The investment banking career path is a highly structured, meritocratic ascent, renowned for its demanding nature. It requires exceptional resilience and sophisticated analytical capabilities. The journey commences at the Analyst level, immersed in technical execution, and progresses through distinct tiers with the ultimate objective of reaching Managing Director—the senior executive responsible for originating significant transactions.

This is not a sprint; it is a marathon where each stage is built upon the mastery of the previous one.

Demystifying the Investment Banking Hierarchy

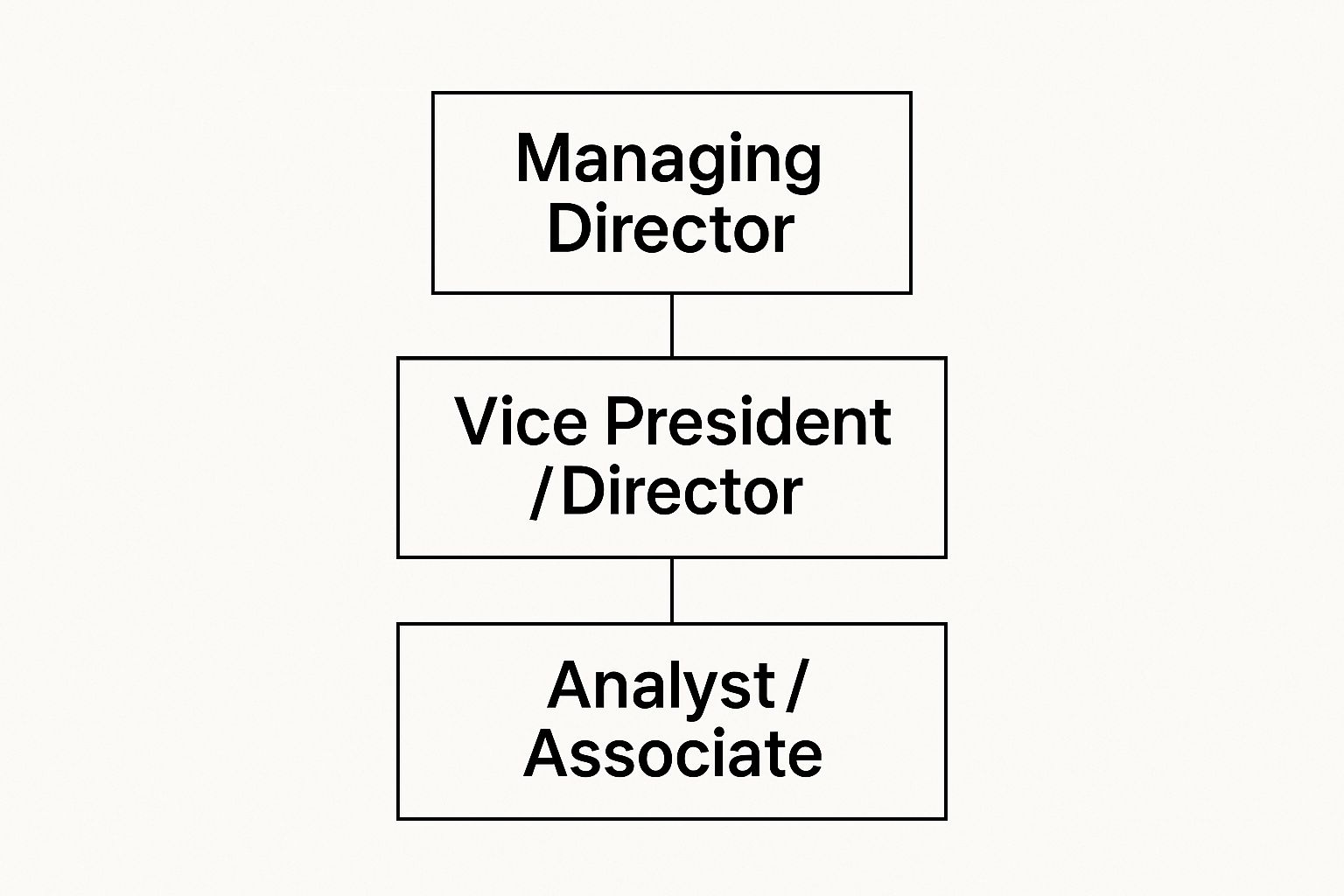

The structure of an investment bank is best visualized as a pyramid. At its broad base are the junior bankers, performing the intensive analytical work. At the apex, a select group of senior partners directs the firm's strategy. This hierarchy is engineered for a singular purpose: to forge elite dealmakers through rigorous training and mentorship, offering a clear—albeit challenging—trajectory for those who excel.

