For discerning global citizens, mastering the concept of health insurance cost sharing is the crucial distinction between financial peace of mind and the stress of unexpected medical expenses. This is not merely about covering healthcare costs; it is about strategically understanding the financial architecture of your policy to protect your health and your assets, regardless of your location.

The entire framework is constructed upon four key financial instruments. A comprehensive grasp of these is essential before a claim is ever initiated.

Decoding Your Financial Partnership with Your Insurer

It is most effective to view your health insurance not as an unlimited payment facility, but as a structured financial partnership. Your monthly premium secures your participation in this partnership, granting you access to the coverage network. However, when it comes to the actual cost of medical care, that responsibility is shared.

This shared model is what is termed health insurance cost sharing. It represents the fundamental set of rules that dictates your personal financial outlay when you utilize your insurance. It is defined by four core components, each playing a distinct role in determining what you owe.

For individuals managing an international lifestyle, proficiency in these terms is not optional—it is a requisite for sound financial management. Our guide on how to decipher expat medical insurance policy terms provides an excellent primer on these concepts.

The Four Pillars of Cost Sharing

At its core, your policy employs four distinct levers to allocate the cost of medical services between you and the insurance company. Understanding how they operate in concert is the key to accurately forecasting your expenses and avoiding unwelcome financial surprises.

Let us dissect the four pillars that define this financial partnership.

| Component | What It Is | When You Pay It |

|---|---|---|

| Deductible | The fixed amount you must personally pay for your covered healthcare services each policy year before your insurance begins to contribute. | At the beginning of your policy year for covered services, until the full deductible amount has been met. |

| Copayment | A fixed, predetermined fee you pay for a specific service, such as a physician's consultation or a prescription. It offers predictability. | At the time of service. You will pay this for each applicable visit or prescription, even after your deductible is satisfied. |

| Coinsurance | The percentage of a medical bill you are responsible for after you have met your annual deductible. | After you have satisfied your deductible. You will continue to pay this percentage until you reach your out-of-pocket maximum. |

| Out-of-Pocket Maximum | The absolute ceiling on the amount you will have to pay for covered medical care in a single policy year. This is your ultimate financial safeguard. | This is not a direct payment, but a limit. Once your total spending (deductible + copayments + coinsurance) reaches this threshold, your insurer covers 100% of all subsequent covered costs for the remainder of the year. |

Consider these four elements as the complete financial architecture of your health plan. Each one is triggered at a different stage of your healthcare journey, protecting both you and the insurer from escalating costs.

The global private health insurance market is substantial, valued at approximately USD 1.7 trillion in 2023 and projected to grow. This significant market size underscores the critical importance of these cost-sharing mechanisms in managing rising healthcare expenses worldwide.

How Deductibles, Coinsurance, and Copays Work

To gain a sophisticated command of your international health coverage, one must look beyond simple definitions. The key lies in understanding the interplay between the core components of health insurance cost sharing. It is this dynamic that allows you to accurately predict your financial obligations and make informed healthcare decisions, anywhere in the world.

These components—the deductible, copayment, coinsurance, and out-of-pocket maximum—are not arbitrary fees. They function in a specific sequence, each becoming active at a different point in your medical care journey.

Envision it as a financial relay. Your deductible is the first leg, your copayments and coinsurance manage the intermediate stages, and the out-of-pocket maximum is the definitive finish line you cannot be asked to cross.

Your Initial Investment: The Deductible

The deductible is the amount you are required to pay out-of-pocket for covered medical services before your insurance plan contributes. It is, in essence, your annual financial commitment before the partnership's cost-sharing benefits are activated. Until you have satisfied this amount, the full cost of your medical bills rests with you.

For example, if your plan specifies a $5,000 deductible, you are personally responsible for the initial $5,000 of your covered medical expenses for that year. Only after you have paid this amount does your insurer begin to share subsequent costs. For a more detailed examination of this crucial policy detail, our guide on understanding excesses and deductibles in the fine print is an essential resource.

