healthcare services.

This model is standard across the industry. As healthcare expenditures continue their upward trajectory, so do deductibles. For instance, in the United States, data from the Kaiser Family Foundation's 2023 Employer Health Benefits Survey indicates the average annual premium for employer-sponsored family health coverage reached $23,968, with the average single deductible standing at $1,735.

Key Cost-Sharing Components At a Glance

Your deductible does not operate in isolation. It is one element of a framework that dictates your total healthcare expenditure over the policy year. To fully comprehend your financial exposure, you must understand how it interacts with other key policy terms.

These components—deductible, copay, coinsurance, and the out-of-pocket maximum—constitute your policy's financial architecture. They define your total potential outlay for the year and are essential terms to grasp, as we explain in our guide to expat medical insurance policy terms.

Here is a concise breakdown of the primary financial components:

| Term | Definition | When It Applies |

|---|---|---|

| Deductible | The fixed amount you pay out-of-pocket for covered medical services before your insurance plan begins to pay. | At the start of your policy year for most medical services. |

| Copay | A fixed fee you pay for a specific service, such as a physician's consultation or prescription, often after your deductible is met. | Per visit or per service, depending on your plan's structure. |

| Coinsurance | The percentage of costs you share with your insurer for a covered health service after you have met your deductible. | After your deductible is paid, until you reach your out-of-pocket maximum. |

| Out-of-Pocket Maximum | The absolute most you will have to pay for covered services in a policy year. After this limit, your plan pays 100%. | After you have paid your deductible and your share of coinsurance. |

Understanding the interplay of these components is crucial for managing your healthcare expenditures effectively and mitigating the risk of unforeseen financial burdens.

How Deductibles Work in Global Health Plans

For expatriates and global citizens, the concept of a medical insurance deductible introduces a greater degree of complexity. While the fundamental principle remains—it is the amount you pay first—its application across diverse countries, currencies, and healthcare systems necessitates a more sophisticated understanding.

International Private Medical Insurance (IPMI) plans are engineered for this borderless lifestyle, and their deductibles are structured accordingly. Unlike a domestic plan confined by a single country's regulations, an IPMI policy must exhibit exceptional flexibility. A firm grasp of your deductible's mechanics is essential for managing your global healthcare finances and avoiding unexpected invoices, regardless of your location.

Per Policy Year Versus Per Condition

One of the most critical distinctions within any global health plan is how the deductible is applied. Insurers typically structure this in one of two ways, and the difference can profoundly impact your out-of-pocket costs. Knowing which model your policy utilizes is fundamental.

The prevailing approach is a deductible applied per policy year. Under this structure, you have a single deductible amount to meet over a 12-month period. Every covered medical expense you incur during that year—whether in Singapore, Spain, or South Africa—contributes toward meeting that one target. Once satisfied, the insurer begins paying its share for all subsequent eligible claims until your policy renews.

A less common but still relevant structure is a deductible applied per medical condition. This model requires you to meet the deductible separately for each new, unrelated health issue. For example, treatment for a fractured arm and subsequent care for a respiratory infection would each trigger the deductible. This can become financially burdensome in a year marked by several unrelated health concerns.

Key Takeaway: For a globally mobile individual, a deductible that applies 'per policy year' almost invariably offers superior financial predictability. It enables the consolidation of all international medical costs toward a single, manageable financial goal.

Individual Versus Family Deductibles

For those relocating abroad with family, it is also vital to comprehend the distinction between individual and family deductibles. These are designed to manage costs when multiple individuals are covered under a single policy, creating a financial safety net for the entire family unit.

Here is a simple breakdown of their function:

- Individual Deductible: This is the amount each person on the policy must meet independently. Once a family member meets their individual deductible, the insurance company begins covering their eligible claims.

- Family Deductible: This is a higher, aggregate amount. Often, once a specified number of family members (typically two or three) have met their individual deductibles, the plan deems the entire family deductible satisfied. At that point, all other insured family members are covered for the remainder of the policy year, even if their personal spending has been minimal.

This dual structure is an intelligent design. It ensures that one family member with significant medical needs does not impede coverage for others, while also establishing a firm ceiling on the family's total out-of-pocket exposure for the year.

A Practical Walkthrough Across Borders

Let's examine a real-world scenario to illustrate how this functions for an expatriate.

Consider a private wealth manager based in London with a global health plan featuring a $2,500 annual deductible. Early in her policy year, she undergoes a minor procedure at a private clinic in London, with a resulting invoice of $1,800. She pays this entire amount personally. This $1,800 is then credited toward her annual deductible, leaving a remaining balance of $700.