Each level of this hierarchy carries a distinct set of responsibilities. The initial years are a trial by fire, centered on financial modeling, valuation, and the construction of pitch decks. As one advances, the role transforms entirely, shifting from a focus on quantitative analysis to one centered on client relationship management and business origination.

The entire career is a deliberate transfer of responsibility. One transitions from being the expert on the financial model to the trusted advisor who can originate and close a nine-figure transaction based on a relationship cultivated over a decade.

The Structured Ascent

Promotions are earned through a combination of technical proficiency, transaction experience, and a demonstrated ability to manage increasing complexity. The system is transparent; the requirements for advancement are well-defined.

- Skill Accumulation: Each role is a foundational block. Analysts are masters of data, Associates manage the deal process, and Vice Presidents begin to lead execution teams.

- Expanding Influence: An individual's impact grows from internal execution to direct client management, culminating in the origination of new business for the firm.

- Increasing Autonomy: Seniority confers greater strategic discretion, including more influence over decision-making, client strategy, and the overall direction of a transaction.

This image breaks down the three main tiers of the investment banking career, from the junior "grinders" to the senior leaders.

As you can see, it’s a clear progression from the analytical grunt work to the strategic peak. Navigating this path requires a powerful professional brand, which is why it's so important to optimize your LinkedIn profile for tangible career results.

For context on compensation, an entry-level Analyst in a primary financial center such as New York or London can anticipate a base salary between $110,000 and $125,000. Including the performance-based bonus, total first-year compensation typically falls within the $170,000 to $220,000 range.

Investment Banking Career Path At a Glance

To provide a clearer picture, here is a summary of the typical investment banking ladder, from entry-level to the senior-most ranks.

| Role | Typical Tenure | Core Focus | Key Responsibilities |

|---|---|---|---|

| Analyst | 2-3 years | Technical Execution | Building financial models, creating pitch decks, conducting industry research. |

| Associate | 3-4 years | Project Management | Managing Analysts, checking models, overseeing deal materials, first client contact. |

| Vice President (VP) | 3-4 years | Deal Execution Lead | Leading deal teams, managing client relationships, negotiating key terms. |

| Director / Senior VP | 2-3 years | Business Development | Sourcing new clients, developing relationships, transitioning to revenue generation. |

| Managing Director (MD) | Ongoing | Revenue Generation | Originating deals, maintaining senior client relationships, firm-level strategy. |

This table illustrates the clear, step-by-step nature of the career. Each stage has a purpose: to prepare you for the next level of responsibility, slowly shifting your focus from spreadsheets and slides to relationships and revenue.

Mastering Execution as an Analyst and Associate

The formative years in investment banking are forged in the Analyst and Associate roles. This stage is not about high-level strategy; it is a crucible designed to cultivate technical mastery, an obsessive attention to detail, and a superlative work ethic. The focus is on flawless, high-volume execution.

A new Analyst functions as the engine room of the deal team. The role revolves around the raw building blocks of every transaction. The primary function is to perform the analytical heavy lifting that underpins the entire process; the work is intense, granular, and fundamental to the team's success.

Your world will be dominated by spreadsheets and presentations. A significant portion of your responsibilities involves building robust financial models and learning to create compelling financial projections for clients. This is not optional; your ability to build, stress-test, and defend these models is the price of admission.

The Analyst Role: A Trial by Fire

As an Analyst, you have two primary directives: be fast and be right. You are expected to produce error-free work under immense pressure. There is zero tolerance for mistakes, as senior bankers make critical decisions based on your quantitative output.