This structure is a fundamental part of how insurers manage financial risk. A 2023 KFF analysis of employer-sponsored plans found that the average single deductible was $1,735, indicating that a significant initial outlay is a common feature in modern insurance design.

The deductible functions as a gatekeeper. Once satisfied, it unlocks the cost-sharing partnership with your insurer for the rest of the year. This initial investment is a primary determinant of your plan's overall affordability and your potential financial exposure.

This mechanism has a direct, inverse relationship with your monthly premiums. Plans featuring higher deductibles typically have lower monthly payments. This is a favored strategy for high-net-worth individuals with sufficient liquidity to self-insure for minor expenses, while retaining robust protection against a major medical event.

Fixed Fees for Specific Services: Copayments

Once your deductible is met and your plan’s cost-sharing provisions are active, copayments (or copays) come into play for certain services. A copayment is a simple, fixed fee paid for a specific service at the point of delivery. It is not a cumulative sum like a deductible, but a per-service charge.

Assume your policy stipulates a $50 copayment for a specialist consultation. It is irrelevant whether you are visiting a cardiologist in Dubai or an orthopedist in London—you will remit that $50 at each appointment.

Common services that involve copayments include:

- Physician Consultations: Covering both primary care physicians and specialists.

- Prescription Medications: Often structured in tiers, with lower copayments for generic drugs and higher ones for brand-name or specialty pharmaceuticals.

- Urgent Care Visits: A set fee for immediate, non-emergency medical attention.

Copayments provide valuable clarity. They inform you of the exact, upfront cost for routine care, which simplifies budgeting for health expenses. Critically, these payments almost always contribute toward your annual out-of-pocket maximum.

The Partnership Phase: Coinsurance

After your annual deductible has been fully satisfied, coinsurance commences. This is where the true financial partnership with your insurer becomes most apparent. Coinsurance is the percentage of the cost for a covered health service that you are responsible for paying.

Let us examine a practical scenario. Your plan has a $5,000 deductible and 20% coinsurance. You undergo a minor outpatient procedure in Singapore that costs $15,000.

- Meet the Deductible: You pay the initial $5,000 of the bill yourself.

- Calculate Coinsurance: The remaining balance is $10,000. Your insurer covers its 80% share ($8,000), and you are responsible for your 20% coinsurance portion, which amounts to $2,000.

- Your Total Cost: For this procedure, your total personal expenditure is $7,000 (your $5,000 deductible + your $2,000 coinsurance).

This percentage-based sharing continues for every covered service until you reach the ultimate financial safeguard.

Your Ultimate Financial Shield: The Out-of-Pocket Maximum

The out-of-pocket maximum is unquestionably the most important feature of your health plan for wealth preservation. This figure represents the absolute maximum amount you will have to pay for covered healthcare services in a single policy year.

Once your combined payments for your deductible, copayments, and coinsurance reach this limit, your insurance company assumes 100% of the costs for all subsequent covered care for the remainder of the year.

Imagine your plan has a $10,000 out-of-pocket maximum. Over several months, you have paid your $5,000 deductible and an additional $5,000 in various copayments and coinsurance. You have now reached your maximum. If you subsequently require a major, unexpected surgery costing $100,000 later that year, your insurer covers the entire $100,000. Your financial liability is capped.

This safety net transforms your health insurance from a simple cost-sharing tool into a powerful asset protection strategy. It insulates you from the financially devastating impact of a catastrophic medical event, providing the ultimate peace of mind that even in a worst-case scenario, your financial risk is clearly defined and limited.

Balancing Premiums with Out-of-Pocket Costs

Selecting an international health plan is not merely an insurance purchase; it is a core financial strategy, analogous to managing an investment portfolio. You are constantly balancing risk and reward. The central trade-off is straightforward: your fixed monthly premium versus your potential out-of-pocket expenditure.