Several months later, during a business trip to Dubai, she requires specialist consultations and diagnostic tests, costing $1,200. As her plan offers global coverage, these costs are eligible. She pays the first $700 of this bill out-of-pocket, which officially satisfies her $2,500 annual deductible for the year.

The remaining $500 from the Dubai invoice is now covered by her insurer (subject to her plan's coinsurance). For any other eligible medical care she requires that year—whether in London, Dubai, or any other location—her deductible is met. Her insurer will begin sharing costs from the first dollar of any new claim.

The Strategic Balance of Deductibles and Premiums

Selecting a medical insurance deductible is not merely an administrative choice; it is a critical financial decision. It represents a strategic trade-off between higher fixed monthly costs (premiums) and higher potential ad-hoc costs (the deductible).

At its heart, this is a decision about cash flow optimization and personal risk tolerance. The relationship is straightforward but powerful: the higher the deductible, the lower the monthly premium.

By selecting a higher deductible, you signal to the insurer your willingness to assume a larger portion of initial medical costs. In return for accepting this risk, you are rewarded with a significantly lower monthly premium. For discerning individuals who prioritize low fixed overheads to free up capital for investments or other ventures, this can be a highly astute financial maneuver.

Conversely, a low deductible ensures minimal out-of-pocket expenses before full coverage activates. This offers budget predictability but comes at the cost of a consistently higher monthly premium. The optimal choice depends entirely on your financial structure and comfort with risk.