The typical Analyst tenure is two to three years, during which you will develop expertise in several key functions:

- Financial Modeling: You will learn to build complex models from scratch for various valuation methodologies (DCF, LBO, Comparables), mergers, and diverse financing scenarios.

- Pitch Deck Creation: You will be responsible for creating the comprehensive presentations—known as "pitch books"—that articulate the strategic rationale for a transaction.

- Due Diligence: This involves conducting painstaking research on companies, markets, and entire industries to verify information and identify potential risks or opportunities.

The Analyst experience is an apprenticeship in precision. You learn that every number, slide, and footnote must be perfect. The firm’s reputation and the client’s capital are at stake.

Graduating to the Associate Level

The promotion from Analyst to Associate represents a significant shift in responsibility. While technical acumen remains essential, the Associate role introduces elements of project management and mentorship. You are no longer solely a builder; you are the first line of quality control and a manager of junior bankers.

Associates, often hired directly from top MBA programs or promoted from the Analyst ranks, are expected to assume greater ownership of the deal process. They become the central coordinating hub for the team, managing the workflow between Analysts and senior Vice Presidents.

Here's how the role evolves:

- Managing Analysts: You are now responsible for delegating tasks, reviewing the Analysts' work for accuracy, and guiding their professional development.

- Refining Complex Models: While an Analyst may build the initial model, the Associate is expected to refine it, stress-test every assumption, and ensure it is client-ready.

- Client Interaction: Associates begin to have more direct, though still supervised, client contact. This typically involves addressing specific inquiries or supporting senior bankers in meetings.

This career stage is about developing a more holistic perspective. You transition from pure execution to understanding the strategic "why" behind each transaction. It is a demanding leap, but it is the critical step toward a true leadership position within the firm.

Pivoting to Leadership as a Vice President

The ascent up the investment banking ladder reaches a major inflection point at the Vice President (VP) level. Here, the role fundamentally changes. It marks the official transition from a pure producer to a leader who balances project management with the initial stages of client relationship development.

The VP serves as the central hub of a deal, the critical link connecting the Managing Director's high-level strategy with the junior team's detailed analytical work. All execution flows through you.

Success is no longer defined merely by building a flawless model. It is about commanding the entire deal process. As the primary project manager, you own every deliverable, ensuring its perfection and timeliness. This is a significant shift in responsibility; accountability now rests with you.

From Executor to Manager

As a VP, your day-to-day focus shifts from creating materials to managing the professionals who do. You will spend considerably less time in Excel and more time directing Associates and Analysts, reviewing their work with exacting standards, and ensuring the final output addresses the client's strategic objectives.

You can expect to spend approximately three to four years in this role, during which you must master a completely new skillset.

Key responsibilities are no longer about your own output, but about orchestrating the team's:

- Managing Deal Teams: You are the conductor of the orchestra. You will manage the workflow, delegate tasks, and ensure your junior bankers meet aggressive deadlines while fostering their development.

- Client Communication: You are now a primary point of contact for the client, expected to articulate complex financial models and strategic concepts with complete confidence.

- Internal Coordination: The VP is responsible for orchestrating all internal teams. You will liaise with legal, compliance, and specialized product groups to ensure every component of the transaction converges seamlessly.

This role demands exceptional organizational skills and the capacity to manage multiple, complex workstreams simultaneously without any degradation in quality.

The VP role is where you truly begin to build your personal brand in the market. You are no longer just an extension of the firm; you are becoming an individual that clients begin to recognize, remember, and trust.

Cultivating Your Network and Business Acumen

Beyond managing the deal process, the VP years serve as your training ground for becoming a senior rainmaker. You are now expected to begin cultivating your own network of contacts within client organizations and across the broader industry.

This is not about actively sourcing your own deals—not yet. It is about laying the foundation for future business.

You will attend more client meetings and, crucially, start contributing to strategic discussions. This is your opportunity to demonstrate that you understand not just the numbers, but also the real-world business implications behind them. Developing this deeper commercial sense and thinking critically about market trends is non-negotiable. Your performance here is what will ultimately determine your path to Director and, eventually, Managing Director.