This decision reflects your personal financial philosophy. Do you prefer predictable, fixed costs, or are you comfortable with some variability in exchange for lower recurring payments? There is no universally correct answer—only the one that aligns with your health profile, financial position, and risk tolerance.

The core principle is an inverse relationship. A lower monthly premium almost invariably means higher potential out-of-pocket costs, typically in the form of a larger deductible. Conversely, a higher premium secures lower—or even zero—costs at the point of service.

The Low-Premium, High-Deductible Strategy

For healthy individuals who view insurance as a safeguard against major catastrophic events, this approach is financially astute. You minimize your fixed monthly cash outflow, freeing up capital for other investments. The strategy is predicated on having sufficient liquidity to cover the higher deductible should a medical issue arise.

This is a mainstream strategy. High-deductible health plans (HDHPs) are common, with a 2023 KFF survey finding that 29% of covered workers are enrolled in one. This is often paired with Health Savings Accounts (HSAs), which saw total assets reach an estimated $123.3 billion at the end of 2023. This indicates a clear trend of individuals actively saving to meet these potential out-of-pocket obligations. You can delve into more of these health insurance industry statistics and trends on Coinlaw.io.

This model places you firmly in control of your routine healthcare spending, but with a powerful backstop for significant medical costs.

Consider a high-deductible plan as a high-water mark for your personal healthcare expenditure. You manage all costs below that mark, but you are completely protected from any financial wave that crests above it.

This requires a disciplined financial mindset. It is not about securing the "cheapest" plan. It is a calculated decision based on your health status, backed by the financial readiness to cover the deductible if necessary.

The High-Premium, Low-Cost-Sharing Strategy

At the other end of the spectrum is the strategy engineered for predictability and peace of mind. A higher premium paired with low health insurance cost sharing is often the most prudent choice for families with young children, individuals managing chronic conditions, or those who simply place a high value on financial certainty.

You invest more each month, but in return, you drastically reduce or eliminate the variable costs of physician visits, prescriptions, and specialist consultations. This approach smooths your healthcare spending over the year, transforming a potentially volatile expense into a predictable, fixed line item in your budget. This removes the anxiety of an unexpected medical bill disrupting your financial planning.

Here, you are prioritizing certainty. You trade the potential for savings for the guarantee of predictable costs, without the need to maintain a large cash reserve for a sudden deductible payment.

Case Study: How This Plays Out for Expats

To observe how this functions in practice, let us consider three distinct global citizens:

- The Globe-Trotting Executive: A healthy 40-year-old executive based in Singapore who travels extensively for business. Physician visits are rare. A low-premium, high-deductible plan is a perfect fit. It minimizes fixed costs while providing robust coverage for a serious accident or illness.

- The Expat Family in Southeast Asia: A family with two young children residing in Kuala Lumpur. Between routine check-ups, common illnesses, and occasional injuries, cost predictability is paramount. A higher-premium plan with low copayments for pediatric visits provides financial stability and ensures they never hesitate to seek medical care for their children due to cost concerns.

- The Retiree in Europe: A retiree in Portugal managing a known health condition. A high-premium plan with a low deductible and a low out-of-pocket maximum is non-negotiable. It ensures the costs for regular specialist visits and prescriptions are predictable and capped, protecting retirement assets from being eroded by medical expenses.

Navigating Real-World Expat Medical Scenarios

While understanding the theory behind health insurance cost sharing is foundational, observing its application in real-world scenarios provides true clarity. To demonstrate precisely how these financial mechanics operate, let us analyze three common medical situations faced by expatriates.

These examples will deconstruct how your policy functions step-by-step—from satisfying the deductible, through the coinsurance phase, and finally, how the out-of-pocket maximum acts as your ultimate financial protection.