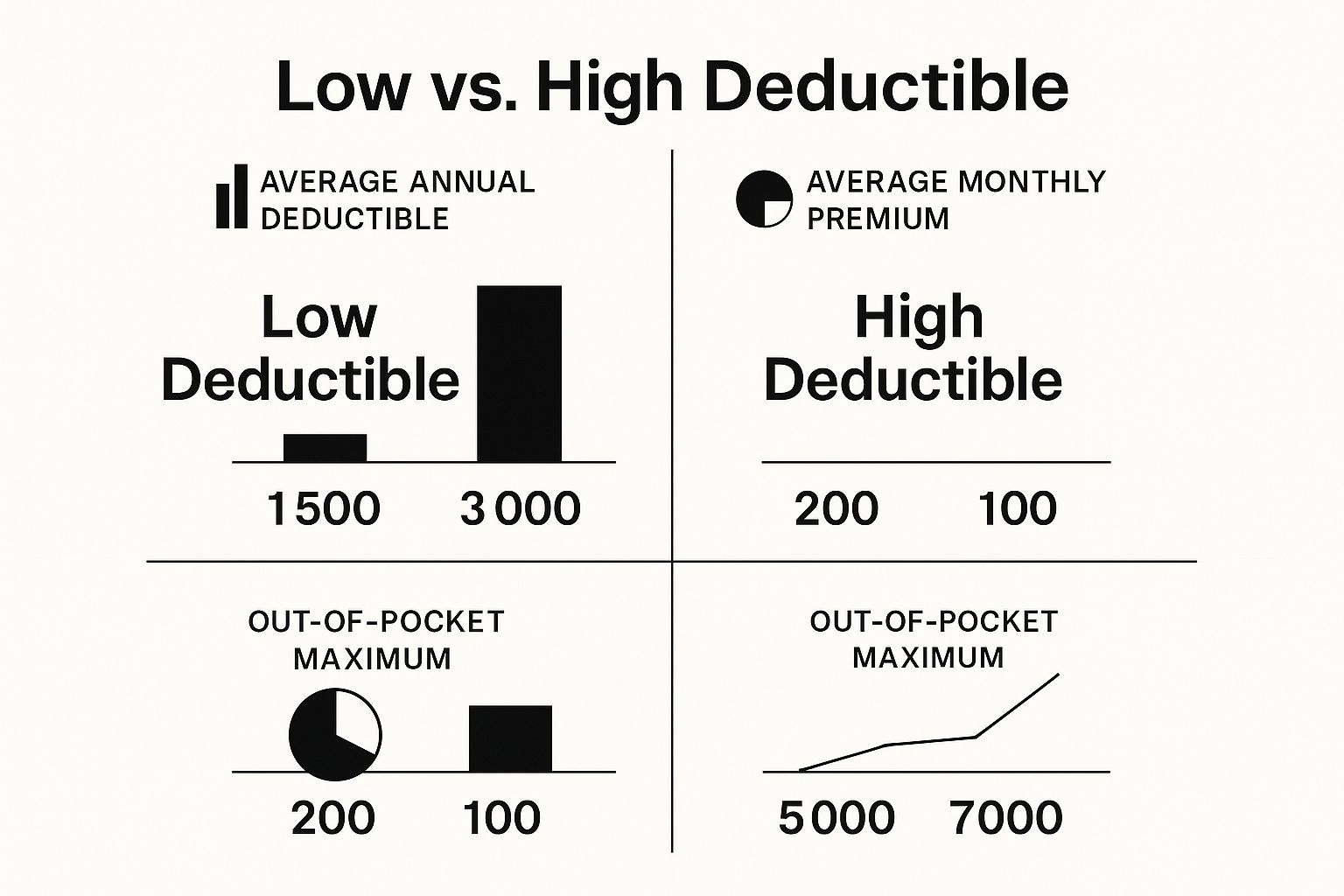

Comparing High and Low Deductible Scenarios

Let's analyze how this plays out with specific figures. Opting for a higher deductible can generate substantial annual premium savings, making it an attractive option for healthy individuals or those with sufficient liquidity to comfortably absorb a larger one-time expense.

Imagine a plan with a $1,000 deductible that costs $500 per month, translating to a fixed annual cost of $6,000. Compare this to a plan with a $5,000 deductible, which might have a premium of only $300 per month, or $3,600 annually.

By choosing the higher deductible, you have achieved a $2,400 saving in premium payments over the year.

This calculated risk is ideally suited for someone who possesses the financial agility to cover a potential upfront cost without disrupting their broader financial strategy. The key is to align your deductible with your investment profile and risk appetite.

The infographic below illustrates this trade-off, showing how monthly payments and potential out-of-pocket costs move in inverse relation to one another.

As depicted, accepting a higher deductible directly reduces your fixed monthly premium but raises your total potential out-of-pocket expenditure for the year.

Deductible vs. Premium: A Strategic Cost Analysis

This table details the financial implications of different deductible choices, highlighting the direct relationship between your upfront risk assumption and ongoing premium costs.

| Deductible Level | Estimated Monthly Premium | Annual Premium Cost | Maximum Initial Out-of-Pocket | Ideal Client Profile |

|---|---|---|---|---|

| $500 | $550 | $6,600 | $500 | Prefers predictable, low upfront costs and is willing to pay a higher premium. |

| $2,500 | $400 | $4,800 | $2,500 | Seeks a balance between moderate premiums and manageable out-of-pocket exposure. |

| $5,000 | $300 | $3,600 | $5,000 | Financially prepared for higher upfront costs in exchange for significant savings. |

| $10,000 | $220 | $2,640 | $10,000 | High-net-worth individual using insurance as catastrophic coverage, keeps costs low. |

This analysis clearly demonstrates that as your deductible increases, your annual premium decreases substantially. The decision is not about which option is inherently "better," but rather which one aligns with your personal financial strategy and health profile.

Global Trends Influencing Your Decision

This strategic balance is becoming increasingly pertinent for expatriates. Globally, insurers are contending with escalating healthcare costs, driven by expensive new medical technologies and demographic shifts. For a deeper look at this, consult our article on why medical insurance premiums rise year after year.

Medical cost inflation is a global phenomenon, with some projections indicating gross increases of nearly 10% in certain regions. To maintain the sustainability of their plans, insurers are increasingly utilizing higher deductibles and other cost-sharing mechanisms to manage the relentless rise in claims. This is a consistent trend across major insurance markets in Europe, Asia, and Latin America.

This global shift means that understanding the deductible-premium relationship is no longer just advisable—it is now an essential component of sophisticated financial planning for any high-net-worth expatriate. Selecting the right deductible is an act of taking deliberate, informed control of your healthcare finances.

How to Choose Your Optimal Deductible

Selecting the right medical insurance deductible is not a simple choice; it is a deeply personal financial calculation. For high-net-worth individuals, this extends beyond seeking premium savings. It is a strategic decision that must balance cash flow, risk tolerance, and your family's health history.

One-size-fits-all recommendations are ineffective because they fail to account for your unique financial and health profile. What is required is a clear framework to identify a deductible that integrates seamlessly with your lifestyle and financial objectives.

Assess Your Family's Health Profile

Begin by developing a realistic assessment of your family's likely medical needs. The most effective approach is to analyze past utilization to forecast future requirements.

Compile your family's total healthcare expenditures from the past three years. This provides a robust baseline and mitigates the impact of any outlier years. Tally all costs—routine consultations, specialist appointments, prescription drugs, and any diagnostic procedures.

Next, turn your focus to the future. Are there any significant medical events anticipated, such as a planned surgery or ongoing management of a chronic condition? Proactive planning ensures your deductible choice is strategic rather than reactive.

This exercise yields a quantifiable estimate of your annual healthcare spend, which is the first crucial piece of information. A family with minimal historical medical needs may feel comfortable selecting a much higher deductible.