The Endgame: Driving Revenue as a Director and Managing Director

Reaching the Director and Managing Director levels represents the final and most profound shift in an investment banking career. The intense, heads-down focus on financial models and deal execution recedes. A new mandate emerges: revenue generation.

This is the apex of the hierarchy. Your value is no longer measured by the pitchbooks you create or the models you perfect, but by the tangible business you generate for the firm.

The transition from VP to Director marks the true beginning of this change. You are now officially a "senior banker," and your primary mission is to originate transactions and nurture the firm’s most important client relationships. While you still provide oversight to deal teams, your principal focus is cultivating a network that leads to signed engagement letters.

The Director: The Emerging Rainmaker

A Director is expected to begin building a personal book of business. This requires a distinctly entrepreneurial mindset. Your days are spent engaging with corporate executives and private equity partners, identifying potential M&A or financing opportunities long before they become public knowledge.

Success at this level hinges on your ability to become a trusted advisor. The key milestones for a Director are critical for advancement:

- Sourcing Your First Deal: Originating a transaction, however small, is the ultimate proof of your value.

- Leading Client Pitches: You are now leading high-stakes presentations, persuading clients to award your firm the mandate.

- Building a Personal Brand: You must become the go-to expert for advice within a specific industry or product group, which is the foundation of a long-term career.

This leap from manager to originator is the most challenging transition on the banking ladder. It demands a sophisticated mix of market savvy, genuine interpersonal skills, and relentless networking.

The Managing Director: The Ultimate Deal Originator

At the peak of the pyramid is the Managing Director (MD). An MD is the firm’s chief revenue officer for their specific niche. Their singular focus is to originate and close the largest, most complex deals. They are masters of relationship management, with a personal network built over a decade or more of dedicated effort.

An MD is essentially an entrepreneur operating within a large corporate structure. Your performance is judged by one metric: the revenue you bring in.

Here, the financial rewards become substantial. Compensation for a top-performing MD can reach multiple millions of dollars annually, directly tied to the size and volume of deals they close. They are the advisors CEOs call for their most critical strategic decisions, leveraging deep industry knowledge and an unparalleled network to shape major corporate events.

The demand for this caliber of talent remains constant. The U.S. investment banking market, for example, has demonstrated consistent growth. You can discover more insights about investment banking career growth on 300hours.com.

Reaching this elite level is the culmination of the entire investment banking career path. It's a journey that transforms a skilled analyst into a strategic business builder—a journey that requires incredible resilience, intelligence, and a singular focus on building lasting relationships.

Promotions, Payouts, and Life After Banking

The investment banking career path is a demanding climb, but it is structured with clear milestones. You always know the location of the next rung on the ladder. However, ascending is not merely about spreadsheet proficiency.

Advancing from Associate to VP, for instance, represents a complete identity shift. The focus moves from flawless execution of assigned tasks to managing the entire project and the junior bankers performing the work. Senior leaders are looking for more than technical skill. They want to see your ability to manage a client call, mentor an Analyst effectively, and begin thinking commercially about the transaction itself.

As you climb, your professional reputation becomes a key asset. This is where managing your image and learning how to boost your professional presence on LinkedIn becomes surprisingly important. Whether you are being considered for a promotion or being contacted by executive recruiters, your digital footprint matters.

Charting Your Next Move: The Prized "Exit Opportunity"

For many junior bankers, the "exit opportunity" is a primary motivator. The intense, high-stakes environment of a bank forges a skillset that is highly valued across the financial landscape. It is a baptism by fire that makes you an incredibly attractive candidate for elite buy-side roles or strategic corporate positions.

The most common exit paths are well-regarded for a reason:

- Private Equity (PE): This is the classic, most coveted exit for top-tier junior bankers. PE firms require individuals who are already experts in financial modeling, valuation, and deal mechanics. They expect you to be effective from day one, ready to analyze acquisitions and work with portfolio companies.

- Hedge Funds: For those with a passion for the markets and an aptitude for developing a strong investment thesis, a hedge fund is an excellent destination. It is less about deal process and more about pure analytical horsepower—dissecting market trends and understanding complex financial instruments to generate returns.