Case Study 1: An Unexpected Procedure in Singapore

Imagine you are an expatriate in Singapore who experiences a sudden, acute medical issue requiring hospitalization. You undergo an unexpected outpatient procedure, and the final consolidated bill for the surgeon, anesthesiologist, and facility totals $12,000.

Your international health plan has the following terms:

- Annual Deductible: $2,500

- Coinsurance: 80/20 (Your insurer pays 80%, you pay 20%)

- Out-of-Pocket Maximum: $7,500

Here is the precise breakdown of costs:

- Meet Your Deductible: You are first responsible for the initial $2,500 of the bill. This payment satisfies your deductible for the entire policy year.

- Calculate the Remainder: After your deductible is paid, $9,500 of the bill remains ($12,000 – $2,500).

- Apply Coinsurance: You now pay your 20% share of the remaining amount, which is $1,900 (20% of $9,500). Your insurer covers the other 80%, or $7,600.

- Determine Your Total Cost: Your total personal liability for this procedure is the sum of your deductible and your coinsurance payment: $2,500 + $1,900 = $4,400.

This scenario perfectly illustrates the sequential operation of your deductible and coinsurance in apportioning the cost.

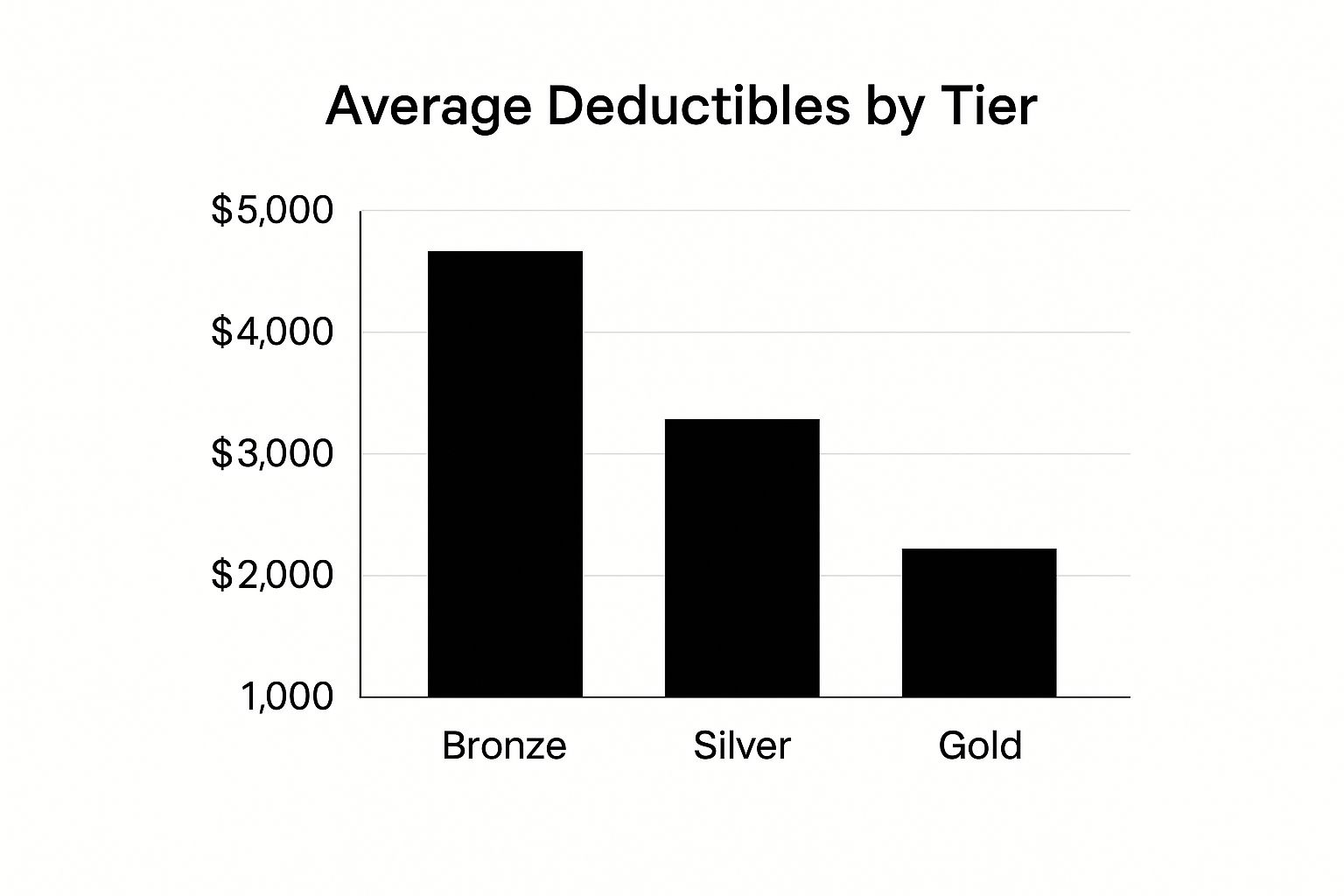

The chart below demonstrates how deductibles can vary significantly between different plan tiers, which would dramatically alter your upfront costs in a situation like this.

As depicted, it is a classic trade-off. Higher-tier plans like Gold and Platinum command higher premiums, but your out-of-pocket expenditure is substantially lower when you require medical care.

Case Study 2: A Planned Surgery in Switzerland

Now, let us consider a wealth manager in Geneva who requires a major, pre-planned knee surgery. The costs are substantial and certain to engage the policy's limits. The total approved cost for the surgery and all subsequent physical therapy is $85,000.

Her premium-level plan features very different terms:

- Annual Deductible: $1,000

- Coinsurance: 90/10

- Out-of-Pocket Maximum: $5,000

In a high-cost scenario such as this, the out-of-pocket maximum is the most critical figure.