Evaluate Your Financial Liquidity

When considering a high deductible, the pivotal question is straightforward: can you fund the full amount immediately without disrupting your financial equilibrium? The funds must come from liquid reserves, not from the forced sale of investments or other assets.

A high deductible is a sound strategy only if you possess the cash to cover it without hesitation. These funds should be held in an accessible account, not tied up in assets that would require liquidation, potentially at an inopportune time.

For instance, a $10,000 medical insurance deductible should be backed by at least that amount in a readily accessible, high-yield savings or money market account. The objective is to prevent a medical event from precipitating a financial one.

Here, the true cost of a deductible becomes apparent. While a higher deductible lowers your fixed monthly premium, it shifts a significant portion of the initial financial burden to you. In the U.S. health insurance market, it is not uncommon for mid-tier 'silver' plans to feature deductibles between $5,000 and $6,000, while some 'bronze' plans can approach $9,000 for an individual. These figures underscore the criticality of maintaining cash reserves commensurate with your chosen risk level.

Consider Your Personal Risk Tolerance

Ultimately, the decision must align with your personal disposition. This is less about quantitative analysis and more about your comfort with financial risk—a factor as important as the underlying mathematics. How much uncertainty are you willing to accept in exchange for lower fixed costs?

Evaluating your deductible is analogous to determining your investment risk tolerance. An individual who values predictability and peace of mind may willingly pay higher annual premiums for the security of a low deductible.

Conversely, an individual with a greater appetite for risk and substantial cash reserves might view a high deductible as an effective cash flow management tool. They accept the possibility of a large, one-time expense in return for significant premium savings that can be deployed elsewhere in their investment portfolio.

By systematically addressing these three pillars—health needs, liquidity, and risk tolerance—you move beyond guesswork. This structured approach enables you to select a deductible that protects both your health and your wealth with precision.

Understanding Your Full Financial Exposure

Selecting your medical insurance deductible is a significant decision, but it is only the first step in determining your total financial risk for the year. To gain a complete picture of your potential liability, you must look beyond this initial figure. Satisfying your deductible activates your main benefits, but it does not mean your financial obligations cease.

This is where two other crucial policy components come into play: coinsurance and the out-of-pocket maximum. Understanding how these three elements function in concert is the only way to accurately forecast your potential expenditure and prevent unwelcome financial surprises.

The Role of Coinsurance

Once you have paid enough out-of-pocket to satisfy your annual deductible, your insurer begins to share in the cost of your care. This phase is governed by coinsurance.

Coinsurance is always expressed as a percentage split, such as 80/20 or 90/10. The first number represents the portion your insurer pays, while the second is the share for which you remain responsible.

Therefore, with a 90/10 coinsurance arrangement, your plan will cover 90% of all eligible medical bills from that point forward. You will continue to pay the remaining 10% until you reach the final financial safeguard in your policy.

The Out-of-Pocket Maximum: Your Ultimate Safeguard

Even with coinsurance mitigating costs, you continue to pay a portion of the bills after meeting your deductible. This raises a critical question: what prevents your expenses from escalating uncontrollably during a year with major health events? The answer is the out-of-pocket maximum.

This figure represents the absolute ceiling on what you will pay for covered healthcare in a single policy year. It is your ultimate financial shield. Once your combined payments—your deductible plus all your coinsurance payments—reach this limit, your insurer steps in and covers 100% of all eligible costs for the remainder of the policy year.

The out-of-pocket maximum transforms your health insurance from a simple cost-sharing plan into genuine catastrophic financial protection. It ensures that a major medical event will not compromise your long-term financial stability.

A Step-by-Step Financial Walkthrough

Let's trace how these components interact in a real-world scenario. Consider a senior executive with an international health plan structured as follows:

- Deductible: $2,000

- Coinsurance: 90/10

- Out-of-Pocket Maximum: $7,000

The executive requires an unexpected but necessary surgical procedure with a total approved cost of $50,000. Here is the precise breakdown of payments:

-

Meeting the Deductible: First, the executive is responsible for the full $2,000 deductible. He pays this amount directly. After this payment, the remaining bill to be settled is $48,000.

-

Applying Coinsurance: The 90/10 coinsurance is now applied to the remaining $48,000. The insurer covers 90% ($43,200), and the executive is responsible for the remaining 10% ($4,800).

-

Reaching the Out-of-Pocket Limit: At this stage, we calculate the executive's total payments for the year. He has paid his $2,000 deductible and his $4,800 share of the coinsurance, for a cumulative total of $6,800. This amount is still below his $7,000 out-of-pocket maximum.