- Corporate Development: This involves moving to the client’s side of the table. You join a large corporation's internal M&A team to execute deals directly. You will be responsible for sourcing, evaluating, and executing the acquisitions and partnerships that shape the company's future.

A tenure in investment banking is more than a job; it's a signal to the entire financial world. It signifies an elite combination of analytical firepower, exceptional resilience, and real-world transaction experience. That reputation is the key that unlocks these other doors.

Ultimately, your time in banking is a launchpad. Whether your objective is to reach Managing Director or to leverage the experience as a springboard to another field, the skills and network you cultivate are unparalleled. The key is to play the long game—always building relationships and capabilities that align with your ultimate career destination.

The Future Outlook for Investment Banking Careers

The investment banking industry is not shrinking; it is evolving. The classic career path remains one of the most durable and rewarding pursuits in high finance, but the skills required for success are shifting in response to technology and a dynamic global economy.

The successful banker of tomorrow will not just be a financial expert. They will be a deep specialist in the high-growth sectors that are reshaping the world.

We are also observing a continued specialization among major financial hubs. New York will likely maintain its preeminence for large-scale M&A transactions. London will remain the key center for complex, cross-border European deals. Meanwhile, hubs like Hong Kong and Singapore are cementing their dominance in regional technology and growth capital markets.

Sustained Demand and the Rise of the Specialist

The demand for skilled banking professionals remains robust. The U.S. Bureau of Labor Statistics projects that employment for financial analysts and related roles will grow by 8% from 2022 to 2032, which is faster than the average for all occupations.

This translates to approximately 41,900 openings each year, driven by retirements and professionals transitioning to other opportunities in private equity, corporate development, or venture capital. For a closer look at the numbers, you can find a solid breakdown of the investment banking job outlook on 365financialanalyst.com.

The modern investment banker is a specialist. Deep expertise in verticals such as technology, sustainable energy, or healthcare is no longer a "nice-to-have" but a core requirement for driving value and originating deals.

This trend underscores the enduring relevance of an investment banking career. The industry is not merely about capital allocation; it has become the critical link between capital, innovation, and major corporate strategy. That is a role of lasting importance.

Frequently Asked Questions

The investment banking career path can seem opaque. For those with the ambition to ascend this ladder, accurate information is invaluable. Below are direct answers to some of the most common questions.

How Long Does It Really Take to Make Managing Director?

The road to Managing Director is a marathon. Typically, it requires 15 to 20 years of dedicated, high-performance work. Each stage is a proving ground where you must earn your advancement.

This timeline is not fixed. Individual performance, the firm's deal flow, and market conditions are significant variables. Some exceptional individuals may advance more quickly, but there is no substitute for years of consistent results.

Reaching the MD level is the final evolution for a banker. It is a complete transformation from a master of technical execution to a trusted advisor who can originate millions in revenue for the firm.

Is an MBA Still a Golden Ticket in Banking?

For decades, a top-tier MBA was the traditional entry point to the Associate role, particularly for career-switchers. It offers an intensive finance education, access to a powerful alumni network, and direct entry into the structured recruiting pipeline.

However, it is not as indispensable as it once was. Many top banks have developed robust Analyst-to-Associate promotion programs to retain their best internal talent. The value of an MBA today depends on your professional background and long-term objectives.

What Skills Separate the Good from the Great?

The baseline requirements are well-known: mastery of financial modeling, valuation, and accounting. But the bankers who truly excel cultivate a broader skillset. As one advances, the focus shifts dramatically.

- Sector-Specific Knowledge: A deep, specialized understanding of a dynamic sector like technology, healthcare, or renewable energy is invaluable. Clients pay for genuine expertise, not generic advice.

- Relationship Acumen: This is the lifeblood of senior banking. It is the ability to build and nurture a network of senior executives who trust your counsel, not just for one deal, but for their company's future.

- Leadership and Communication: You must be able to command a deal team under pressure and articulate complex strategies with absolute clarity and conviction. This is what separates VPs from MDs.

Navigating a demanding global career requires that your health be a top priority. For expert, objective guidance on securing premium international private medical insurance tailored to the needs of finance professionals, connect with Riviera Expat. Find clarity and confidence in your healthcare choices at https://riviera-expat.com.