The out-of-pocket maximum is your financial circuit breaker. It is the absolute, contractually guaranteed cap on what you will pay for covered medical care in a policy year, shielding you from financially crippling healthcare bills.

Let's trace the financial flow:

- Meet the Deductible: She first pays her $1,000 deductible.

- Coinsurance Kicks In: With the deductible met, the remaining bill is $84,000. She begins paying her 10% coinsurance share on the subsequent bills.

- Hitting the Cap: She will continue paying 10% of the costs until her total payments (deductible + coinsurance) reach her $5,000 out-of-pocket maximum. In this case, she pays the $1,000 deductible plus an additional $4,000 in coinsurance payments.

- The Insurer Assumes Full Responsibility: Once she has paid that $5,000, her financial obligation for the year is complete. The insurer covers 100% of all remaining approved costs. Of the original $85,000 bill, her final cost is precisely $5,000, and the insurer pays the remaining $80,000.

For any major planned procedure of this nature, understanding the pre-authorisation and direct settlement process is absolutely essential to prevent any adverse financial surprises with the hospital.

Case Study 3: Managing a Health Condition in London

Our final example is a banker in London managing a chronic health condition. This involves ongoing, predictable care throughout the year, primarily comprising services with fixed fees.

His policy is structured for this type of regular use:

- Annual Deductible: $500 (applies only to major procedures, not his routine office visits)

- Specialist Visit Copayment: $75 per visit

- Prescription Copayment: $30 per refill (for his Tier 2 medication)

- Out-of-Pocket Maximum: $6,000

Throughout the year, his medical activity is as follows:

- 8 visits to his specialist (8 x $75 = $600)

- 12 prescription refills (12 x $30 = $360)

His total out-of-pocket cost for managing his condition is a predictable $960 for the year ($600 + $360). The advantage of copayments is their predictability; the costs are fixed and distributed over time.

Crucially, every dollar of these copayments contributes toward his $6,000 out-of-pocket maximum. This provides a vital financial safety net should his condition worsen, requiring more intensive and expensive treatment later in the year.