-

Final Responsibility: For this $50,000 procedure, the executive’s total cost is $6,800. The insurance plan covers the remaining $43,200. For any further medical care that year, he would only be responsible for another $200 before his total payments reach the $7,000 out-of-pocket maximum. After that point, his insurer pays for everything. This system ensures that processes like pre-authorisation and direct settlement work smoothly once cost-sharing limits are met. You can learn more by exploring our detailed guide on pre-authorisation and direct settlement for a clearer picture of the claims process.

Common Misconceptions About Deductibles

Misunderstandings regarding deductibles are common. In my experience, these misconceptions can lead to flawed financial strategies and significant, unexpected invoices at the most inopportune times.

To utilize your policy with confidence, it is essential to dismantle several prevailing myths. Correcting these assumptions ensures your decisions are based on the actual mechanics of your coverage, not on flawed premises.

Many assume a lower deductible is always the superior financial choice due to its perceived safety. While it offers predictability, this perspective often overlooks the substantially higher premiums associated with it. Over several years of good health, the excess capital allocated to these high premiums can easily surpass what would have been paid out-of-pocket on a plan with a higher deductible, resulting in a net financial disadvantage.

Preventive Care Is Often Exempt

Perhaps the most valuable myth to dispel is the notion that one must satisfy the full deductible before receiving any benefits from the plan. For most high-quality international health plans, this is incorrect.

The key distinction is that many preventive services are covered at 100%, often before a single dollar has been paid toward the deductible. This is not an act of altruism by insurers; it is a calculated strategy designed to promote long-term health and manage their own claims exposure.

Services that frequently bypass the deductible include:

- Annual physical examinations and wellness checks.

- Standard immunizations and vaccinations.

- Routine health screenings for conditions such as hypertension or high cholesterol.

This is an embedded benefit that should be utilized without hesitation. These essential services operate entirely outside the standard deductible framework.

Not All Plans Are Created Equal

Another prevalent error is assuming all deductibles function identically. As previously discussed, some plans apply the deductible per policy year, while others apply it per condition. This single detail can fundamentally alter your potential financial exposure.

It is also a frequent mistake to assume your deductible resets on January 1st. A policy's deductible is tied to its "policy year," which typically commences on the date your coverage was activated, not on the calendar new year.

Mastering these structural details is not merely about understanding fine print; it is essential for accurate financial planning and avoiding adverse surprises. Moving beyond these common myths provides the nuanced knowledge required to use your policy effectively, protecting both your health and your financial well-being.

Frequently Asked Questions

When navigating global health insurance, several key questions about deductibles consistently arise. Here are direct answers to the most common queries we receive from expatriates and international professionals.

Does My Deductible Apply To Prescription Medications?

This depends entirely on the specific structure of your policy. High-end international health plans often manage prescription drug benefits separately from the main medical deductible, which can be a significant advantage.

It is common for top-tier plans to feature a separate—and much lower—deductible exclusively for medications. Some plans may waive a drug deductible altogether, employing a simple copayment system instead. The definitive source of information is the "Summary of Benefits" in your policy documents, which will specify precisely how these costs are structured.

How Does A Family Deductible Work?

A family deductible is designed with two components: an individual deductible for each person and an overall family deductible. This structure is advantageous because it ensures one family member's significant medical expenses do not prevent others from accessing their coverage when needed.

The mechanism is as follows: once an individual meets their personal deductible, the insurance begins paying its share for their care. However, for coverage to activate for all other members on the plan, the family's aggregate medical spending must reach the higher, combined family deductible. This is a practical system that addresses both major individual events and the cumulative cost of smaller issues across the entire family.

This dual-component system is a hallmark of a well-designed family plan. It provides protection against both a single catastrophic event and the aggregate financial impact of multiple health issues within a policy year.

Are Certain Services Exempt From The Deductible?

Yes, and this is a critical feature of any quality health plan. Insurers are incentivized to promote wellness, so they almost universally exempt preventive care from the deductible.

This means you can access essential wellness services covered at 100% from the beginning of your policy year, without contributing to your deductible. This typically includes services such as:

- Annual physicals

- Routine vaccinations

- Standard health screenings (e.g., for cholesterol or blood pressure)

This is a valuable benefit designed to remove cost barriers to proactive health management. It is prudent to confirm exactly which services your policy defines as "preventive" to fully leverage this feature.

Making an informed decision on your health coverage is paramount. As specialists in international private medical insurance for high-net-worth professionals, Riviera Expat delivers the expert guidance you need to select a plan that aligns perfectly with your global lifestyle. Visit us at https://riviera-expat.com to secure your peace of mind.