Cost Sharing in Action: A Scenario Analysis

To synthesize these concepts, this table compares the final financial outcomes of our three scenarios, clearly illustrating how policy terms interact with medical costs to determine the allocation of payment responsibility.

| Medical Scenario | Total Billed Amount | Your Total Cost (Deductible + Coinsurance) | Insurer's Total Cost |

|---|---|---|---|

| Unexpected Procedure (Singapore) | $12,000 | $4,400 | $7,600 |

| Planned Surgery (Switzerland) | $85,000 | $5,000 (Capped by OOP Max) | $80,000 |

| Chronic Condition (London) | $960 in Copays | $960 | Varies based on total service cost |

As these examples demonstrate, a universally "best" plan does not exist. The optimal choice is entirely dependent on your specific health needs, financial situation, and anticipated utilization of insurance. A plan that is perfectly suited for a healthy individual might be a suboptimal choice for someone managing an ongoing condition.

Optimizing Your Coverage for Global Lifestyles

Understanding the mechanics of health insurance cost sharing is merely the foundation. True value is realized through the active management of your coverage, transforming a simple policy into a strategic financial asset. For global citizens, this requires moving beyond passive acceptance of terms to the adoption of proactive tactics to control costs, prepare for expenses, and ensure your plan evolves in step with your dynamic life.

Effective management is not a singular decision but an ongoing financial discipline, demanding a sophisticated approach to both preparation and execution. The objective is to ensure your healthcare capital is deployed with the same efficiency as your investment capital.

Funding Your Out-of-Pocket Exposure

The most direct method to mitigate the financial impact of a deductible or coinsurance is to anticipate and prepare for it. For those who are eligible, a Health Savings Account (HSA) is an exceptionally powerful tool for this exact purpose. It allows you to contribute pre-tax dollars into an account designated specifically for medical expenses.

HSAs offer a unique triple tax advantage: contributions are tax-deductible, funds grow tax-deferred, and withdrawals for qualified medical expenses are tax-free. This elevates it from a simple savings account to an investment vehicle perfectly engineered to cover your share of healthcare costs. This strategy is transformative for anyone with a high-deductible health plan (HDHP), turning a potential financial liability into a structured savings opportunity.

The Critical In-Network and Out-of-Network Distinction

When your professional and personal life transcends borders, your insurer’s provider network is not just a list of facilities—it is your financial lifeline. The cost differential between receiving care "in-network" versus "out-of-network" can be staggering. It is often the single greatest variable in your ultimate out-of-pocket expenditure.

- In-Network Providers: These are the hospitals, clinics, and physicians with whom your insurer has a pre-negotiated contractual relationship, including discounted rates. When you utilize their services, you are billed at these favorable rates, and your standard deductible and coinsurance apply.

- Out-of-Network Providers: These providers have no agreement with your insurer. If you seek care from them, you are exposed to their full, undiscounted billing rates.

Using an out-of-network provider can trigger a separate, often dramatically higher, deductible and a less favorable coinsurance split. This strategic distinction is a cornerstone of effective health insurance cost sharing management.

Before any non-emergency treatment, verifying a provider's network status is a non-negotiable step. A premier international policy should offer a robust, easily searchable global network of top-tier facilities, making this process straightforward.

Conducting a Strategic Annual Policy Review

Your life is not static; neither should your health coverage be. An annual policy review is an essential financial check-up. It is your opportunity to ensure your plan's cost-sharing structure continues to serve your best interests. This is far more than a cursory glance at the premium; it is a deep analysis of your coverage in the context of your current life circumstances.

During your review, ask these critical questions:

- Have my travel patterns changed? Increased time in a region with high healthcare costs might necessitate a plan with a lower out-of-pocket maximum.

- Has my or my family's health status changed? A new diagnosis or the anticipation of a major life event, such as starting a family, demands a rigorous re-evaluation of your deductible and copayment levels.

- Does my current deductible align with my liquid assets? You must be positioned to comfortably absorb your maximum out-of-pocket cost. Reassess this against your current financial standing.

- Is my insurer's network still robust in my key locations? Networks can change. The preferred hospital in London, Singapore, or Dubai might no longer be in-network. Verification is crucial.

This yearly assessment empowers you to make deliberate, informed adjustments. It ensures your policy remains a precise instrument for wealth protection and health security, rather than an overlooked recurring expense. It is the ultimate expression of taking control of your global healthcare finances.

Common Questions About Global Cost Sharing

When navigating the complexities of an international health plan, the financial details can seem daunting. A few practical questions invariably arise. For individuals living abroad, obtaining clear, direct answers is not merely helpful—it is essential for managing your finances and utilizing your coverage with confidence. Let us address the most common questions about health insurance cost sharing.

How Do I Choose the Right Deductible for My International Lifestyle?

Selecting a deductible should be approached as a strategic financial decision, not simply an insurance variable. It is a balance between your fixed monthly outlay and your potential sudden expenditure should you require care. The optimal choice depends on your personal health profile and financial position.

If you are in excellent health and possess a strong financial cushion, a high-deductible plan can be an astute choice. You will benefit from a much lower monthly premium, freeing up capital. In this configuration, your insurance functions as a safeguard against major, unexpected medical events, while you self-fund minor costs.

Conversely, if you or your family anticipate more frequent physician visits, or if you prioritize predictable budgeting, a lower-deductible plan is the more prudent option. While your monthly premium will be higher, you gain the assurance of minimized financial shock from a large, unexpected bill for routine or specialist care.

Here is the key takeaway: Premiums are fixed, predictable payments to maintain your policy. Out-of-pocket costs are variable and arise only when you use medical services. Your personal tolerance for financial risk should be the primary guide in your decision.

Does My Out-of-Pocket Maximum Include Monthly Premiums?

This is a frequent point of confusion, and the answer is an unequivocal no. It is absolutely critical to understand that these are two entirely separate costs that fulfill different roles in your financial planning.

Your monthly premium is the fee you pay to the insurance company to keep your policy active. This is paid regardless of whether you access medical services.

The out-of-pocket maximum is your ultimate financial shield for the year. It is the absolute ceiling on what you will pay for your portion of covered medical services. It is a cumulative total of your expenditures on your:

- Annual deductible

- Copayments for physician visits and prescriptions

- Coinsurance for hospital stays and medical procedures

Once your total payments for these three components reach your out-of-pocket maximum, your insurer is contractually obligated to cover 100% of all other approved medical bills for the remainder of that policy year.

What Are the Financial Risks of Using an Out-of-Network Provider Abroad?

Utilizing an out-of-network physician or hospital abroad is a significant financial risk. Your insurer has not negotiated discounted rates with these providers, meaning you are exposed to their full, undiscounted charges, which can be exceptionally high.

The financial repercussions extend far beyond just a higher price. Many international plans apply a completely different—and much more stringent—set of rules for out-of-network care. You could face:

- A separate, much larger deductible that must be met before the plan contributes anything for that out-of-network service.

- A less favorable coinsurance split, leaving you responsible for a larger percentage of the final bill (e.g., 40% instead of the standard 20%).

- A significantly higher out-of-pocket maximum, which dramatically increases your total potential financial exposure.

For any high-net-worth individual living or working internationally, selecting a plan with a robust, accessible global provider network is not merely a feature—it is a fundamental component of intelligent financial planning and risk management. Always verify a provider’s network status before scheduling any non-emergency appointment.

Navigating these details is where expert guidance provides immense value. At Riviera Expat, we specialize in cutting through the complexity to help you secure an international health plan that aligns perfectly with your financial strategy and global life. Secure your financial peace of mind today.